The cryptocurrency landscape is witnessing a notable resurgence of interest in Solana (SOL), as recent data reveals that more than $120 million has been bridged to the network over the past month. This revitalization in liquidity showcases a renewed confidence among market participants, particularly following a tumultuous period characterized by significant fund outflows. According to insights from Debridge, the largest influx originated from Ethereum (ETH) with $41.5 million, closely followed by Arbitrum’s $37.3 million. Additional contributions came from other blockchains, including Base, BNB Chain, and Sonic, further illustrating the growing appeal of Solana amidst evolving market dynamics.

This resurgence comes on the heels of substantial challenges faced by the Solana network, notably marked by the fallout from the LIBRA memecoin controversy in Argentina. Following this incident, investors had withdrawn an alarming $485 million to safer alternatives like Ethereum and BNB Chain. However, the current spike in liquidity aligns intriguingly with the recent performance of memecoins, which have seen notable price rallies, suggesting that exploratory trading might be returning to the Solana ecosystem.

Despite this cautious optimism, Solana’s fee generation paints a more sobering picture. In March, the blockchain generated just under $46 million in transaction fees—a stark contrast to the over $400 million recorded in January 2025. April’s figures are even more modest, sitting around $22 million. While spot Solana ETFs are expected to launch in Canada this week, they may need to bolster investor sentiment further to support the network’s recovery.

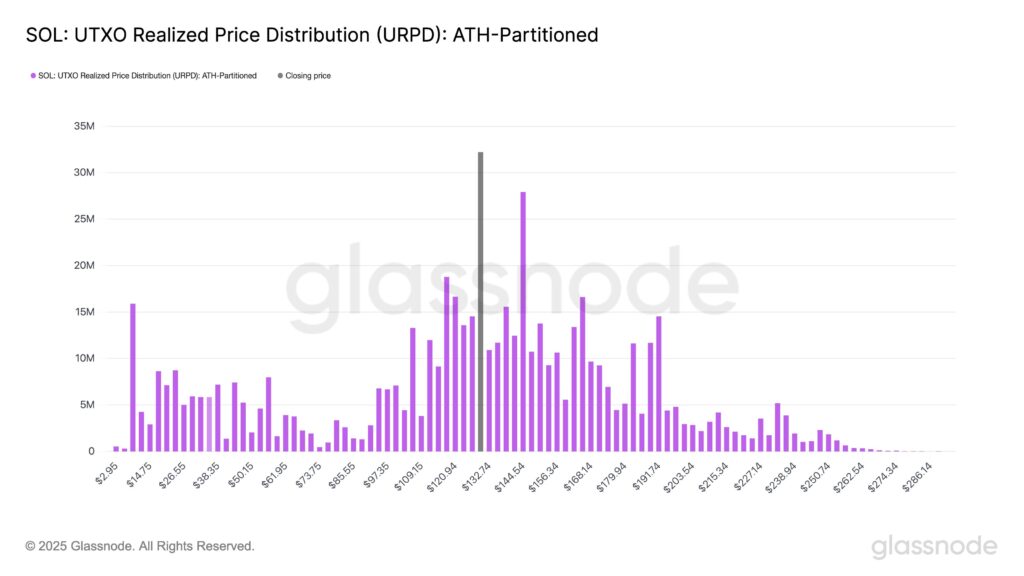

From a market perspective, Solana has its hurdles yet to overcome. The SOL price remains below the critical $140 mark, indicating a bearish trend. Analysts have noted that for the price to shift towards a bullish outlook, it must close above $147. Current technical indicators suggest resistance at the 50-day exponential moving average, complicating recovery efforts. Moreover, a recent bearish divergence noted on multiple charts hints at potential volatility, emphasizing the need for cautious optimism as the market navigates its next steps.

The overall dynamics illustrate a blend of cautious recovery and significant challenges for Solana, paving the way for an intricate balance in investor sentiment.

Key Points on Solana’s Recent Liquidity Trends and Market Challenges

The recent developments in the Solana (SOL) ecosystem reveal significant shifts in liquidity and trading behavior. Here are the crucial aspects that could impact readers and investors:

- $120 million in liquidity bridged to Solana:

- Confidence in the Solana network is on the rise as liquidity is transferred from other blockchains.

- Main contributors include Ethereum ($41.5 million) and Arbitrum ($37.3 million).

- Solana’s recovery from past scandals:

- Following Argentina’s LIBRA memecoin scandal, $485 million was pulled from Solana.

- The current influx indicates a potential rebound in investor trust.

- Memecoin price rallies:

- Recent price increases in memecoins such as POPCAT and FARTCOIN could correlate with interest in Solana.

- Such rallies suggest overall bullish sentiment in the crypto market, impacting trading decisions.

- Fee generation comparisons:

- Total fees dropped to $22 million for April, down from over $400 million in January.

- This decline may affect Solana’s revenue streams, influencing development and partnerships.

- Technical analysis indicates bearish trends:

- Solana is facing strong resistance under the $140 level.

- Bearish divergences may lead to further price corrections, which could impact traders and long-term holders.

- Key support levels identified:

- Significant buying at the $130 level suggests a potential support zone.

- Future price movements may hinge on whether SOL can maintain this support and break resistance at $144.

This analysis does not serve as investment advice. Readers are encouraged to conduct their own research to understand the market better.

Solana’s Liquidity Surge: Market Shift or Temporary Relief?

The recent influx of over $120 million in liquidity to Solana has raised eyebrows in the competitive landscape of cryptocurrency. A significant portion of this liquidity is attributed to transfers mainly from Ethereum, indicating a potential revitalization of confidence among traders in the Solana network. This is a noteworthy turn of events considering the backdrop of the LIBRA memecoin scandal that saw Solana suffer a nearly $485 million exodus just a few weeks prior. The juxtaposition of these circumstances provides a clear view of both the challenges and opportunities facing Solana.

With liquidity flowing back into Solana from networks like Ethereum and Arbitrum, the network is eyeing a chance for recovery. Traders are shifting their focus, buoyed by recent successful memecoin rallies. However, while this influx can be seen as a competitive advantage, Solana also grapples with the specter of past challenges. The network’s fees have significantly plunged from earlier highs, which could deter potential investors looking for a consistent revenue stream. In comparison, Ethereum has maintained a more robust fee generation model, often hovering around $1 billion monthly, which underscores a potential disadvantage for Solana as it attempts to reclaim market standing.

This evolving scenario could significantly benefit short-term traders who thrive on liquidity influxes and price volatility. The speculative nature of memecoins nearing resurgence signals potential profit opportunities. However, for long-term investors or stakeholders looking for stability, Solana’s current bearish trend might become a point of concern. The indicators suggest that until Solana can decisively overcome the technical barriers it faces, such as the 50-day exponential moving average, it risks facing further declines.

Ultimately, while the liquidity shift presents an opportunity for rebounding interest in Solana, the stark contrast with Ethereum’s robust performance, alongside Solana’s precarious technical indicators, outlines both the potential for significant gains and the threat of continued instability. Thus, the current narrative is as much about cautious optimism as it is about navigating a volatile market landscape.