In a significant step for the cryptocurrency industry, Securitize has teamed up with the decentralized finance (DeFi) protocol Mantle to introduce a new institutional fund called the Mantle Index Four (MI4) Fund. Announced on April 24, this innovative fund aims to provide investors with exposure to a diverse range of digital assets, much like a traditional index fund that tracks various stocks.

The MI4 Fund will encompass well-known cryptocurrencies such as Bitcoin (BTC), Ether (ETH), and Solana (SOL), along with stablecoins pegged to the US dollar. A unique aspect of the fund is its integration of liquid staking tokens, including Mantle’s mETH, Bybit’s bbSOL, and Ethena’s USDe, which are expected to bolster returns through on-chain yield. This launch comes at a time when both retail and institutional investors are showing increasing interest in cryptocurrencies, particularly Bitcoin, as a potential hedge against growing macroeconomic uncertainty.

“The goal is to create a market capitalization-weighted index fund that could serve as the ‘S&P 500 of crypto,’” said Timothy Chen, Mantle’s global head of strategy.

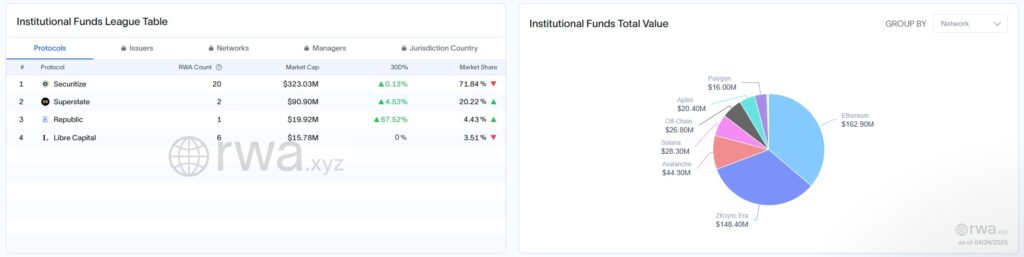

As of now, Mantle’s mETH offers a yield of approximately 3.78% and is part of a protocol boasting over $680 million in total value locked. Securitize, recognized for its robust tokenization platform for real-world assets (RWAs), holds about 71% of the market share in this space. Their largest affiliated fund, the BlackRock Institutional Digital Liquidity Fund (BUILD), manages over $2.5 billion in net assets.

Speaking to Cointelegraph in March, Securitize’s co-founder and CEO Carlos Domingo highlighted the growing demand for tokenized investments, noting that institutional investors, private equity firms, and credit managers are increasingly looking towards tokenization to enhance efficiency, reduce operational friction, and improve liquidity.

Tokenization Platform Securitize Partners with Mantle for Institutional Fund

Securitize and Mantle are collaborating to launch an institutional fund aimed at providing yield on a diversified basket of cryptocurrencies. Here are the key points of this initiative:

- Partnership Overview:

- Securitize and Mantle have teamed up to create the Mantle Index Four (MI4) Fund.

- The fund is designed to track a diverse mix of cryptocurrencies, similar to an index fund.

- Investment Composition:

- The MI4 Fund includes major cryptocurrencies like Bitcoin (BTC), Ether (ETH), and Solana (SOL), as well as stablecoins pegged to the US dollar.

- It integrates liquid staking tokens, such as Mantle’s mETH and Bybit’s bbSOL, to enhance returns through onchain yield.

- Yield Generation:

- The Mantle Staked Ether (mETH) offers an approximate yield of 3.78% APR.

- The fund leverages digital assets to generate yield, appealing to both retail and institutional investors.

- Market Context:

- The fund launches amid heightened interest from investors seeking cryptocurrency exposure as a hedge against macroeconomic uncertainty.

- Institutional interest in cryptocurrencies is reflected in the increasing demand for yield-generating products.

- Securitize’s Market Position:

- Securitize holds approximately 71% of market share as a tokenization platform for real-world assets (RWAs).

- Its largest fund, BlackRock Institutional Digital Liquidity Fund (BUILD), manages over $2.5 billion in net assets.

“Demand for tokenized funds is accelerating as institutional investors turn to tokenization to enhance efficiency, reduce operational friction, and improve liquidity.” – Carlos Domingo, Securitize Co-founder and CEO

Securitize and Mantle: A Strategic Partnership in the Crypto Space

The collaboration between Securitize and Mantle to launch the Mantle Index Four (MI4) Fund represents a significant advancement in the world of decentralized finance (DeFi) and cryptocurrency investment strategies. This joint venture offers considerable benefits and challenges compared to similar financial products in the market.

Competitive Advantages: Securitize’s reputation as a leading tokenization platform, with a robust 71% market share in the institutional space, provides a strong foundation for the MI4 Fund. The fund’s design echoes traditional index funds, making it easily understandable for investors. With its focus on diverse cryptocurrencies, including Bitcoin, Ether, and Solana, the MI4 Fund positions itself as a comprehensive investment vehicle. This diversification can appeal to both institutional and retail investors looking to hedge against macroeconomic uncertainties. Moreover, the incorporation of liquid staking tokens enhances returns, making it an attractive option for yield-seeking investors.

Furthermore, Mantle’s target to become the “S&P 500 of crypto” illustrates an ambitious vision of creating an industry standard for cryptocurrency investments. The yield on Mantle’s mETH (3.78%) is particularly compelling, potentially drawing in investors seeking reliable passive income. Additionally, the fund taps into the growing trend of tokenization, where assets are digitized to improve efficiency and liquidity, a feature increasingly favored by institutional investors.

Disadvantages: While there are numerous advantages, the MI4 Fund also faces challenges. The volatility inherent in cryptocurrencies can deter conservative investors, particularly in volatile economic climates. Additionally, the novelty of liquid staking tokens may confuse traditional investors, creating a barrier to entry. Market saturation is another concern; many crypto investment products are vying for attention, and distinguishing the MI4 Fund from competitors may be a hurdle.

Beneficiaries and Challenges: This partnership could significantly benefit institutional investors looking to diversify their crypto portfolios without diving directly into individual assets. Firms already invested in digital assets may find this fund a convenient route to enhance their yield. However, smaller investors or those unfamiliar with DeFi products may feel overwhelmed and skeptical, potentially creating a divide in the market. Furthermore, traditional asset managers might view this emerging competition as a threat, prompting them to innovate and adapt quickly to retain market share.

In summary, the alignment between Securitize and Mantle could reshape how institutions and individuals interact with the cryptocurrency market, but it will necessitate overcoming educational barriers and market volatility challenges to realize its full potential.