In a significant milestone for the cryptocurrency industry, Solana (SOL) futures began trading on the Chicago Mercantile Exchange (CME) Group’s U.S. derivatives exchange on March 17. This marks a pivotal moment as it reflects the growing mainstream adoption of cryptocurrencies. With the CME previously announcing plans in February to introduce two types of SOL futures contracts—standard contracts representing 500 SOL and smaller “micro” contracts for 25 SOL—these futures are the first regulated contracts for Solana to enter the U.S. market.

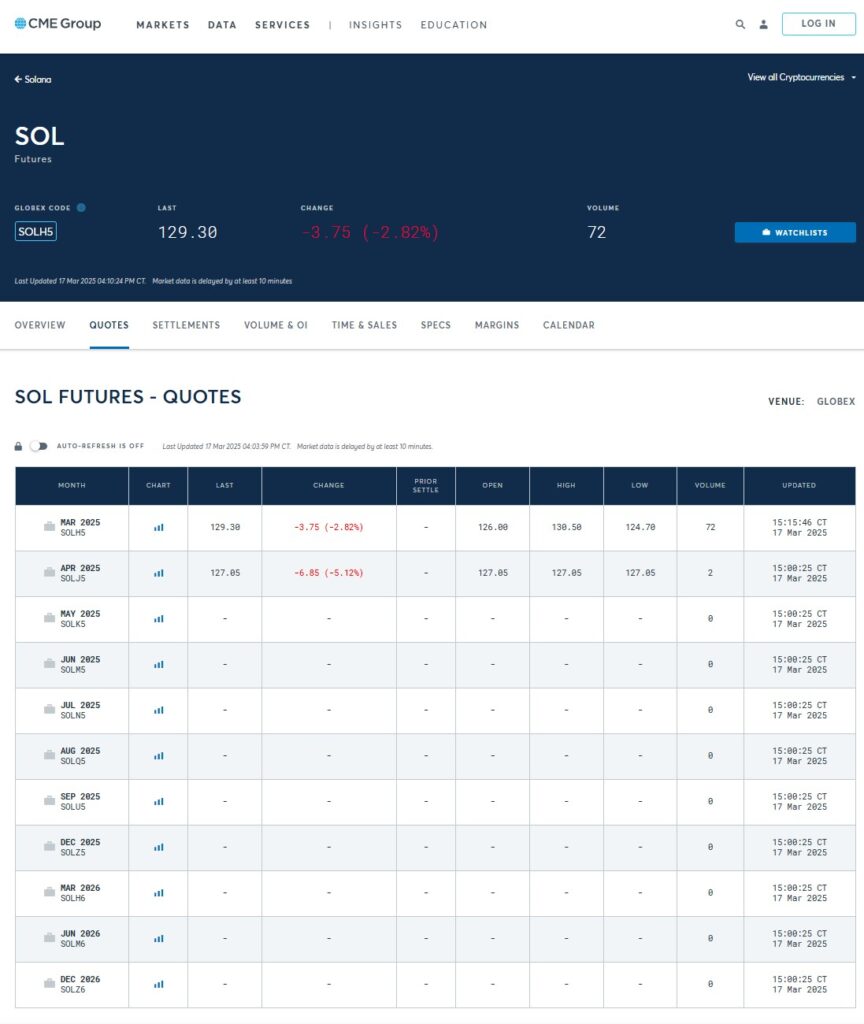

On its inaugural trading day, futures contracts involving nearly 40,000 SOL, valued at around million, were exchanged, according to initial data from CME’s website. However, early pricing data suggests a bearish sentiment among traders, as CME’s April futures priced Solana at 7 per token, slightly lower than the March contracts.

“Solana has come a long way in the last five years,”

stated Chris Chung, founder of Solana-based swap platform Titan. He expressed optimism about the future, noting that with the launch of SOL futures, exchange-traded funds (ETFs) related to Solana could emerge soon.

Indeed, the approval of Solana spot ETFs appears to be on the horizon, with industry experts, including Chung, predicting that the U.S. Securities and Exchange Commission (SEC) may give the green light to proposals from asset managers VanEck and Canary Capital as early as May. With multiple ETF filings submitted to the SEC, the agency has until October 2025 to make final decisions on these requests.

