Recent insights from Sygnum, a prominent crypto bank group, shed light on the current competition between two major players in the blockchain space: Solana and Ethereum. Despite Solana’s notable advances in transaction volume and fees, Sygnum’s analysis suggests that the network’s ability to challenge Ethereum as the preferred choice for institutions lacks “convincing signs.” This perspective underscores the complexities surrounding Solana’s revenue, which is heavily influenced by its memecoin activity, raising concerns about its long-term stability.

“Current sentiment around Ethereum remains poor,”

the report notes, indicating that market attention is increasingly directed toward Solana’s growing dominance in fee generation. However, Sygnum cautions that the true determining factor for institutional adoption will be traditional financial entities’ decisions regarding technology platforms, rather than just market sentiment. The analysis highlights Ethereum’s reputation for security, stability, and longevity, which continue to be highly valued attributes amongst institutional players.

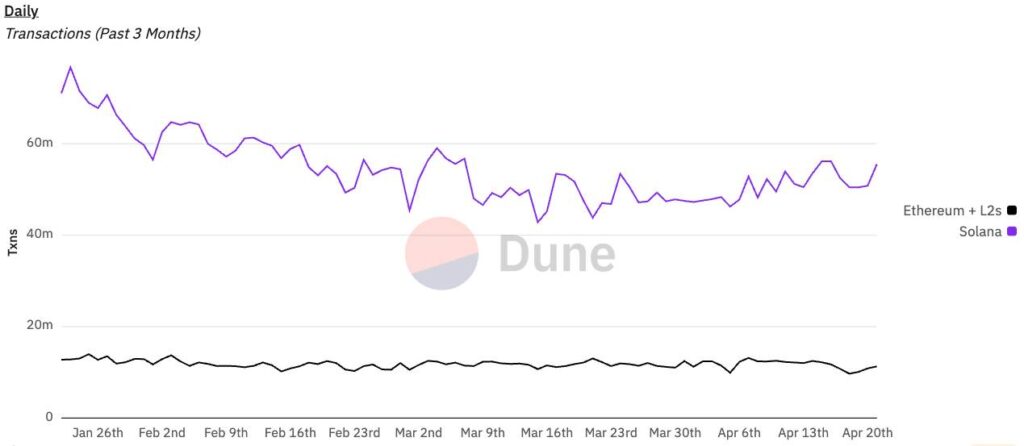

While Solana’s transaction volumes significantly overshadow those of Ethereum and its layer 2 solutions, Ethereum still commands a greater value locked on-chain, revealing a critical discrepancy in their market standings. Notably, Solana is leading in fee generation, but Sygnum points out that a significant portion of these fees benefit validators rather than enhancing the value of the Solana token itself.

“In fact, when it comes to revenues, Ethereum still exceeds Solana 2-2.5x,”

Sygnum elaborated, suggesting that this revenue model could hinder Solana’s potential outperformance. They argue that Solana could improve its standing by focusing on more stable revenue sources like tokenization and stablecoins, areas where Ethereum has already made substantial inroads backed by traditional finance and regulatory support.

Despite these challenges, Solana’s backing remains robust, and its community has shown resilience and readiness to adapt. As the cryptocurrency landscape evolves, the competition between these two blockchain titans will undoubtedly continue to capture the attention of investors and institutions alike, especially as Ethereum adjusts its strategies amid a changing market environment.

Solana vs. Ethereum: Institutional Preferences and Revenue Concerns

Key points from the article highlight the ongoing battle between Solana and Ethereum for institutional adoption, emphasizing factors that could impact reader decisions in the crypto space:

- Instability in Solana’s Revenue:

- Revenue from Solana is concentrated in the memecoin sector, causing concerns about its stability.

- Traditional institutions prioritize security and stability, which Ethereum offers over Solana.

- Comparative Transaction Volumes:

- Solana has higher transaction volumes compared to Ethereum; however, it does not reflect the overall value locked on-chain.

- Ethereum’s superior locking of value suggests a more robust foundation for institutional applications.

- Tokenomics Implications:

- Solana’s tokenomics are viewed as volatile, with the majority of fees going to validators instead of increasing the token’s value.

- Ethereum’s revenues still outperform Solana’s by a factor of 2 to 2.5 times, highlighting ongoing concerns about Solana’s economic viability.

- Potential for Stable Revenue Sources:

- Solana could enhance its standing if it diversifies into more stable revenue sources, such as tokenization and stablecoins.

- Achieving stable revenue streams may attract institutional interest, thereby changing the competitive landscape.

- Institutional Orientation:

- Institutional decisions will significantly shape the medium-term outlook for both blockchains.

- Ethereum’s existing market share in essential use cases further solidifies its position against potential competitors like Solana.

“Solana’s capability to challenge Ethereum relies heavily on its revenue stability and ability to attract traditional finance backing.”

This analysis can aid readers in evaluating their investment decisions in the crypto market, particularly when considering the reliability and future potential of blockchain platforms.

Solana vs. Ethereum: Analyzing Market Dynamics and Institutional Preferences

The ongoing rivalry between Solana and Ethereum for supremacy in the blockchain landscape reveals nuanced dynamics that affect institutional adoption and market perceptions. Recently, a report from crypto bank Sygnum highlighted some critical distinctions in the two networks’ prospects. Despite Solana’s robust transaction volume and fee generation capabilities, it struggles to be recognized as a solid alternative to Ethereum, particularly among traditional financial institutions.

Competitive Advantages of Solana: Solana shines in transaction throughput, consistently outpacing Ethereum in sheer volume. This capacity makes it increasingly appealing for applications requiring high-speed transactions, thus attracting specific decentralized finance (DeFi) projects. Its low fees and capabilities to handle numerous transactions position Solana well in a market that’s growing more competitive.

Competitive Disadvantages of Solana: However, Solana’s reliance on memecoins for revenue generation introduces volatility, raising concerns about its long-term viability. This concentration in a niche sector puts its stability into question, especially when competing against Ethereum’s more diversified revenue sources. Furthermore, Ethereum’s established reputation for security and consistency makes it a preferred option for institutions seeking robust platforms for their operations.

While potential opportunities exist for Solana to carve out market share in areas like tokenization, it faces significant hurdles. Institutional players might hesitate to adopt a blockchain that has yet to demonstrate sustained revenue stability, especially when Ethereum continues to exhibit an extensive track record in case studies involving governments and financial regulators.

Who Stands to Benefit or Face Challenges? Institutions focused on speed and low-cost transactions may find Solana advantageous. Its capability to efficiently handle high transaction volumes can draw decentralized applications (dApps) that prioritize user experience. Conversely, more traditional financial entities could face challenges if they overlook the gradual shifts in market sentiment toward alternative blockchains like Solana. If they fail to adapt and innovate, they may miss opportunities as the crypto space rapidly evolves.

Ethereum, with its strong foundation and existing partnerships, retains a competitive edge that appeals to institutional investors. Those involved in the burgeoning sectors of DeFi, NFTs, and stablecoin issuance are likely to continue favoring Ethereum due to its extensive ecosystem and perceived reliability. However, as Solana evolves and seeks to diversify its revenue streams, it could spark new interest, particularly if its community prioritizes making structural changes that enhance tokenomics.