A recent development in the world of cryptocurrency has caught the eye of the trading community, particularly surrounding Solana, a prominent blockchain platform. A significant Solana wallet, which belongs to a so-called “whale” investor, has achieved remarkable profits that highlight the potential rewards of long-term staking strategies. According to blockchain analytics firm Lookonchain, this wallet initially staked nearly 1 million SOL tokens in 2021, costing the investor around $27 million at the time when Solana was priced at approximately $27 per token.

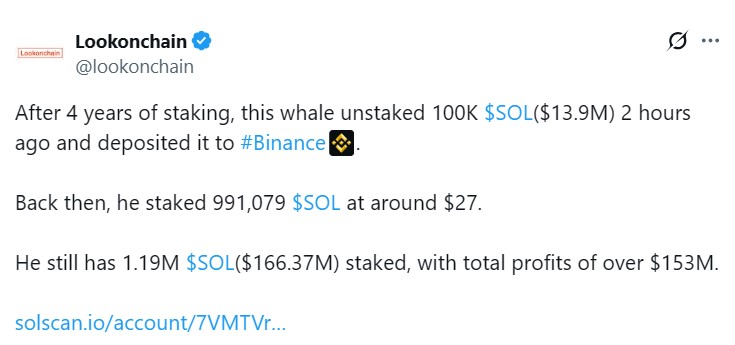

Fast forward to today, that same wallet has seen its holdings swell to 1.29 million SOL tokens, now valued at around $140 each, bringing the total worth to an impressive $180 million. As part of cashing in on these gains, the whale recently unstaked and transferred 100,000 SOL tokens — worth about $14 million — to a cryptocurrency exchange, a typical move that typically suggests the intention to sell.

“The whale still possesses 1.19 million SOL, translating to a current value of about $166 million, resulting in an unrealized profit of roughly $153 million since the staking began.”

This isn’t an isolated case; earlier this month, a significant number of tokens were also unlocked for other investors, leading to the largest single-day release of staked SOL when four wallets saw their accumulated $37 million worth of tokens transformed into over $206 million in value. However, following this unlock, about $50 million in tokens were sold, illustrating the urge among investors to capitalize on the market’s fluctuations.

Additionally, the Solana network has recently gained traction in the staking arena, momentarily surpassing Ethereum in total staked value, amassing over $53 billion. While this event was fleeting, as Ethereum later reclaimed its top spot, the rise in interest for Solana has sparked debates within the community about the implications of such competition in the cryptocurrency landscape.

As staking continues to be a popular strategy among major investors, observant traders and enthusiasts alike are keenly watching how these moves will influence market dynamics, including pricing trends and investor sentiments across both Solana and Ethereum.

Solana Whale Sees Massive Profits from Staking Play

Key points from the recent analysis of a Solana whale’s staking ventures:

- Enormous Initial Investment: A wallet staked nearly 1 million SOL tokens in 2021, costing approximately $27 million.

- Significant Appreciation: The value of the tokens escalated to around $180 million after Solana’s price rose to about $140.

- Profit Realization: The whale began to cash out by unstaking 100,000 SOL tokens (worth around $14 million) to sell on Binance.

- Current Holdings: Post-offloading, the whale retains 1.19 million SOL, valued at approximately $166 million.

- Unrealized Profit: The total unrealized profit for the wallet stands at around $153 million, showcasing significant gains from the staking activities.

The impact of these events on the reader can be profound:

- The significant profits made by this whale highlight the potential benefits of early investment and long-term holding strategies in the volatile cryptocurrency market.

- Understanding the staking process could empower individual investors to make informed decisions about their own crypto holdings.

- Monitoring whale activities can provide insights into market trends and potential price movements, which may influence personal investment strategies.

- Witnessing large-scale transactions, like the whale offloading SOL tokens, may indicate market liquidity and provide cues for readers to assess when to enter or exit their positions.

- The brief overtaking of Ethereum in staking market cap serves as a reminder of the competitive nature of blockchain networks and their market dynamics, which could impact reader decisions regarding asset diversification.

Staking Success: The Rise of Solana Whales and Market Implications

Recent developments regarding Solana staking have garnered attention, especially with buzz surrounding a significant wallet that has transformed an initial investment of $27 million into an impressive $180 million since 2021. The whale’s notable offloading of 100,000 SOL tokens suggests an active strategy to capitalize on currently high prices, setting the stage for both opportunities and challenges within the broader crypto ecosystem.

Comparative Edge of Solana’s Staking Environment: One notable competitive advantage for Solana in this scenario is the network’s demonstrated ability to attract large investors looking for high-yield staking opportunities. The substantial returns seen by whales not only amplify confidence in Solana’s staking mechanics but also position it firmly against rivals like Ethereum. While Ethereum has historically dominated the staking market, Solana’s brief flip, when it surpassed Ethereum in staking market cap, indicates a shifting sentiment that could lure more liquidity to its platform.

However, there are inherent disadvantages to such volatility. The rapid rise in value can invite skepticism from smaller investors. With large holders like the mentioned whale cashing out, there may be fears of a larger market correction, which could discourage entry into Solana for those not already familiar with its dynamics. Moreover, while staked tokens showcase potential for high yields, the withdrawal and selling these assets can create price fluctuations that impact the overall stability of the market.

Who Stands to Gain or Lose? This situation could significantly benefit seasoned investors and traders who have monitored Solana’s staking landscape closely and can execute timely trades to maximize gains. Furthermore, institutions looking to diversify their crypto portfolios may view the whale’s success as a compelling case for including Solana among their assets. Conversely, retail investors eager to join the fray may find themselves at risk of significant losses, especially if market sentiment shifts quickly following large sell-offs by whales. The fear of missing out (FOMO) could lead to hasty decisions that result in unfavorable positions.

This pattern of whale activity and subsequent market impact isn’t limited to Solana; it mirrors trends in other crypto assets where significant transactions can create waves. Nonetheless, with an influx of large stakes also comes the opportunity for more innovative and robust staking protocols, which could mean exciting developments ahead for crypto enthusiasts and investors navigating this highly dynamic landscape.