Recent findings from the fifth annual Singapore Crypto Market Survey shed light on the evolving landscape of cryptocurrency awareness and ownership in Singapore. Conducted in February 2024 with a diverse group of 1,500 participants, the survey revealed that a staggering 94% of respondents are familiar with at least one digital asset, marking a significant increase in crypto awareness among the populace.

However, this rise in awareness contrasts with a notable decline in actual ownership, which has dipped from 40% in 2023 to 29% in 2024. Despite this fall, sentiment around cryptocurrency remains robust. More than half of current crypto holders—53%—express intentions to grow their investments over the next year. Additionally, 17% of individuals not currently holding digital assets indicated they are considering entering the market.

“Bitcoin continues to be the anchor of the crypto market in Singapore, as it is held by 68% of investors, while 86% view it as either a currency, store of value, or investment asset,” the report highlights.

Interestingly, the survey found that the investment demographic is predominantly made up of Millennials and Generation X individuals aged 25 to 54, who represent 71% of current holders. The data also suggested a gender gap in crypto trading, with 35% of men participating compared to only 24% of women. Among the more active traders, 76% belong to the younger age group, emphasizing a strong interest in digital asset trading.

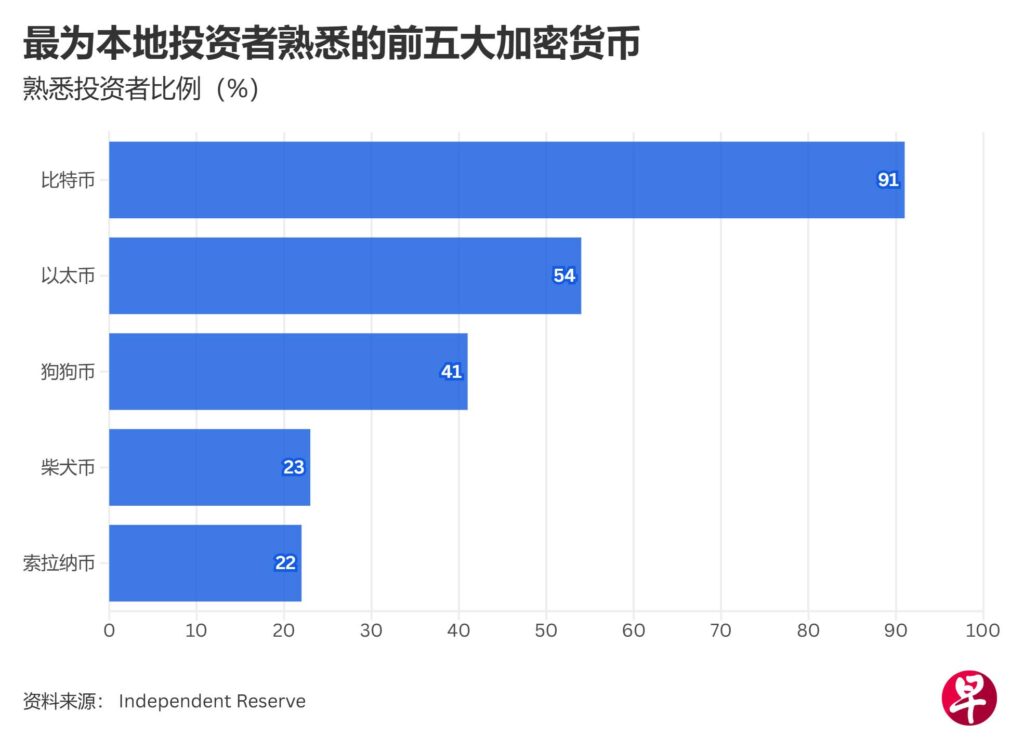

In terms of preferences for asset management, direct ownership remains favored, with 61% of investors choosing to hold their cryptocurrencies rather than using exchange-traded funds. Bitcoin’s dominance is evident, garnering 91% public awareness, followed by Ethereum at 54% and Dogecoin at 41%. Meanwhile, stablecoins are popular for trading and DeFi activities, with 46% of investors holding them, primarily pegged to the US dollar.

Despite the changing ownership dynamics, it seems that Singapore is solidifying its status as a global cryptocurrency hub. As reported, the nation leads in blockchain innovation, boasting 1,600 blockchain patents and a burgeoning workforce in crypto-related jobs. With a proactive regulatory approach, Singapore’s Monetary Authority is redefining the crypto exchange landscape, having issued 13 major payment institution licenses in the past year alone.

Crypto Awareness and Ownership Trends in Singapore

Recent survey findings on cryptocurrency in Singapore reveal significant trends that impact potential investors and the overall market outlook.

