In a recent report from Standard Chartered, the layer-1 blockchain Solana is described as potentially becoming a “one-trick pony” primarily focused on memecoin generation and trading. The research highlights Solana’s strength in providing rapid and cost-effective transaction confirmations, making it a popular choice for high-volume trading. However, this specialization in memecoins has raised concerns, as it accounts for the majority of Solana’s transactional activities, creating a precarious reliance on a volatile market.

The report indicates that the frenetic trading of memecoins has inadvertently served as a test of Solana’s scalability. Yet, with the decline in trading volumes, this reliance poses future challenges for the platform’s sustained growth. Standard Chartered warns that without a diversification of use cases, Solana could struggle to maintain its market momentum.

“As memecoin trading volumes decline, we expect Solana to underperform Ethereum over the next two to three years,” the report states, emphasizing the need for Solana to branch out into sectors like financial applications and social media that also require fast and affordable transaction processing.

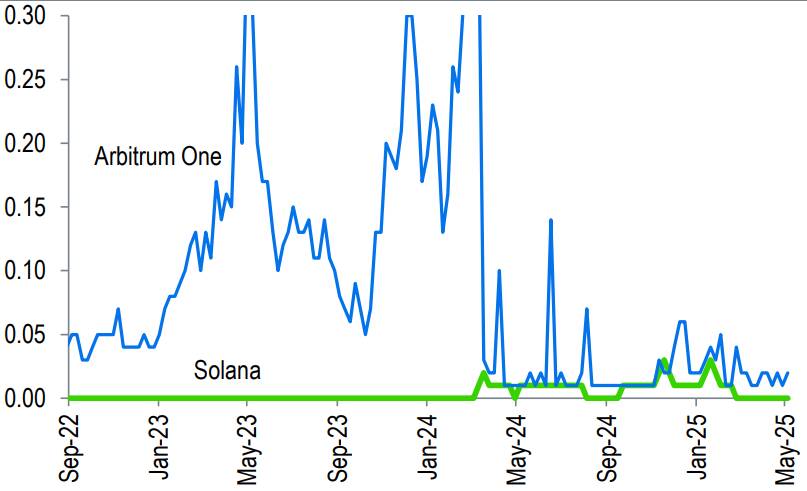

While Solana has established itself as a rapid and budget-friendly alternative to Ethereum, the competitive landscape is shifting. Recent upgrades in Ethereum’s layer-2 platforms have allowed it to close the gap on transaction costs, complicating Solana’s value proposition. The modular design of Ethereum, which enhances its scalability while upholding decentralization, poses new threats to Solana’s previously unmatched advantages.

Solana’s Challenges in the Memecoin Market and Beyond

Key points from the recent Standard Chartered report on Solana’s evolving role in the blockchain space:

- High-Volume, Low-Cost Solutions: Solana’s design enables fast and inexpensive transaction confirmations, making it suitable for high-volume applications.

- Memecoin Dominance: A significant portion of Solana’s activity revolves around memecoin trading, which has served as a stress test for its scalability.

- Declining Memecoin Activity: Recent reports indicate that memecoin trading on Solana has passed its peak, leading to concerns about sustained activity on the blockchain.

- Impact on Future Growth: The decline in memecoin trading volumes could hinder Solana’s momentum, potentially impacting its long-term viability as opposed to Ethereum.

- Need for Diversification: Standard Chartered suggests that Solana must explore other sectors, such as high-throughput financial apps and social media, to remain competitive.

- Competitive Pressures: The rise of Ethereum layer-2 solutions has narrowed the competitive edge that Solana once held, affecting its perceived value proposition.

- Long-Term Outlook: The bank predicts Solana may underperform Ethereum in the next two to three years before potentially catching up, emphasizing the need for innovation.

- Scalability Challenges: Expanding into new sectors may take years, posing further risks as Solana navigates the evolving blockchain landscape.

“As Solana strives to maintain relevance, the intersection of memecoin trading, scalability, and the competitive landscape will significantly influence investors and users alike.”

Solana’s Transition Amidst Memecoin Decline: Opportunities and Challenges

Recent insights from Standard Chartered paint a vivid picture of Solana’s current market position as it grapples with its identity as a leader in memecoin generation and trading. While its architecture boasts rapid transaction confirmations at low costs, this focus has led to a concentration in a volatile sector. The report emphasizes that the flourishing of memecoins could be viewed as a double-edged sword; while it showcased Solana’s scalability, it also embedded the platform deeply within a risky and speculative market.

The decline in memecoin trading volume presents significant challenges for Solana, especially as it risks losing momentum. Investors and developers may find themselves backing a platform that, although efficient, is now associated with diminishing returns in a niche that appears to be stabilizing or retracting. In contrast, rivals like Ethereum are expanding their capabilities and functionality, ensuring that their modular framework not only enhances scalability but also maintains decentralization. Thus, Solana’s competitive edge is increasingly under threat as Ethereum’s layer-2 solutions catch up in transaction costs.

For entities that rely heavily on Solana for memecoin transactions, this shift could spell trouble as the allure fades. Conversely, sectors looking to tap into Solana’s potential for high-volume, low-cost transactions—such as financial applications or social media—may find opportunities even amidst current challenges. However, the projected timeline for Solana to diversify effectively into these areas reveals a daunting road ahead, suggesting that stakeholders should brace for a prolonged period of uncertainty.

The ultimate beneficiaries during this transition may be developers who can innovate within Solana’s ecosystem while forging new pathways beyond memecoins, yet they must navigate a landscape increasingly dominated by Ethereum’s resilience. Meanwhile, casual investors attracted to the surge of memecoins may be left grappling with the volatility as they seek stability in a maturing blockchain environment.