In a significant shift within the cryptocurrency landscape, 2025 has seen a remarkable 66% reduction in the number of rug pulls compared to the previous year. Despite this welcome drop in frequency, the impact of these scams is increasingly severe, with the amount lost to rug pulls nearing $6 billion this year. A recent report from DappRadar emphasizes that a staggering 92% of these losses stem from a controversial incident involving the Mantra’s OM token, which its founders have denied was a rug pull.

“In early 2024, there were 21 recorded rug pull incidents, while only seven have occurred so far this year,” notes Sara Gherghelas, a DappRadar analyst. “This shift suggests that rug pulls are becoming less frequent, but far more devastating when they do occur.” This reality highlights the changing dynamics within the Web3 space, where scams are evolving into more sophisticated operations, often backed by polished branding and elaborate narratives.

“Despite increasing awareness and more tools to detect suspicious behavior, rug pulls remain a recurring issue,” Gherghelas points out.

Memecoins appear to be the primary vehicles for these scams, with recent incidents showcasing the vulnerabilities within this market segment. A notable example is the Libertad project’s Solana-based token, Libra, which experienced a meteoric rise in market capitalization to $4.56 billion after social media involvement from Argentina’s president Javier Milei. However, the token’s value plummeted over 94% shortly after, leaving many investors reeling.

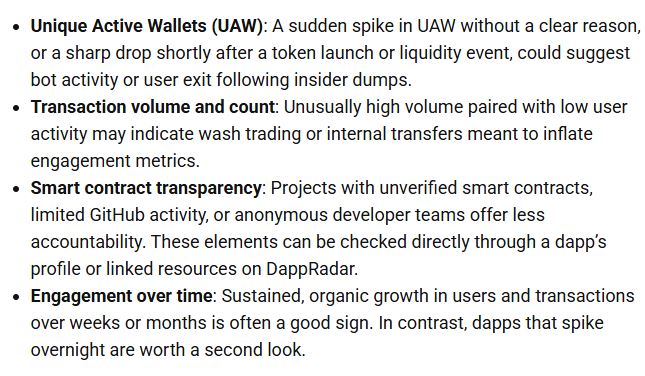

As bad actors refine their tactics, DappRadar encourages users to remain vigilant. Red flags for potential rug pulls include sudden spikes in unique active wallets and erratic trading volumes. Gherghelas advises that awareness, along with enhanced security measures, can play a crucial role in mitigating risks inherent in the rapidly evolving cryptocurrency market. While the battle against rug pulls continues, the tools and information available to users are expanding, paving the way for a safer investment experience amidst the allure of the digital asset space.

Understanding the Current Landscape of Crypto Rug Pulls

Recent trends in the cryptocurrency market reveal significant changes in the occurrence and impact of rug pulls, which are scams resulting in the sudden disappearance of project funds.

- Decrease in Frequency:

- 66% year-on-year decrease in the number of rug pulls from early 2024 to early 2025.

- Only 7 rug pulls recorded in 2025 compared to 21 in early 2024.

- Increasing Impact:

- Nearly $6 billion lost to rug pulls in 2025.

- 92% of losses attributed to the collapse of the OM token, which the founders deny was a rug pull.

- In comparison, losses were only $90 million in early 2024.

- Evolution of Rug Pulls:

- Rug pulls are becoming more sophisticated and devastating.

- In 2025, memecoins have emerged as the primary source of rug pulls.

- High-profile cases such as the Libertad project illustrate the risks associated with speculative tokens.

- Identifying Red Flags:

- Unusual spikes in unique active wallets or trading volume without cause may indicate suspicious activity.

- Projects with unverified smart contracts, limited GitHub activity, or anonymous teams pose higher risks.

- Need for Vigilance:

- As the cryptocurrency ecosystem evolves, so do the tactics of scammers.

- Awareness and vigilance are crucial to reduce the impact of potential scams.

- Users equipped with knowledge can better navigate the complexities of DeFi and newly launched tokens.

“As the industry matures, so do the tactics used by bad actors. But the tools available to users are also getting stronger.” – Sara Gherghelas, DappRadar Analyst

Shifts in Crypto Rug Pulls: Frequency vs. Devastation

The latest report from DappRadar reveals intriguing trends in the world of crypto rug pulls, highlighting a significant drop in their occurrence while noting a troubling increase in the scale of losses incurred. With a staggering 66% year-on-year reduction in the number of incidents—from 21 in early 2024 to just seven in early 2025—crypto enthusiasts might be tempted to breathe a sigh of relief. However, these statistics mask a deeper issue: the remaining rug pulls are now causing unprecedented financial damage, with nearly $6 billion lost in 2025 alone, primarily attributed to the controversial collapse of Mantra’s OM token.

The comparison to earlier years is telling. In 2024, total losses from rug pulls stood at a mere $90 million during the same period, signaling that scammers are honing their craft and employing increasingly sophisticated tactics. This evolution raises serious concerns, particularly concerning memecoins, which have emerged as the primary offenders in recent scam activities.

While the decreasing frequency of rug pulls could benefit investors seeking greater stability and legitimacy within the crypto space, the growing scale of these scams poses significant risks. Those who may not be fully informed about the industry—potential novice investors or individuals drawn in by high-profile endorsements—could find themselves particularly vulnerable. In this regard, projects like the Libertad project or any new token that gains attention rapidly are double-edged swords; they can attract significant investments but also expose uninformed buyers to substantial risks, especially if they fail to recognize red flags like sudden spikes in activity or unusual volume patterns.

Moreover, the crypto landscape’s ongoing maturation necessitates both improved user awareness and more robust protective measures. The decline in rug pulls is heartening, yet the sheer volume of losses when they do happen is alarming. This paradox creates a complicated environment for new players entering the market. While seasoned investors may navigate the complexities with vigilance, those new to crypto might not recognize warning signs, leading to greater financial jeopardy.

In essence, while the news of fewer rug pulls is a positive shift, the increased severity of those that do occur highlights a critical need for informed investment. As projects become slicker and more convincing, users must arm themselves with knowledge and resources to detect potential scams effectively. The challenge will be to balance the allure of new opportunities with the vigilance required to ensure successful investing in an ever-evolving digital landscape.