A significant moment in the Solana community unfolded as stakeholders decisively voted against a proposal intended to overhaul the cryptocurrency’s inflation system. The proposal, known as SIMD-228, aimed to shift Solana’s inflation structure from a fixed schedule to a flexible, market-responsive model. Although the proposal did not pass, it was dubbed a pivotal win for Solana’s governance process, highlighting the active participation of its community.

“Even though our proposal was technically defeated by the vote, this was a major victory for the Solana ecosystem and its governance process,” expressed Tushar Jain, co-founder of Multicoin Capital, reflecting on the democratic nature of the decision.

In total, approximately 74% of the staked supply participated in the vote involving 910 validators, with only 43.6% siding with the proposal, ultimately falling short of the required 66.67% approval. Jain noted that this voting event marked the largest governance vote in the cryptocurrency world, both in terms of participant numbers and market cap, emphasizing the significance of collective decision-making among users.

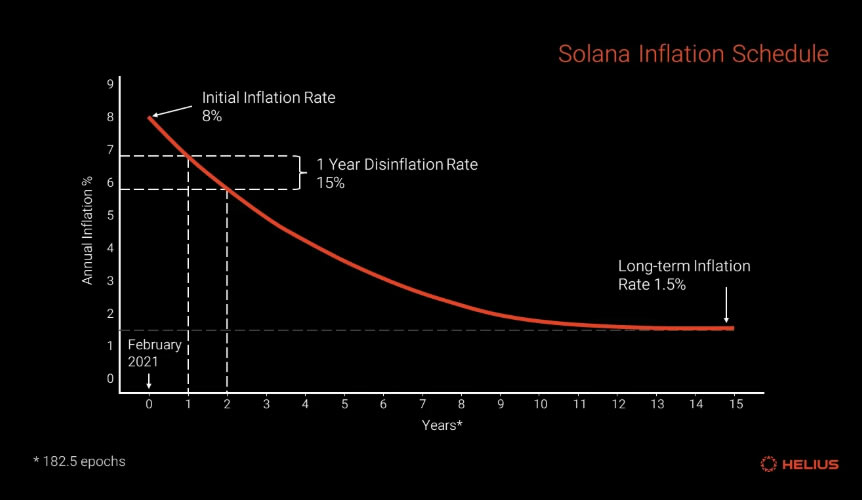

The SIMD-228 proposal was designed to adjust Solana’s inflation from its current annual rate of 4.66%—which begins at 8% and gradually decreases—to a model that would adapt in real-time based on staking participation. Advocates believed this change could potentially stabilize the network while reducing unnecessary token issuance. However, detractors raised concerns about the increased complexity of the model and the implications it might have for smaller validators, potentially impacting their profitability.

“This was a meaningful scaling stress test—a social, rather than technical, stress test—and the network passed despite a wide stratification of diverging opinions and interests,” Jain added.

The excitement surrounding the proposal, despite its rejection, was palpable, even prompting comparisons to high-stakes civic engagement in the United States. The voter turnout dramatically surpassed historical figures from U.S. presidential elections, showcasing the robust involvement within the Solana community.

Interestingly, the reaction in Solana’s market price remained relatively muted with a slight dip of 1.5%, bringing the asset below 5. Yet, in the broader context, Solana has experienced a significant downturn of nearly 60% in just two months, driven largely by the recent decline in interest around memecoins, further evidencing the challenges facing the network.

As the Solana community looks ahead, the outcome of SIMD-228 serves as a reminder of the power of collaborative governance and active engagement among stakeholders in shaping the future of the network.

Solana’s Proposed Inflation System Change Rejected

Key points regarding the recent governance proposal for Solana’s inflation system and its implications:

- Proposal Defeat: The proposal SIMD-228 to shift Solana’s inflation from a fixed schedule to a dynamic model was rejected.

- Stakeholder Participation: Approximately 74% of the staked supply participated in the vote, marking it as the largest crypto governance vote in terms of participants.

- Voting Results:

- 43.6% voted in favor of the proposal.

- 27.4% voted against it.

- 3.3% abstained from voting.

- Current Inflation Rate: Solana’s inflation is currently at 4.66%, starting at 8% annually and decreasing annually.

- Potential Benefits of Proposed Model:

- Increased network security through dynamic inflation adjustments based on staking.

- Encouragement of active SOL usage in decentralized finance (DeFi).

- Concerns Raised:

- Lower inflation could negatively impact smaller validators’ profitability.

- Complexity of a dynamic model may lead to instability in unexpected scenarios.

- Market Reaction: The price of SOL dipped by 1.5% on the day of the proposal’s rejection, continuing a trend of significant price decline over the previous two months.

“This was a meaningful scaling stress test — a social, rather than technical, stress test — and the network passed despite a wide stratification of diverging opinions and interests.” – Tushar Jain

This situation highlights the importance of community governance in cryptocurrencies and how stakeholder decisions can impact the stability and security of a network, potentially affecting individual investors and users’ participation in the ecosystem.

The Impact of Solana’s Governance Vote and Its Implications for the Ecosystem

The recent rejection of Solana’s proposal SIMD-228 to overhaul its inflation system marks a pivotal moment for the blockchain community. While the proposal did not gain sufficient support—falling short with just 43.6% of the votes in favor—its significance lies not in the outcome but in the high levels of engagement from stakeholders. This democratic process showcases the potential of decentralized governance, echoing trends seen in other blockchain networks that emphasize community participation.

Competitive Advantages of Solana’s Governance: The turnout for the SIMD-228 vote represents a landmark achievement, as it eclipsed participation rates even in major political elections. Such active involvement can foster a sense of ownership among community members and reinforce loyalty to the Solana ecosystem. Moreover, the dynamic inflation model proposed could have brought crucial advantages, like enhanced security and adaptability to real-time market conditions. This could encourage broader participation in decentralized finance (DeFi), potentially attracting more users to the ecosystem and enhancing utility for SOL holders.

In contrast, similar governance initiatives in other platforms have often led to contentious debates and divisive forks. For instance, Ethereum’s transition to proof-of-stake was met with both praise and significant dissent from parts of its community. Solana appears to have sidestepped a potential rift, demonstrating that governing through transparent voting can unify stakeholders, even in disagreement—a feat that could trouble other blockchain ecosystems grappling with contentious proposals.

Potential Disadvantages and Challenges: However, the proposal’s rejection isn’t without its drawbacks. The current inflation model, while stable, has led to skyrocketing inflation rates that could inadvertently put downward pressure on SOL prices. Critics argue that the existing setup might hinder smaller validators, who could struggle to remain profitable under high inflation rates, possibly leading to a centralization of power among larger players. This risk remains a constant threat across various networks that prioritize larger stakes over community diversity.

Moreover, the complexity introduced by dynamic inflation adjustments carries its own risks. Unexpected shifts in staking rates could precipitate instability, turning the perceived benefits of a flexible model into a detrimental factor for SOL’s price and overall usability. The market’s muted reaction to the vote outcome, with a marginal price drop of 1.5%, further underscores the uncertainty surrounding Solana’s economic landscape.

Beneficiaries and Stakeholders: The implications of this governance outcome could vary significantly for different stakeholders within the ecosystem. Larger investors and validators may appreciate the status quo, as stable inflation ensures their holdings are safeguarded. In contrast, smaller validators and newer participants might find themselves at a disadvantage, especially as Solana’s network faces increasing competition from other platforms, such as Polygon and Avalanche, which have adopted more accessible governance processes and inflation strategies. As such, the Solana community must navigate these complexities delicately to ensure ongoing growth and inclusivity.