The cryptocurrency landscape is buzzing with activity as Solana’s native token, SOL, shows signs of resilience amid fluctuating market conditions. After successfully holding the $140 support level for a week—a feat not seen in over two months—trader confidence appears to be on the rise. The interest is palpable, particularly as SOL futures open interest reached a significant milestone of $5.75 billion on April 30, highlighting strong institutional engagement.

Despite a 4% dip in SOL’s price after struggling to maintain the $150 mark, the sustained support at $140 suggests a level of stability that many traders find reassuring. The growing demand for leveraged SOL positions on futures markets, which neared record highs, raises hopes for a potential rally, with a target of $200 being floated by some analysts ahead of a possible spot ETF approval by the U.S. Securities and Exchange Commission on October 10.

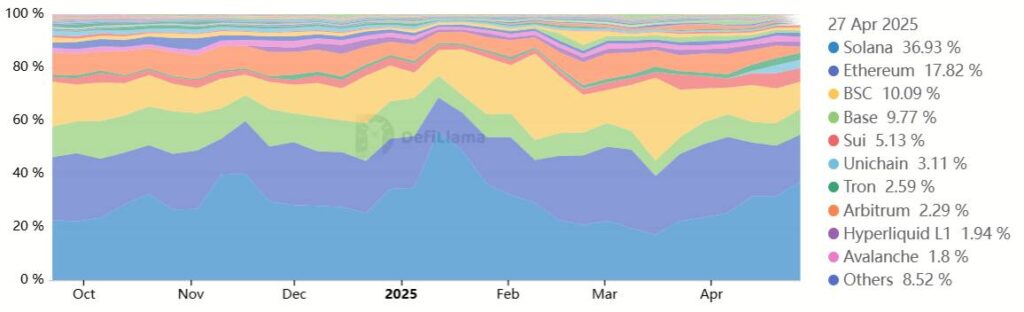

“While some traders remain cautious, the recent increase in decentralized exchange volumes and Solana’s second-place ranking in total value locked (TVL) at $9.5 billion illustrates the network’s strong fundamentals,”

said an industry expert. Solana’s decentralized applications are not just relying on speculative trading; they are generating real revenue. In fact, top platforms like Meteora and Pump-fun have recently emerged as major fee earners, signaling robust activity within the ecosystem.

The disparities in trading volumes between Solana and other platforms like Ethereum are particularly striking. Over the past week, Solana’s decentralized exchanges recorded trading volumes nearly 90% higher than Ethereum, suggesting a preference among traders for the Solana network due to its lower transaction fees and faster processing times.

As we edge closer to the SEC’s decision regarding a potential spot ETF for Solana, analysts are keeping a close watch on market movements. The possibility of such an approval could attract new retail investors, further boosting SOL prices. While the short-term outlook has its uncertainties—especially concerning bearish positions in futures—Solana’s strong fundamentals and increasing institutional interest could pave the way for a bright future in the crypto arena.

Key Points on Solana’s Market Trends

Understanding the recent developments in Solana’s market can help readers make informed decisions regarding their investments or interest in cryptocurrencies.

- $140 Support Level Maintained:

Solana has held the $140 support level for a whole week, the first time in over two months, indicating increased trader confidence.

- Institutional Interest:

SOL futures open interest reached $5.75 billion on April 30, reflecting strong institutional interest and signaling potential market growth.

- Potential for Price Rally:

With rising decentralized exchange (DEX) volumes and a total value locked (TVL) of $9.5 billion, there’s speculation that SOL could rally to $200 before the anticipated spot ETF approval on October 10.

- Short-term Price Decline:

Despite a 4% decline from April 29 to April 30 after falling below the $150 mark, the sustained $140 support suggests a resilient market.

- Demand for Leverage Positions:

A surge in demand for leveraged SOL positions signals traders might be reconsidering chances for a rally, though a negative funding rate indicates some bearish sentiment.

- High Total Value Locked (TVL):

Solana’s TVL stands at $9.5 billion, making it a strong contender for decentralized finance applications, beyond just speculative memecoins.

- Strong Decentralized Exchange Volume:

Solana’s decentralized exchanges report trading volumes nearly 90% higher than Ethereum, showcasing its market dominance.

- Spot ETF Approval Potential:

The anticipated approval of a spot Solana ETF could attract new retail investors, possibly elevating SOL prices further.

This information is intended for general knowledge purposes and does not constitute legal or investment advice, emphasizing the importance of conducting personal research before investing.

Analyzing Solana’s Market Position: Strengths and Challenges

Solana’s recent performance indicates a notable shift in market dynamics, particularly in relation to the broader cryptocurrency landscape. Holding the $140 support level for an extended period signifies a noteworthy rebuilding of trader confidence, something that hasn’t been seen for over two months. This steady support can be contrasted with competitors like Ethereum, which continues to struggle with high transaction fees that make participation costly for smaller investors. While Solana’s decentralized exchanges have exhibited impressive trading volumes—surpassing Ethereum’s—there’s still an element of volatility that could present risks for potential investors.

Institutional interest in Solana is evident, with SOL futures open interest climbing to $5.75 billion, making it one of the top contenders in this arena. However, this impressive figure also highlights a dichotomy: despite the strong demand for futures, many traders are veering toward bearish positions, as indicated by the negative funding rate on perpetual contracts. This suggests that while there may be institutional confidence, retail investors might be proceeding with caution, a stark contrast to the exuberance seen in other cryptos like Bitcoin, which enjoys more established bullish sentiment.

For those considering investment opportunities, Solana’s capability to draw in retail investors, particularly with a potential spot ETF approval on the horizon, could bring substantial benefits. However, the recent decline of 4% between April 29 and April 30 after failing to sustain higher price levels serves as a wake-up call. In an environment where optimism can turn quickly due to external market pressures, investors must weigh the risks carefully.

The recent surge in TVL to $9.5 billion indicates that Solana is not merely reliant on speculative tokens but has diversified applications such as liquid staking and synthetic derivatives, sparking institutional interest in a way that challengers like XRP have yet to achieve. However, this growth comes with the caveat of significant concentration in certain decentralized applications, which raises concerns about sustainability if interest shifts to new platforms or rivals.

In terms of trading advantages, Solana’s competitive edge lies in its ability to process higher volumes at lower fees, enhancing the user experience on its decentralized platforms. Yet, this very dependence on volume for growth could pose challenges if the market turns bearish—leaving Solana vulnerable to sharp drops in trading activity. Consequently, while the possibility of reaching a $200 target could entice speculative traders, it remains essential to consider external factors that could hinder this potential surge.

Overall, while Solana’s current positioning seems promising, investors—both retail and institutional—should remain vigilant as market conditions are inherently fickle. By understanding both Solana’s strengths and the challenges it faces, stakeholders can make more informed decisions in this rapidly evolving cryptocurrency landscape.