The cryptocurrency landscape is currently wrestling with a key challenge: security. A recent survey conducted by Bitget Wallet, which gathered insights from 4,599 users, revealed that over 37% of investors view security risks as the primary barrier to adopting cryptocurrency for payments. While concerns about hacks and phishing scams tarnish the industry’s credibility, the allure of speed and efficiency keeps nearly 46% of users leaning towards crypto payments over traditional fiat options.

“Security concerns remain the biggest obstacle to the mainstream adoption of cryptocurrency payments,” said Alvin Kan, chief operating officer of Bitget Wallet. “Address poisoning scams have particularly threatened user trust, with victims unknowingly sending over .2 million to scammers just this March.”

In response, Bitget Wallet has taken impressive steps to bolster security. The platform has rolled out multi-layered protection mechanisms, including MEV (Maximum Extractable Value) protection, which by default helps prevent front-running and sandwich attacks across major blockchains such as Ethereum and Solana. Moreover, their innovative GetShield engine scans smart contracts and decentralized applications (DApps) for any malicious behavior, providing users with an extra layer of safety before they confirm any transactions.

Backing these advancements is a substantial 0 million user protection fund designed to offer reassurance against potential asset losses caused by platform-level issues. Yet, regional differences also emerge in how users perceive security in cryptocurrency payments. For instance, while Gen X might prioritize security, younger Gen Z users often emphasize usability and cost efficiency.

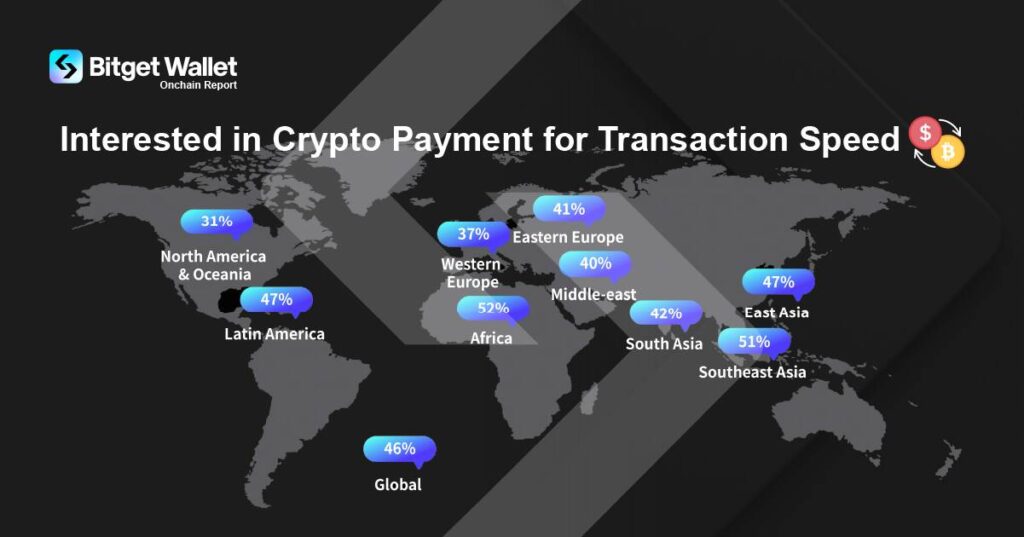

“Africa and Southeast Asia stand at the forefront of cryptocurrency payments, with 52% and 51% interest in these transactions, respectively. This trend is largely driven by high remittance costs and limited access to traditional banking services,” Kan noted.

For users in unbanked regions, Bitget Wallet simplifies the onboarding process, as it offers non-custodial wallets that eliminate the need for traditional bank accounts. By supporting over 130 blockchains and various stablecoins, it aims to enable efficient global transactions while maintaining purchasing power.

In Latin America, the rationale for embracing crypto payments is clear: excessive fees associated with traditional bank transfers, which can average around 7.34% by 2024, push users toward cryptocurrency alternatives. As the industry continues to evolve, the pursuit of improved security measures remains vital for nurturing wider acceptance of cryptocurrency in everyday transactions.

