In the latest developments from the cryptocurrency industry, high-profile moves and regulatory changes are making headlines. Pavel Durov, the founder of the widely-used messaging platform Telegram, has received the green light from a French court to relocate from France to Dubai. This shift, reported by Barron’s, highlights Dubai’s reputation as a haven for entrepreneurs due to its business-friendly policies and lack of extradition agreements. Sources indicate that Durov departed France recently, shedding light on a notable exit from one of Europe’s more stringent jurisdictions.

In another significant story, David Sacks, a prominent figure in venture capital, has divested more than 0 million in cryptocurrencies and related stocks prior to assuming his role as the White House AI and crypto czar. A recent White House memorandum reveals that Sacks took essential steps to minimize conflicts of interest by liquidating positions in popular digital assets, including Bitcoin and Ethereum. His new position will focus on establishing a robust legal framework for the cryptocurrency sector, underscoring the government’s interest in shaping the future of digital finance.

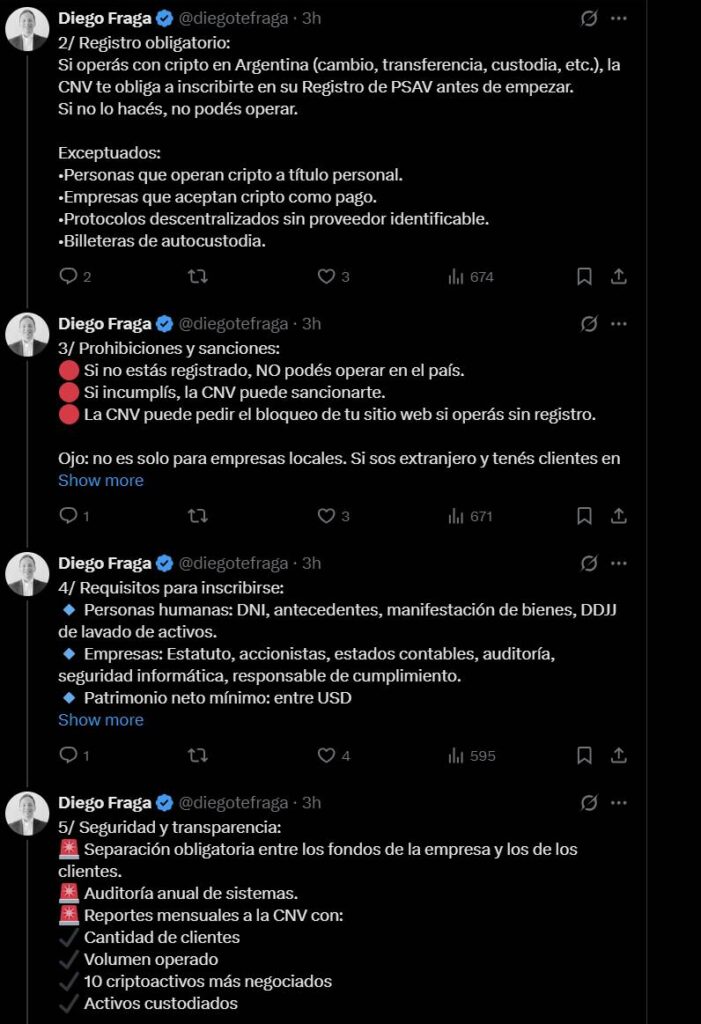

On the regulatory front, Argentina is making strides with the introduction of new rules for virtual asset service providers (VASPs). The National Securities Commission (CNV) has officially published regulations aimed at creating a more transparent and secure environment for cryptocurrency operations. These new rules mandate registration for VASPs, enforce security measures, and establish guidelines for money laundering prevention and proper asset management. According to tax lawyer Diego Fraga, compliance is essential, with potential penalties for companies that operate without proper registration.

As the landscape of cryptocurrency continues to evolve, these developments reflect a mix of personal, corporate, and governmental actions that could shape the industry’s future in significant ways.

Today in Crypto: Key Developments

Here are some of the most important updates in the crypto landscape today:

-

Pavel Durov’s Relocation:

- Durov, the founder of Telegram, has relocated from France to Dubai following court approval.

- Dubai is known for its business-friendly environment, potentially impacting Durov’s ability to grow his business without extradition concerns.

-

David Sacks’ Major Sell-off:

- David Sacks sold over 0 million in crypto and related stocks before assuming his role at the White House.

- This sell-off raises questions about conflicts of interest as Sacks is now in charge of shaping the legal framework for the crypto industry.

-

Argentina’s New Crypto Regulations:

- Argentina’s CNV has published regulations impacting virtual asset service providers (VASPs).

- These regulations focus on transparency, cybersecurity, and user protection, which are crucial for the legitimacy of the crypto market.

- Failure to comply could result in revocation of registration, ensuring only compliant firms operate.

Understanding these developments can help individuals and businesses navigate the changing landscape of cryptocurrency and make informed decisions related to investment and compliance.

The Changing Landscape of Crypto: Key Developments and Their Impacts

In the ever-evolving world of cryptocurrency, significant recent developments highlight competing narratives shaping the industry. Pavel Durov’s relocation to Dubai underscores a trend of industry leaders seeking jurisdictions with more favorable regulatory environmenst, while David Sacks’ divestment of over 0 million in crypto assets before entering a pivotal governmental role raises questions about potential conflicts of interest. Meanwhile, Argentina’s new regulations for virtual asset service providers (VASPs) aim to bolster user safety and industry transparency.

Pavel Durov’s Departure to Dubai: Durov’s move can be seen as advantageous for his business endeavors. Dubai’s reputation as a haven for tech entrepreneurs, paired with its relaxed regulatory landscape, could foster innovation in the blockchain space. However, this shift may pose challenges for businesses in Europe, as it illustrates a brain drain towards regions that offer a more welcoming atmosphere for crypto activities. Regions like France could face stagnation in tech investments and a potential reputation loss as firms migrate for favorable conditions.

David Sacks’ Strategic Withdrawal: Sacks’ significant sell-off comes at a critical juncture as he steps into a role with the White House, offering a unique edge. His actions may signal to investors that high-level governance can indeed coexist with the dynamic realm of cryptocurrency, although skepticism surrounding his conflicts of interest could create hurdles. This may impact firms relying on trust and stability in an already uncertain environment. Transparent governance from insiders like Sacks could either alleviate concerns or intensify scrutiny, informing how other tech leaders navigate similar transitions.

Argentina’s Regulatory Shift: The new rules imposed on VASPs in Argentina represent a double-edged sword. On one hand, these regulations are crafted to enhance consumer protection and instill confidence in the digital asset market, which can attract legitimate players. On the flip side, they may stifle innovation by imposing burdensome compliance requirements that could deter smaller firms from entering the market. The ramifications for investors, especially in a nation coping with economic volatility, are profound, as clear guidelines may stimulate some stability, but possibly at the cost of reduced entrepreneurial agility.

Overall, these scenarios illustrate the contrasting dynamics at play in the crypto landscape, with movements that could bolster some sectors while simultaneously creating friction for others. Emphasizing the balance between innovation and regulation is crucial as stakeholders from various regions navigate the shifting paradigms of the cryptocurrency world.