The cryptocurrency market is buzzing with excitement as Solana’s token, SOL, has recently made headlines by rallying more than 20% against Ether (ETH) over the past week. This surge places a spotlight on the growing interest in the Solana ecosystem, with traders now speculating whether SOL could reach the ambitious target of $300, potentially setting new all-time highs for the token. Analysts are closely watching the SOL/ETH ratio, which peaked at 0.080 on April 13, achieving its highest weekly close ever.

“The SOL/ETH chart has just flashed a sign of strength,” noted the pseudonymous trader Bitcoinsensus, highlighting the positive momentum in Solana’s performance.

As SOL continues on this upward trajectory, the gains over the last seven days reflect a remarkable 35% increase for Solana, in stark contrast to a 13% increase for Ethereum during the same period. The SOL/ETH trading pair has consistently formed higher highs on daily charts since April 4, suggesting a clear uptrend.

While excitement grows around the potential for Solana to reach $300, it’s important to note that historical insights suggest challenges might lie ahead. The SOL/ETH ratio previously climbed to as high as 0.093 back in January, paralleling a broader crypto rally at the time. Now, traders are echoing past patterns, with popular crypto analyst BitBull comparing Solana’s current market behavior to Ethereum’s pre-2021 breakout.

“SOL is now showing a similar structure on the CME futures chart,” BitBull remarked, hinting at the possibility of a significant price movement ahead.

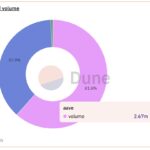

Despite these positive indicators, there are significant hurdles on the horizon for SOL. Recent data reveals a dramatic drop in Solana’s network fees, falling over 97% to approximately $898,235 as of April 14, highlighting reduced trading activity across its decentralized applications. Moreover, daily decentralized exchange volumes plummeted to $2.17 billion, which is significantly lower than the January high of $35.9 billion.

As of now, SOL’s price sits at around $133, still over 54% below its all-time high recorded in January. The overall sentiment remains cautious, reflecting the age-old wisdom in the crypto community that while the potential for growth exists, a substantial rise in network activity is essential for Solana to overcome existing challenges and aim for new heights.

Solana’s SOL Price Rally and Potential Breakout

Key developments in the cryptocurrency market regarding Solana’s SOL price performance over the past week:

- SOL Rallies Over 20% Against ETH:

- Solana’s SOL has increased by 35% over the last seven days compared to a 13% rise in Ether’s price.

- The SOL/ETH ratio reached a new all-time high close of 0.080 on April 13.

- Potential Price Breakout:

- Trader BitBull suggests that SOL could reach $300, echoing Ethereum’s breakout in 2021.

- The current trading range for SOL is between $120 and $130.

- Technical Indicators Show Strength:

- The SOL/ETH pair has formed higher highs on the daily chart, indicating a possible uptrend.

- Previous peaks of the SOL/ETH ratio suggest volatility and room for growth.

- Challenges Ahead:

- A significant drop in Solana’s network fees indicates reduced trading activity and engagement.

- Daily DEX volumes on Solana have plummeted by 93% from their January highs.

“Just like Ethereum’s run in 2021, Solana is setting up for a massive move in 2025.” – Trader BitBull

The information regarding Solana’s price movements and network metrics can significantly impact potential investors or existing holders by highlighting both opportunities for growth and risks related to decreased network activity. Understanding these dynamics is crucial for informed decision-making in the volatile cryptocurrency market.

Solana’s Ascent: Navigating the Competitive Landscape of Crypto Trading

Recently, Solana’s SOL has experienced a remarkable upswing, outperforming Ether with a notable 20% gain over the last week—positioning it as a point of interest among traders. This movement highlights a shift in market dynamics, particularly as Solana’s SOL/ETH ratio reached unprecedented heights. However, it’s essential to place this news within the broader context of the cryptocurrency ecosystem, where both advantages and drawbacks are in constant play.

Competitive Advantages: The SOL’s strong performance against ETH indicates growing investor confidence in Solana’s ecosystem, which is commonly recognized for its speed and lower transaction costs compared to Ethereum. A notable trader, BitBull, even suggests that SOL may follow a trajectory similar to Ethereum’s historic breakout in 2021. This potential for parabolic growth could attract a wave of new investors looking for the next big opportunity, especially as SOL seems poised to make a run toward its $300 target. The buzz around the SOL/ETH ratio also plays into this narrative, suggesting that Solana could continue to outperform other cryptocurrencies, thereby drawing attention from traders looking for advantageous pairs.

Competitive Disadvantages: Despite these bullish indicators, Solana does face significant headwinds. The dramatic decrease in network fees—plummeting over 97%—and the sharp decline in daily transaction activity raise concerns about the underlying health of the network. As trading volumes drop, particularly on decentralized platforms associated with Solana, questions arise about the sustainability of its recent price gains. Thus, while it may have gained traction against ETH, the long-term viability of such growth is reliant on increased user engagement and network activity. This discrepancy could deter long-term investors who prioritize robust metrics over short-term price changes.

In the fast-paced world of cryptocurrency, timing is crucial. Traders with a keen eye on market behavior could benefit from Solana’s current momentum, particularly those with a high-risk tolerance. Conversely, more risk-averse investors or those reliant on proven metrics may find themselves in a precarious position if the anticipated growth doesn’t materialize, as fluctuating network activity might signal more than just short-lived price projections. Ultimately, those looking to capitalize on Solana’s potential will need to weigh the promising indicators against the lurking risks of diminished network engagement.