- High Familiarity with Digital Assets: 94% of respondents are familiar with at least one digital asset.

- Decline in Ownership: Actual ownership dropped from 40% in 2023 to 29% in 2024.

- Gender Disparity:

- 35% of men actively investing in crypto compared to 24% of women.

- Dominance of Millennials and Gen X:

- 71% of crypto holders are aged 25–54.

- 76% of weekly traders belong to this demographic.

- Strong Sentiment Among Investors:

- 53% of current holders plan to increase their investments in the next year.

- 17% of non-holders are interested in entering the market.

- Bitcoin as a Dominant Asset:

- Held by 68% of crypto investors.

- 86% view it as a currency, store of value, or investment asset.

- 77% anticipate Bitcoin will exceed $100,000 by 2030.

- Preferred Ownership Methods:

- 61% prefer holding assets directly rather than through ETFs.

- Arbitrage Trading Trends:

- 67% reported selling part or all of their holdings to exploit price swings.

- Memecoins and Stablecoins:

- 46% of investors hold stablecoins, primarily for trading and DeFi.

- 28% hold at least one memecoin, with Dogecoin being the most popular.

- Singapore’s Crypto Hub Status:

- Leading the world with 1,600 blockchain patents and 81 active exchanges.

- Monetary Authority of Singapore granted 13 major payment institution licenses to crypto exchanges in 2024.

The increasing regulatory framework and technological advancements in Singapore position it as a key player in the global cryptocurrency landscape, which may provide investment opportunities and influence market dynamics for individuals interested in digital assets.

Singapore’s Crypto Landscape: Insights and Comparisons

The recent surge in crypto awareness in Singapore is certainly noteworthy, with an impressive 94% of surveyed individuals acknowledging at least one digital asset. However, this heightened awareness contrasts sharply with a notable decrease in actual crypto ownership, which has plummeted from 40% to 29% in just a year. While various regions grapple with trust and regulatory frameworks, Singapore is emerging as a competitive landscape for digital assets. Here, we explore the advantages and challenges this presents in the broader cryptocurrency sector.

Competitive Advantages: Singapore’s established position as a global crypto hub is bolstered by its regulatory framework, which has seen significant expansion in recent years. With the Monetary Authority of Singapore issuing 13 major payment institution licenses, the city-state boasts a conducive environment for exchanges and crypto ventures. Additionally, the dominance of Bitcoin and the strong interest in expanding holdings among existing investors reveal a fertile ground for growth. The appeal of direct ownership, favored by 61% of crypto enthusiasts, suggests a community that values autonomy over investments—potentially increasing user engagement and loyalty.

In contrast, many other regions are still grappling with regulatory uncertainties and lack comprehensive structures to support digital asset trading. Thus, the stability and clarity provided by Singapore’s regulations may attract international investors seeking safer grounds to engage in cryptocurrency trading, particularly as the sentiment remains optimistic, with 53% of current holders planning to increase their positions in the upcoming year.

Competitive Disadvantages: Nevertheless, the decline in actual ownership rates raises questions about the longevity of Singapore’s crypto boom. The gap between awareness and ownership indicates potential barriers to entry, such as security concerns, market volatility, or insufficient education on digital assets. Additionally, a summary of demographic insights reveals a concerning gender gap in participation, with male investors outnumbering female counterparts significantly. This disparity could hinder widespread adoption, making it harder for initiatives aimed at encouraging equal participation to gain traction.

Furthermore, should market conditions shift unfavorably, the current enthusiasm could dampen quickly, affecting investor confidence and market participation. The rise of arbitrage trading also suggests a speculative mindset that might not be sustainable in rapidly changing market conditions.

Potential Beneficiaries and Challenges: Primarily, young adults—Millennials and Gen X—who dominate the crypto investor demographic could significantly benefit from the advancements in Singapore’s crypto regulations and opportunities for growth. Their strong inclination towards engaging with Bitcoin and other digital assets indicates a proactive approach to investment that could yield returns as the market matures. However, for new entrants into the crypto space, particularly women and less tech-savvy individuals, the declining ownership trend could deter their participation. This is particularly relevant given the findings showing that 17% of non-holders are interested in investing—an audience that could be lost if the barriers to entry remain insurmountable.

Overall, while Singapore’s crypto market showcases promising growth and innovation, the discrepancies between awareness and ownership alongside demographic divides urge stakeholders to devise strategies addressing engagement and education. With the right approach, this vibrant ecosystem can thrive, benefiting a broader segment of the population and maintaining its competitive edge on the global stage.