In an intriguing turn of events in the cryptocurrency landscape, Ki Young Ju, the founder and CEO of CryptoQuant, has stirred the pot by challenging long-held beliefs about Bitcoin’s cyclical nature. In a recent post, Ju emphasized that simply tracking retail investor activity on blockchain may not offer the full picture. He suggests that many retail investors are now entering the market through exchange-traded funds (ETFs), a method that doesn’t show up in traditional data analysis. Ju highlighted that a striking 80% of recent spot Bitcoin ETF inflows originate from retail investors, illustrating a significant shift in how participants are interacting with the market.

Since the launch of spot Bitcoin ETFs in January 2024, these financial products have attracted around .88 billion in inflows, a clear indicator of renewed interest. Ju’s commentary came as a response to debate around his forecast that the current Bitcoin bull cycle might be winding down, as he observed a lack of new liquidity and diminishing retail engagement. He noted that while Bitcoin may take time to reclaim its previous all-time high, he does not predict an immediate crash but rather a sustained adjustment period.

“The idea that the cycle isn’t over just because onchain retail activity is absent needs reconsideration,” Ju commented on March 19.

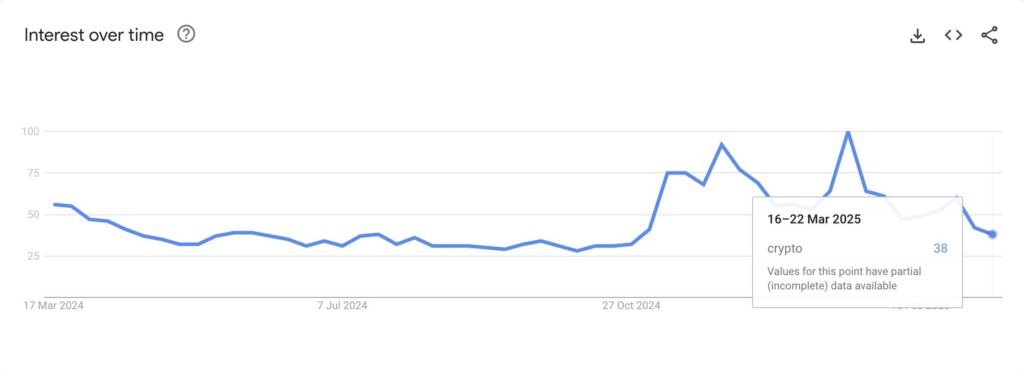

As traders closely monitor the market for signs of enthusiasm or fatigue among retail investors, metrics like the Crypto Fear & Greed Index are particularly telling. Recently, this index reflected a score of “Fear” at 31, indicating a notable shift in market sentiment. Also of interest is the decline in general searches for “crypto” on Google, which have dropped by nearly 62% since the peak interest period in January.

With this evolving narrative, the cryptocurrency community finds itself navigating a landscape shaped by both regulatory developments and investor behavior. As Ju indicated, embracing this new approach to understanding retail activity may reveal a different route to identifying market trends and potential opportunities. In a space often marked by volatility, these insights could prove pivotal in the coming months.

Bitcoin Market Insights: Understanding Current Trends

Key points highlighted by Ki Young Ju and related market indicators:

- Retail Investors and ETFs:

- Retail interest in Bitcoin is being funneled primarily through ETFs rather than direct on-chain activity.

- Since January 2024, Bitcoin ETFs have seen inflows totaling approximately .88 billion.

- 80% of spot Bitcoin ETF flows come from retail investors, indicating a significant shift in how retail participation is measured.

- Market Sentiment Analysis:

- The Crypto Fear & Greed Index shows a current reading of 31 (Fear), indicating bearish sentiment among traders.

- Google search trends for “crypto” have dropped by approximately 62% since January, reflecting decreased retail interest.

- Historical peaks in search activity are correlated with significant Bitcoin price highs, suggesting retail engagement is a pivotal market mover.

- Market Cycle Expectations:

- Ki Young Ju suggests that the bullish cycle may be over, with a potential bear market phase on the horizon.

- He predicts it could take 6-12 months for Bitcoin to recover to its all-time high, emphasizing that the market’s current liquidity levels are low.

- Implications for Investors:

- Understanding retail participation through ETFs rather than on-chain transactions is crucial for future market predictions.

- Recognizing market sentiment indicators can aid in making informed decisions and understanding market movements.

- Investors should be cautious during periods of declining retail interest and consider macroeconomic factors influencing market trends.

Analyzing the Shift in Bitcoin Sentiment: An Executive’s Perspective

In the ever-evolving cryptocurrency landscape, a recent assertion from CryptoQuant’s founder, Ki Young Ju, has sparked discussions about the current state of Bitcoin. Ju argues that traditional indicators focused primarily on retail investor activity may no longer accurately reflect market dynamics. This insight positions him uniquely among crypto executives who often cling to historical market behaviors when forecasting future trends.

Competitive Advantages

Ju’s perspective emphasizes a pivotal shift: while many believe the absence of on-chain retail activity signals a bearish trend, he suggests that retail flows are now primarily funneled through Bitcoin ETFs. This innovative avenue potentially opens the floodgates for retail participation without the tell-tale signs visible on traditional on-chain metrics. With nearly billion having flowed into these ETFs since their inception earlier this year, it positions Ju’s insights as not just provocative but grounded in emerging data, appealing to those who keep a keen eye on financial innovations.

Simultaneously, this aligns with broader market sentiments and actions, where regulatory protections enhance retail investor confidence, well after experiencing the initial leaps of the bull market. Given that many retail investors have moved their assets from wallets into these funds, Ju’s analysis could resonate with those looking to navigate this modified landscape effectively.

Potential Challenges

However, Ju’s viewpoint isn’t without its criticisms. As the Crypto Fear & Greed Index shows heightened fear, and Google searches for “crypto” have plummeted, there’s a significant sentiment hurdle that Ju’s assertion must overcome. For retail investors who rely heavily on traditional indicators, this shift could create confusion and mistrust. Those more inclined to observe direct market movements may find themselves leaning toward skepticism rather than embracing new strategies.

Who Benefits and Who Might Struggle?

Investors with a risk-taking approach may find Ju’s insights instrumental in adjusting their strategies, particularly those keen on ETFs as a vehicle for crypto exposure. Conversely, conservative investors who prefer tried-and-true indicators may face challenges in aligning their strategies with this new paradigm. Moreover, if the anticipated influx of retail investments through ETFs doesn’t materialize as expected, those relying on this shift for market confidence may find themselves in a precarious position as they navigate the complexities of a bear market sentiment.

As the landscape continues to shift, keeping a pulse on emerging trends and indicators will be vital for all market participants. Adapting to these changes could either pave the way for growth or present hurdles that investors must strategically maneuver around.