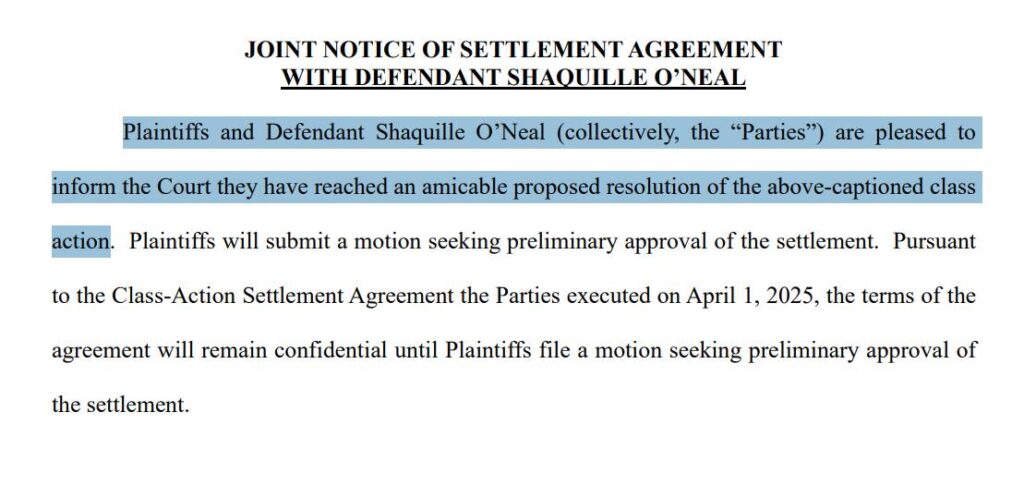

In a significant turn of events within the cryptocurrency space, NBA legend Shaquille O’Neal has reached a settlement with investors who suffered losses from the disastrous collapse of the FTX exchange. This development was revealed in a recent filing in the US District Court for the Southern District of Florida, though the specifics of the settlement amount remain under wraps for now. The final terms are expected to be disclosed following a formal request for preliminary court approval by the investors, according to court documents.

O’Neal, alongside a host of other celebrities, has faced scrutiny for endorsing FTX—a platform that has since declared bankruptcy. The ongoing litigation is part of a broader effort where investors are seeking a staggering $21 billion in damages from those involved with FTX, including insiders and promoters, significantly higher than the $9.2 billion that the bankruptcy proceedings can potentially cover.

“The case represents just one facet of the larger narrative surrounding FTX and its high-profile backers,”

Notable figures gearing up for legal battles include NFL star Tom Brady, supermodel Gisele Bündchen, and investor Kevin O’Leary, all of whom are entwined in similar legal complexities stemming from their promotion of the failed platform. Interestingly, O’Neal’s legal journey began with challenges in serving him with court documents, prompting attorneys to describe his actions as evasive, even claiming he was “running from the lawsuit.” Efforts included attempting to deliver legal papers during his appearances at NBA games.

In addition to this recent settlement, O’Neal is also in the news for agreeing to pay $11 million to resolve a separate class-action lawsuit regarding his involvement in the Astrals NFT project, which operates on the Solana blockchain. Accusations in this lawsuit center around claims that the NFTs he promoted might be classified as unregistered securities, highlighting the ongoing regulatory challenges facing celebrities in the rapidly evolving world of digital assets.

As the cryptocurrency industry continues to navigate its growing pains, the legal repercussions for celebrities endorsing crypto platforms serve as a crucial reminder of the associated risks, not just for investors but also for prominent endorsers.

Shaquille O’Neal Settles FTX Investor Lawsuit

This article discusses the recent settlement reached by Shaquille O’Neal with investors affected by the collapse of the cryptocurrency exchange FTX. Below are the key points regarding this situation and its potential implications for readers:

- Settlement Reached: O’Neal has settled with investors who claimed losses from FTX, though the settlement amount remains confidential.

- Broader Multidistrict Litigation: This case is part of a larger effort seeking up to $21 billion in damages from FTX affiliates, which highlights the extent of the crisis.

- Celebrity Involvement: Many celebrities, including Tom Brady and Gisele Bündchen, are also facing legal challenges for their endorsements of FTX, indicating a trend of high-profile endorsements leading to investor losses.

- Challenges in Legal Proceedings: O’Neal was notably difficult to serve legal papers, which underscores the lengths to which legal teams will go in pursuing accountability for investor losses.

- Implications for Investors: The potential damages sought could affect the overall recovery available to investors, highlighting the risk associated with celebrity endorsements in financial investments.

- Additional Legal Issues: O’Neal is also involved in a separate settlement concerning his promotion of an NFT project, suggesting ongoing scrutiny of celebrity endorsements in the cryptocurrency and digital asset markets.

These developments may alert investors to the risks of relying on celebrity endorsements when making financial decisions, as high-profile names do not guarantee safe investments.

Celebrity Endorsements Under Fire: The FTX Fallout

The recent settlement of NBA star Shaquille O’Neal with investors impacted by the FTX collapse highlights a growing trend in the entertainment and finance sectors where celebrity endorsements are increasingly scrutinized. Unlike many of his peers, O’Neal managed to resolve his involvement in the crypto scandal quietly, which can be viewed as a double-edged sword. While the nondisclosure of the settlement amount may provide some semblance of privacy and protection, it also leaves the door open for speculation and further legal scrutiny against other endorsers.

Compared to other high-profile individuals caught in the FTX vortex, such as Tom Brady and Gisele Bündchen, O’Neal’s strategic decision to settle may serve as a tactical advantage. This choice allows him to sidestep prolonged legal battles that could damage his reputation more severely. Celebrities like Brady and Bündchen, who continue to face significant legal challenges, may be at risk of greater financial and public relations fallout given their extensive promotional activities with the defunct exchange.

Potential Benefits and Risks for Investors and Celebrities

This situation poses unique challenges for investors who are attempting to recuperate losses. On one hand, O’Neal’s settlement suggests that some avenues for restitution might be possible, potentially encouraging others to engage in similar negotiations. However, it also raises questions about accountability. The broader implications of this case may deter future celebrity endorsements of cryptocurrency ventures, as investors become more cautious about placing trust in high-profile figures.

For celebrities endorsing financial products, the risks are substantial. While endorsement deals may offer lucrative opportunities, the consequences of a product’s failure, as seen with FTX, can have debilitating repercussions. Celebrities could find themselves alienated from fans and sponsors alike, facing increased legal scrutiny while dealing with the fallout from their endorsements.

Interestingly, O’Neal’s recent $11 million settlement related to the Astrals NFT project echoes the ongoing conversation regarding the regulatory environment surrounding digital assets. This dual settlement experience offers a cautionary tale for both investors and endorsers in the rapidly evolving crypto landscape, emphasizing the necessity for due diligence and the potential hazards of celebrity influence in this domain. Indeed, both parties must tread carefully as the lines between promotion and accountability continue to blur in the fast-paced world of cryptocurrency.