Bloomberg Intelligence is estimating a 70% likelihood of approval for these Solana ETFs, emphasizing the growing confidence in the asset. Futures contracts are not only used for hedging and speculation by various market participants but also serve a critical role for establishing benchmarks that can affect the performance of spot cryptocurrency ETFs.

The CME’s venture into Solana futures follows its previous listings for Bitcoin and Ether, signaling a robust interest in providing regulated trading options for digital assets. As the landscape evolves, the introduction of SOL futures showcases how cryptocurrencies are steadily integrating into mainstream financial markets.

Solana Futures and Their Impact on Cryptocurrency Adoption

Solana (SOL) futures have been launched on the Chicago Mercantile Exchange (CME), marking a significant milestone in the adoption of cryptocurrency in mainstream finance. Here are the key points surrounding this event:

- First Regulated Solana Futures: Solana futures were traded for the first time at the CME on March 17, 2023, emphasizing mainstream acceptance.

- Contract Types:

- Standard contracts representing 500 SOL

- Retail-friendly “micro” contracts representing 25 SOL

- Notional Value Traded: On its first trading day, futures worth nearly million were exchanged.

- Bearish Sentiment: Early pricing data indicates a somewhat bearish outlook for SOL among traders, with April futures priced lower than the March expiring contracts.

- SEC Approval for ETFs: Approval of proposed spot Solana ETFs is anticipated soon, with experts predicting decisions as early as May 2023.

- Impact of Futures on ETFs: Regulated futures markets are essential for supporting spot cryptocurrency ETFs, providing a stable benchmark for performance measurement.

- Growing Interest: The CME previously launched futures for Bitcoin and Ether, indicating a trend toward expanding offerings in the cryptocurrency space.

“Solana has come a long way in the last five years… SOL exchange-traded funds will surely follow shortly behind.” – Chris Chung, founder of Solana-based swap platform Titan

Understanding the dynamics of SOL futures could impact readers who are investors or participants in the cryptocurrency market by providing insights into market sentiment and potential future movements in the cryptocurrency sector.

Solana Futures on CME: A Game-Changer in Cryptocurrency Trading

The recent launch of Solana (SOL) futures on the Chicago Mercantile Exchange (CME) marks a pivotal moment in the cryptocurrency market, especially given the regulatory framework that accompanies it. This introduction signifies not just an increase in the legitimacy of Solana but also highlights its potential as a reliable investment option. Compared to its predecessors like Bitcoin and Ether, which have long dominated the futures trading space at CME, Solana’s uptake presents both distinct advantages and some challenges.

One of the significant advantages of Solana futures is the dual offering of contracts: both standard and micro contracts. This approach allows a broader range of investors—from institutional players looking at larger positions to retail traders who may prefer manageable investments—to access this emerging digital asset. While Bitcoin and Ether futures have primarily attracted institutional investment, Solana’s micro futures could democratize access, making it appealing for everyday investors who want to diversify into cryptocurrencies without risking substantial sums.

However, the first day of trading revealed some caution in the market, with early pricing indicating a bearish sentiment among traders. This could signal skepticism regarding Solana’s stability or developmental trajectory compared to more established cryptocurrencies. If this sentiment persists, it might create hurdles for new investors looking to enter the Solana market, as well as for the ongoing efforts to establish spot ETFs based on SOL.

Speaking of ETFs, the anticipatory atmosphere surrounding potential approvals from the SEC adds an intriguing layer to the scenario. It is believed that successful trading of futures contracts could bolster the case for regulatory approval of Solana ETFs. However, as we’ve seen with previous ETF launches for Bitcoin and Ethereum, market sentiment can heavily influence regulatory decisions. If the futures market for Solana does not gain traction, it could stall ETF approvals and hinder the momentum Solana is experiencing, posing risks for both potential investors and existing stakeholders.

Ultimately, the launch of Solana futures could benefit a wide spectrum of investors—from seasoned traders seeking to hedge and speculate to retail newcomers hoping to capitalize on the growing acceptance of cryptocurrencies. However, the initial bearish market reaction could create apprehension, especially for those unfamiliar with navigating the inherent volatility of crypto markets. As Solana aims to carve out its niche within the futures landscape, all eyes will be on how this plays out in the coming weeks—keeping in mind the interplay of investor sentiment, SEC decisions, and overall market dynamics.