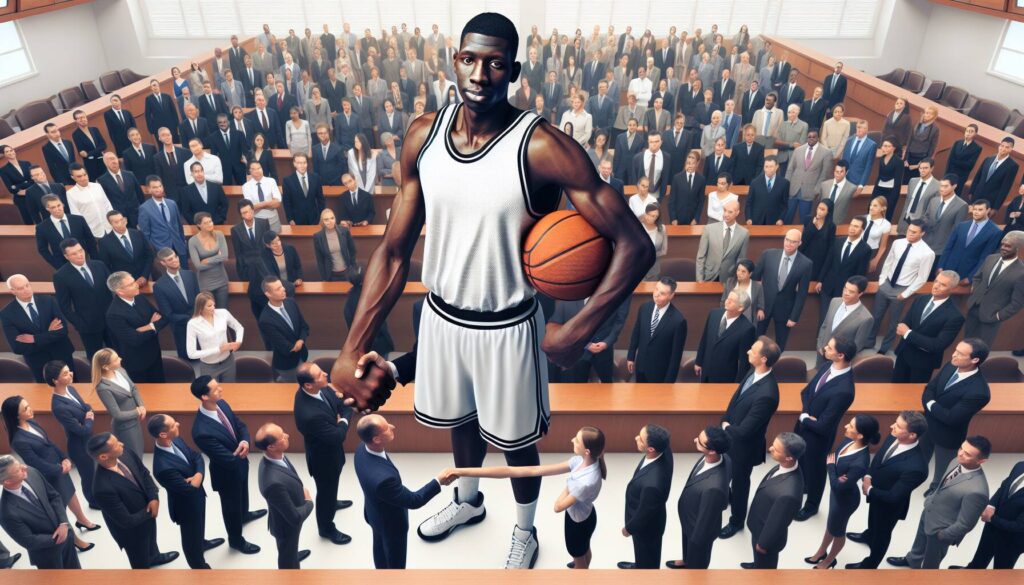

In a notable development within the cryptocurrency world, former NBA superstar Shaquille O’Neal has reached a settlement agreement with a group of investors involved in the FTX crypto exchange. These investors had accused O’Neal of playing a role in promoting the alleged fraud surrounding the now-defunct exchange. The specific details of the settlement, including the amount O’Neal will pay, have not yet been disclosed, leaving many to speculate about the implications of this high-profile case.

The lawsuit, which has drawn significant attention, seeks up to $21 billion in total damages not only from O’Neal but also from a host of other celebrity promoters and former executives connected to FTX. Among those named in the class action are renowned figures such as tennis sensation Naomi Osaka, baseball star Shohei Otani, and football legend Tom Brady. Comedian Larry David, ‘Shark Tank’ investor Kevin O’Leary, and model Gisele Bundchen have also faced accusations as part of this sweeping lawsuit.

“Shaquille O’Neal becomes the first high-profile defendant in the ongoing litigation to reach a settlement, marking a significant turn in a case that has already seen other celebrities like Jaguars quarterback Trevor Lawrence enter into agreements with investors.”

This recent settlement is not a first for O’Neal in the realm of cryptocurrency promotions. Last year, he and several associates agreed to pay $11 million to investors who lost money in an NFT project that he helped promote, showcasing a pattern of celebrity involvement in various crypto ventures. As the legal proceedings continue, this case could set a precedent for how celebrity endorsements in the cryptocurrency space are viewed, particularly in cases of financial failure.

As more settlements unfold in this high-stakes legal battle, it serves as a reminder of the complexities and risks associated with celebrity endorsements in the fast-evolving cryptocurrency market. Investors and fans alike are watching closely as the situation develops, reflecting the broader implications for stars promoting financial products in a landscape that has already faced its share of controversy.

Shaquille O’Neal Settles FTX Investor Lawsuit

The recent settlement between Shaquille O’Neal and FTX investors highlights significant issues surrounding celebrity endorsements of financial products. Here are the key points related to this topic:

- Settlement Agreement:

- Shaquille O’Neal has reached a settlement with FTX investors accused him of promoting fraudulent activities associated with the crypto exchange.

- Details of the financial settlement have not been disclosed yet.

- Class Action Lawsuit:

- Investors in the lawsuit are seeking up to $21 billion in total damages from O’Neal and other celebrity promoters.

- Prominent figures named include Steph Curry, Tom Brady, and Naomi Osaka, amplifying the case’s visibility and potential impact.

- O’Neal’s Legal History:

- This is not the first settlement O’Neal has reached tied to promoting a failing crypto project; he previously settled a case involving an NFT venture.

- Last year, he agreed to pay $11 million to NFT holders from a project he promoted.

- Impact on Celebrity Endorsements:

- This lawsuit sheds light on the responsibilities of celebrities when promoting financial products, especially in volatile markets like cryptocurrency.

- It raises questions about consumer protection and the potential risks of relying on celebrity endorsements in financial decisions.

- Broader Implications:

- Investors may become more cautious about following celebrity endorsements, affecting how brands choose to market products in the future.

- The case could influence regulations on advertising and endorsements in the financial sector, potentially leading to stricter guidelines.

The situation emphasizes the need for due diligence and scrutiny when it comes to investment opportunities, particularly those endorsed by high-profile personalities.

Shaquille O’Neal’s Settlement with FTX Investors: A Deeper Dive into the Celebrity Endorsement Fallout

Recently, Shaquille O’Neal made headlines by reaching a settlement with a cohort of FTX investors who alleged that he played a significant role in promoting the fraudulent crypto exchange. This case highlights the growing scrutiny surrounding celebrity endorsements in the volatile world of crypto, raising questions about accountability and responsibility among public figures. When compared with similar news involving other celebrity endorsers facing similar lawsuits, O’Neal’s situation illustrates a significant dilemma for both investors and high-profile promoters.

One competitive advantage for O’Neal in this scenario is his proactive approach to settling, which could potentially limit the long-term reputational damage often associated with lengthy legal battles. By reaching an agreement, he may mitigate the negative PR fallout that accompanies ongoing litigation and accusations of wrongdoing. However, the total settlement amount remains undisclosed, which leaves room for speculation and could tarnish his image further if perceived as insufficient compared to the claimed damages reaching $21 billion.

On the flip side, settling also brings disadvantages. While some may view this as a pragmatic move, others could interpret it as an admission of guilt, weakening his standing as a trustworthy brand ambassador. This sentiment resonates across the crypto endorsements landscape, as other celebrities like Tom Brady and Naomi Osaka are similarly caught in the crossfire. Each has their own unique challenges navigating the implications of their endorsements, especially now that legal precedents are being set regarding accountability in advertising.

For investors and stakeholders within the crypto sphere, this development could either be a source of relief or heightened concern. On one hand, settlements may offer some restitution to investors who felt duped by their investments; however, the repeated pattern of celebrity endorsers implicating themselves in fraudulent activities could cultivate distrust in future influencer partnerships. Furthermore, as more settlements unfold, it forces a reevaluation of who can safely associate with which projects, affecting the dynamics of endorsement deals widely.

In summary, while Shaquille O’Neal’s legal measures seem tactically sound, they also pose complex implications for celebrity endorsers at large. The growing trend of legal action against public figures involved in promoting esports, NFTs, and crypto-assets showcases just how precarious celebrity support has become in the fast-evolving digital financial landscape.