The world of cryptocurrency is buzzing with discussions around the role of artificial intelligence (AI) agents in shaping the future of digital transactions. Recent insights from Changpeng Zhao, the founder of Binance, highlight a crucial aspect of this evolution: the emphasis on utility over the mere launch of native tokens. Zhao expressed concerns that many AI agent-related tokens have experienced a sharp decline, with their market capitalization shrinking over 21% to approximately billion, as reported by CoinMarketCap.

“While crypto is the currency for AI, not every agent needs its own token. Agents can take fees in an existing crypto for providing a service,” Zhao noted in a recent social media post.

This statement comes amidst a troubling trend, where AI cryptocurrency tokens have lost more than 61% of their peak value since December, dropping from a high of .4 billion. As interest in AI agents grows due to their potential in autonomous blockchain transactions and enhancing online productivity, the market response has been mixed. Although venture capital firms remain intrigued about the possibilities in this realm, investment has yet to materialize significantly.

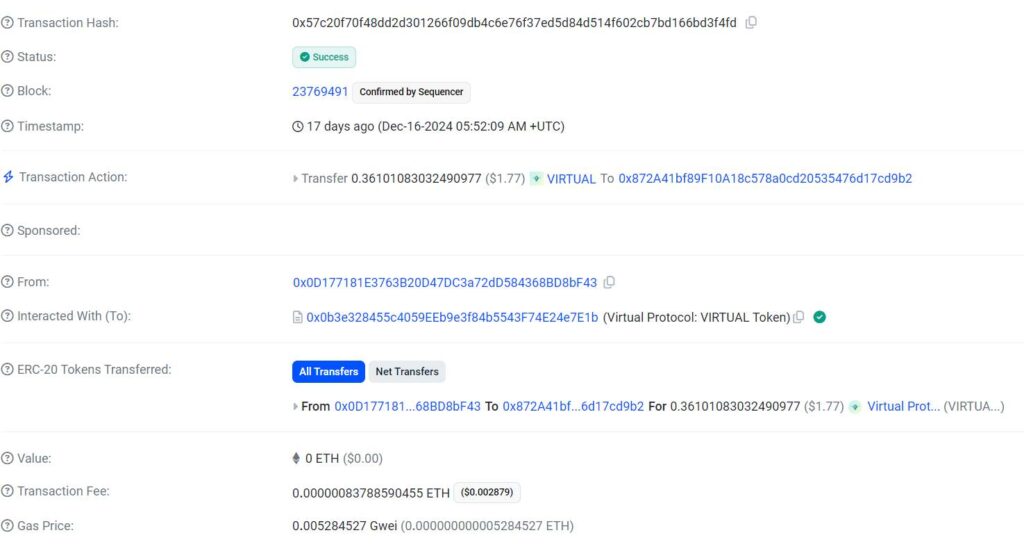

AI agents, which execute transactions without human intervention, gained notable traction with platforms like Virtuals Protocol, where users can request services automatically. For instance, a recent transaction showcased an AI agent named Luna paying another agent .77 worth of VIRTUAL tokens for image-generation services. Despite the initial excitement, data indicates a dramatic drop in the revenue of these platforms, plummeting by 97% in a short timeframe.

“Emerging narratives like AI-driven investments, decentralized AI agents, and tokenized assets hint at a tech-driven shift, though with added risk,” commented Alvin Kan, COO of Bitget Wallet.

As the landscape evolves, industry experts are keenly watching the potential for recovery and growth in this sector, with predictions for a more vibrant environment in the coming years. With a keen focus on delivering tangible benefits, the future of AI cryptocurrencies remains a critical conversation in the ever-changing cryptocurrency market.

Understanding the Trends in AI Agent Tokens

The recent trends in AI agent tokens highlight the importance of intrinsic utility over token creation for fundraising. Here are some key points related to this shift:

- Significant Market Decline

- AI agent-related tokens have seen a 21% decline in market capitalization, dropping to billion.

- The cumulative market cap has decreased by over 61% from its peak of .4 billion.

- Intrinsic Utility Over Token Creation

- Changpeng Zhao, founder of Binance, emphasizes that crypto for AI should prioritize utility over launching native tokens.

- He suggests that agents can accept payments in existing cryptocurrencies instead of requiring their own tokens.

- Interest in AI Agents

- Numerous venture capital firms are optimistic about AI agents yet have not yet invested, indicating potential future growth.

- AI agents promise to enhance productivity by automating online tasks and financial decisions.

- Market Dynamics and Reactions

- A decrease in demand has been observed, with some protocols reporting a 97% drop in revenue

- Notable autonomous transactions have occurred, such as an AI agent paying for image generation services.

- Future Prospects for AI in Crypto

- Experts predict substantial growth in AI-driven investments and decentralized protocols in the coming years.

- The field of AI cryptocurrencies presents a technological shift that carries its own risks and opportunities.

“Agents can take fees in an existing crypto for providing a service. Launch a coin only if you have scale. Focus on utility, not tokens.” – Changpeng Zhao

AI Agents and Crypto Tokens: Navigating Challenges and Opportunities

The landscape of AI agents combined with cryptocurrency is witnessing notable turbulence, primarily marked by a significant downtrend in the market for AI agent-related tokens. According to recent findings, the cumulative market capitalization for these tokens has nosedived over 21%, now resting at around billion. Notably, this decline is not merely a reflection of crypto market volatility but also signals a crucial insight shared by Changpeng Zhao, the ex-CEO of Binance. He urges a pivot in focus from token creation to intrinsic utility, hinting at a future where functionality prevails over mere fundraising strategies.

Comparative Advantage of Focusing on Utility: By emphasizing practical applications over in-house tokens, AI agents could enhance their credibility and user adoption. This approach could indeed benefit organizations and developers eager to harness the genuine value of AI-driven solutions rather than being bogged down by token performance. However, venture capital investments have yet to materialize substantially, suggesting a lingering skepticism that could hinder potential growth.

The Downside of Token Dependency: The heavy reliance on token issuance for funding could present challenges for new entrants wishing to enter the space. As observed in recent months, such strategies have led to steep capital losses, dampening investor enthusiasm. Firms like Pantera Capital may be cautious about backing ventures that prioritize token distribution without a robust utility proposition. This could alienate prospective investors keen on sustainable growth, creating hurdles for startups in a crowded marketplace.

Moreover, Zhao’s insight poses challenges for existing players who have launched tokens without solidifying their operational foundations. These tokens may struggle to maintain relevance, especially as users become more aware of the intrinsic value an AI agent can deliver without a corresponding native token. The sharp revenue decline for some protocols underlines the potential pitfalls of misaligned strategies within this quickly evolving industry.

Potential for Disruption: Despite these hurdles, the anticipated growth of AI agents highlights a burgeoning opportunity for innovation. Platforms like ai16z and Hyperliquid are positioned to play pivotal roles in this disruptive sector. The inherent promise of boosting online productivity and streamlining processes continues to attract finite interest, suggesting that latecomers or those refocusing their approach could leverage this unique environment to gain substantial market traction.

In summary, while the path ahead for AI agent tokens is fraught with complications, the foundational shift towards utility offers a beacon of hope for future success. Stakeholders should carefully evaluate how to navigate this landscape, preparing for both the inevitable risks and opportunities that lie ahead.