The cryptocurrency market has recently experienced a significant decline in investor confidence, as evidenced by the dramatic outflows from digital asset exchange-traded products (ETPs). A report from CoinShares revealed that nearly $800 million was withdrawn from crypto ETPs last week alone, marking the third consecutive week of negative movement. The vast majority of these outflows, amounting to approximately $751 million, came from Bitcoin (BTC)-based products, while Ether (ETH) products followed with $37.6 million withdrawn.

In total, since February, the crypto ETP market has seen a staggering $7.2 billion in outflows, effectively undermining this year’s earlier inflows, which now stand at merely $165 million. This shift in sentiment has been attributed to multiple factors, including recent tariff-related activities initiated by former President Donald Trump. His executive order imposing a 10% tariff on imports sparked uncertainty in the market, with CoinShares’ head of research, James Butterfill, noting a “wave of negative sentiment” contributing to the current trend.

“The wave of negative sentiment that started in February has resulted in record outflows,” James Butterfill, CoinShares head of research.

Interestingly, while major cryptocurrencies like Bitcoin and Ether experienced significant outflows, some altcoins bucked the trend and showed signs of resilience. XRP, Ondo Finance, Algorand, and Avalanche reported small gains, reflecting a diverse landscape within the crypto sector. However, other altcoins such as Solana, Aave, and Sui also saw collective outflows exceeding $6 million last week.

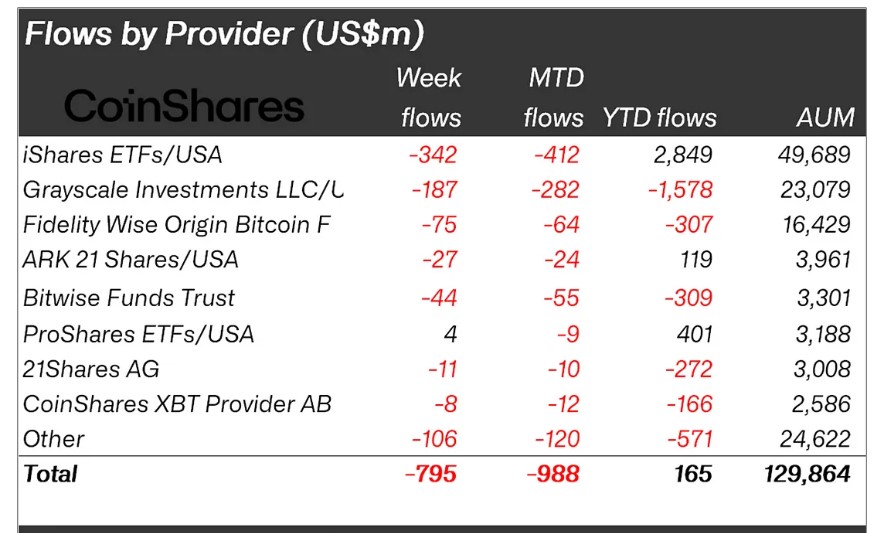

Among the leading providers of ETPs, BlackRock’s iShares faced the most substantial withdrawals, registering $342 million in outflows last week, and accumulating a total of $412 million in outflows for the month so far. Despite these setbacks, iShares still boasts approximately $2.8 billion in year-to-date inflows and manages an impressive $49.6 billion in assets.

The ongoing shifts within the cryptocurrency market mirror increasing investor caution amid broader economic uncertainties, highlighting the volatile nature of digital assets. As the landscape evolves, stakeholders remain watchful of trends that may impact future investment strategies in the ever-changing world of cryptocurrencies.

Impact of Recent Outflows in Digital Asset ETPs

Recent trends in the digital asset market indicate significant outflows from exchange-traded products (ETPs), particularly in the context of Bitcoin and Ethereum. Here are the key points that illustrate the current situation and its potential impact on investors:

- Outflows of Nearly $800 Million: Over the last week, digital asset ETPs experienced approximately $795 million in outflows, marking the third consecutive week of negative movement.

- Dominance of Bitcoin Outflows: A considerable portion of these outflows, about $751 million, was attributed to Bitcoin-based products, highlighting investor sentiment towards the largest cryptocurrency.

- Minor Gains in Altcoins: Despite the significant outflows from major tokens, certain altcoins such as XRP, Ondo Finance, Algorand, and Avalanche exhibited small price gains, indicating a possible shift in investor interest.

- Cumulative Outflows Since February: Total outflows from crypto ETPs have accumulated to $7.2 billion since February, nearly negating the year-to-date inflows of $165 million.

- Impact of Tariff Policies: CoinShares attributed the outflows to tariff-related activities initiated by the Trump administration, which has fostered market uncertainty and negativity since early February.

- Significant Outflows from BlackRock: BlackRock’s iShares suffered the highest outflows among providers, with $342 million withdrawn last week, contributing to a total of $412 million for the month-to-date.

- YTD Gains of Bitcoin’s Products: Despite the outflows for Bitcoin products, they still show a year-to-date gain of $545 million, suggesting resilient long-term investment interest.

“The wave of negative sentiment has resulted in record outflows of $7.2 billion.” – James Butterfill, CoinShares

The trends observed in digital asset ETPs may directly impact individual investors by influencing their portfolio strategies, particularly in how they respond to market conditions and potential volatility. Understanding these dynamics is essential for making informed investment choices in the cryptocurrency landscape.

Sector Shake-Up: Analyzing Outflows in Digital Asset ETPs

Recent data from CoinShares reveals a staggering trend in the digital asset market, with exchange-traded products (ETPs) experiencing nearly $800 million in outflows just last week alone. This alarming situation raises questions about potential competitive advantages and disadvantages for various players in the market. For instance, while BlackRock’s iShares faced significant losses amounting to $342 million in a week, the firm still boasts an impressive $2.8 billion in year-to-date inflows, demonstrating resilience amid volatility.

The root cause of these outflows appears to be the unpredictable tariff activities rolled out by the U.S. government, particularly under President Trump’s administration. This policy uncertainty has led to what CoinShares’ head of research, James Butterfill, terms a “wave of negative sentiment.” In contrast to the mainstream capitulation towards Bitcoin and Ether, select altcoins like XRP and Algorand have defied the trend, showing small but noteworthy gains. This scenario positions altcoins as potential lifelines for investors seeking refuge from the turbulent waters of established cryptocurrencies.

However, these developments could serve as a double-edged sword. On one hand, the negative sentiment surrounding major digital assets might encourage more investors to explore altcoin investment opportunities, thereby diversifying their portfolios. On the other hand, prolonged uncertainty could deter institutional investors from committing to any crypto-related products altogether, fearing sustained volatility and potential losses.

The broader implications of this trend could significantly influence investor behavior. Those heavily invested in traditional Bitcoin and Ether ETPs may find themselves in a precarious position, potentially forcing them to reconsider their strategies in the face of mounting losses. Conversely, investors who have diversified into altcoins may find themselves capitalizing on a growing interest in alternatives to Bitcoin’s perceived stability.

While the mass exodus from digital asset ETPs marks a challenging period for major players like BlackRock, it also signals an evolving market landscape. As some investors seek safety in altcoins, others may pivot towards different trading strategies, leading to a more fragmented but dynamic investment environment.