The cryptocurrency landscape is buzzing with excitement as Solana (SOL) showcases significant market developments. Recently, Solana has captured attention by forming a megaphone chart pattern that suggests increased volatility, hinting at a potential price target of $210. This technical formation aligns with the altcoin’s recent performance, where SOL tested a critical resistance level at $180 but struggled to maintain its stance above that mark.

Despite a slight decline of 5.65% since mid-May, Solana has managed to hold above the $170 threshold. The upper resistance trendline of the megaphone pattern is positioned near $185, which, if breached, could ignite a surge towards the $210 target—representing a promising 21% upside from current levels. However, it’s worth noting that such patterns can also signal bearish movements, particularly if the price fails to break the $180 resistance, potentially leading to a pullback toward significant support levels.

“Solana is experiencing a revival in investor interest, with Glassnode reporting a 4% to 5% rise in 30-day capital inflows, matching XRP’s growth.”

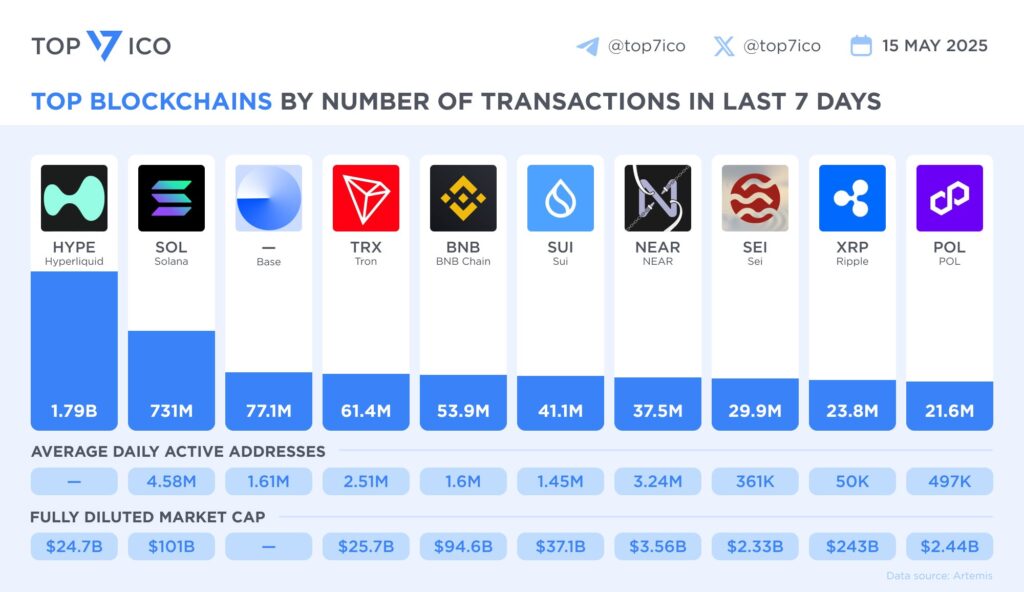

This renewed investor enthusiasm is underscored by Solana’s remarkable growth in realized cap, which has increased by $4 billion, bringing it to $78.5 billion as of May 14. Such robust metrics indicate a reinvigorated demand within the Solana ecosystem. Supporting this observation, Solana recorded an impressive 731 million transactions over the past week, securing its place as the second-ranked blockchain in terms of transaction volume, nearly closing in on leading platforms.

As the cryptocurrency market continues to evolve, Solana’s performance paints a picture of resilience and potential, sparking conversations among investors and analysts alike. With ongoing developments and increased activity, the path ahead for Solana offers captivating possibilities in a dynamic sector that never ceases to surprise.

Key Takeaways on Solana’s Market Dynamics

The following points summarize the recent developments regarding Solana (SOL) and their potential impacts on investors:

- Formation of Megaphone Pattern:

- Solana has formed a megaphone chart pattern indicating increasing volatility.

- The upper resistance trendline is around $185 with immediate resistance at $180.

- Price Target of $210:

- A confirmed breakout above $180 could potentially propel Solana’s price to a target of $210.

- This represents a 21% potential rally from current prices, which could impact investor sentiments positively.

- Importance of Volume Confirmation:

- Volume confirmation during breakout is crucial; low volume may predict a false move.

- Potential for Pullback:

- A failure to break through $180 may lead prices towards $161 or lower support near $150.

- Growth in Realized Cap:

- Solana’s realized cap has increased by $4 billion, reaching $78.5 billion, signaling a significant revival in investor interest.

- This increase coincides with a rising capital inflow of 4% to 5%, indicating renewed demand within the Solana ecosystem.

- High Transaction Volume:

- Solana executed 731 million transactions over the past week, ranking second among blockchains.

- This performance supports the view of Solana’s strength compared to other chains and can attract more investors.

Investing carries risks; readers are encouraged to conduct independent research when making investment decisions.

Solana’s Market Momentum: Analyzing Competitive Advantages and Challenges

Solana (SOL) has been making headlines lately, with its price hovering around a crucial resistance level and the formation of a megaphone chart pattern suggesting potential price movements. In this ever-evolving landscape of cryptocurrencies, it’s essential to consider how Solana stacks up against its competitors like Ethereum, Binance Smart Chain, and Cardano.

Competitive Advantages: One of Solana’s most significant advantages is its booming ecosystem. Recent reports indicate a remarkable surge in investor interest, highlighted by a $4 billion increase in its realized cap and an astounding 731 million transactions processed recently. This vibrant activity showcases Solana’s ability to handle a high transaction volume, positioning it favorably against other chains. For instance, while Hyperliquid also shows impressive transaction numbers, Solana’s position as the second-ranked blockchain by transactions could attract more developers and users looking for scalability and efficiency.

Moreover, the observed 4% to 5% rise in 30-day capital inflows suggests a normative uptick in demand for Solana, aligning itself with trends seen across other notable networks like XRP. This momentum could appeal particularly to investors seeking new opportunities in the market, especially as traditional methods like Bitcoin ETF inflows face stagnation.

Competitive Disadvantages: However, it’s essential to observe that the megaphone chart pattern can also signal volatility and potential bearish outcomes. The recent failure to establish a strong position above the $180 mark could be concerning for investors who may fear a pullback towards the 100-day exponential moving average at $161. If Solana fails to break above the $180 resistance convincingly, it risks losing momentum and possibly discouraging new entrants to the ecosystem. This uncertainty could also create headwinds for current investors, as market sentiment may shift towards more stable options like Ethereum, which consistently boasts robust developer support and broader adoption for decentralized finance (DeFi) applications.

Who Stands to Benefit or Face Challenges: For investors chasing high-reward opportunities, Solana may present an exciting prospect, especially if traders can leverage the moment when it breaks key resistance levels. However, should volatility increase or if momentum stalls, this could deter risk-averse investors, paving the way for a more cautious approach to entering the market. In contrast, long-term holders might see these fluctuations as a sustainable opportunity to bolster their positions, capitalizing on Solana’s current growth trajectory. Additionally, developers and innovators might gravitate towards Solana, but they must weigh its potential risks against the stability offered by established alternatives.