Security Concerns and Cryptocurrency Adoption

The significant barriers to mainstream cryptocurrency payments include security issues, impacting both investors and everyday users. Here are the key points regarding these challenges and their implications:

- Security Risks as Major Barrier:

- 37% of investors cite security concerns as the main barrier to using cryptocurrency for payments.

- Phishing scams, such as address poisoning, continue to undermine confidence in the industry.

- Preference for Crypto Payments:

- 46% of users prefer cryptocurrency payments over fiat due to faster transaction speed and efficiency.

- Enhanced Security Measures by Bitget Wallet:

- Multi-layered protection mechanisms including MEV (Maximal Extractable Value) protection to prevent front-running and sandwich attacks.

- Smart authorization detection through the GetShield engine to identify malicious activities before users confirm transactions.

- Financial Safety Nets:

- Bitget Wallet’s operations are supported by a 0 million user protection fund to cover losses from platform-related issues.

- Regional Adoption Trends:

- Africa (52%) and Southeast Asia (51%) show high interest in crypto payments due to high remittance costs and limited banking access.

- In Latin America, traditional wire transfer costs average 7.34%, encouraging crypto payment adoption.

- Simplified Access to Crypto for Unbanked Regions:

- Bitget Wallet offers non-custodial wallets requiring no traditional bank account, promoting financial inclusion.

- Local fiat on-ramps and multichain support enhance access to cryptocurrency without requiring extensive technical knowledge.

“Concerns over crypto payment security are paramount, but advancements in security protocols may help ease fears and encourage broader adoption.”

Analyzing Security in Cryptocurrency Payments: The Bitget Wallet Approach

The landscape of cryptocurrency payments is notably influenced by security challenges, which remain the foremost deterrent for widespread adoption. As highlighted by a comprehensive survey from Bitget Wallet, a substantial portion—over 37%—of investors cite security risks as their main hesitance towards utilizing cryptocurrencies for payments. This worry is further validated by a series of high-profile hacks and phishing scams that continue to undermine trust in crypto transactions.

In the wake of these challenges, Bitget Wallet has positioned itself as a beacon of innovation, implementing robust multi-layered security mechanisms that aim to reassure users. Their commitment to security is comparable to other wallets in the space, yet Bitget sets itself apart with features like MEV protection and an advanced smart contract scanning technology called GetShield. Such measures are engineered not only to enhance transactional safety but also to restore consumer confidence in crypto payments. While competing wallets may offer basic transactional security, Bitget’s proactive stance on addressing emerging threats like address poisoning scams provides a unique selling proposition that can attract security-conscious users.

However, the competitive landscape does not come without challenges for Bitget. As competitors ramp up their own security measures, the pressing question remains: will these enhancements suffice to quell the pervasive fears of hacking and fraud? Additionally, younger users, primarily from Gen Z, have cited usability and cost efficiency as their top priorities, which may overshadow security concerns. If Bitget fails to balance security enhancements with ease of use and low transaction costs, it risks alienating this crucial demographic.

Moreover, the effectiveness of Bitget’s offerings can be pivotal for regions with high crypto adoption such as Africa and Southeast Asia. With a significant population in these areas expressing interest in crypto payments—driven by the burdens of high remittance costs and limited banking access—the wallet’s simplified onboarding process and non-custodial setup play a vital role. However, if users perceive the added security layers as complicated, it could hinder engagement and lead to frustration.

In contrast, the Latin American market represents a different challenge for Bitget. With traditional banking systems imposing hefty transaction fees—averaging over 7%—their enhanced security mechanisms may indeed catalyze a switch to crypto payments, provided users can navigate them effortlessly. Should Bitget succeed in simplifying the user experience while maintaining high security standards, it could emerge as a leader in this challenging market.

Ultimately, as competition intensifies and security concerns remain paramount, Bitget Wallet’s strategy could either pave the way for increased adoption or become a potential stumbling block if not executed flawlessly. The onus lies on Bitget to ensure that while they prioritize security, they also cater to the varied needs of their diverse user base, which could either bolster their reputation or jeopardize their standing in the evolving crypto payments arena.