Solana has made headlines this week with an impressive 18% price increase, signaling a resurgence of bullish sentiment amongst investors. This upward momentum has brought the altcoin close to the crucial 50-week exponential moving average (EMA), a technical level that, when breached, has historically led to substantial rallies. Notably, back in October 2023, Solana experienced a similar breakout, eventually soaring by an astonishing 515% by March 2024.

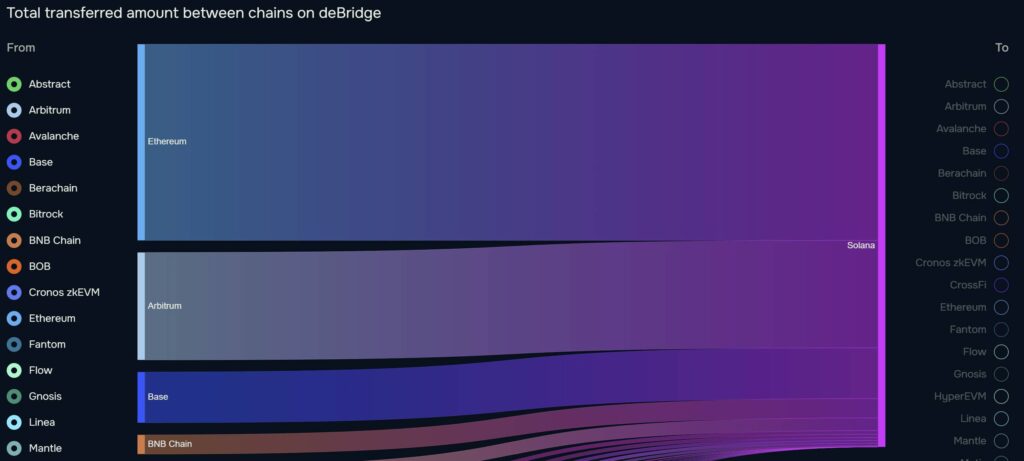

Recent activity illustrates a growing confidence in the Solana network, evidenced by over $165 million in liquidity bridged from other blockchains in just the last 30 days. Ethereum, Arbitrum, and other networks contributed significantly to this figure, underlining Solana’s appeal in the decentralized finance (DeFi) landscape. With a current market share of approximately 28.99%, Solana is emerging as a leader in DeFi activity, boasting impressive trading volumes that further enhance its position.

“If the 50-week moving average holds, analysts suggest potential price targets for Solana could soar between $250 and $350 by September 2025.”

As Solana approaches this pivotal 50-week EMA, many are watching closely to see if it can maintain its momentum and potentially transform resistance levels into support. The positive trends not only indicate a recovery from earlier dips but also hint at possible future gains, sparking interest among investors and enthusiasts alike in the evolving cryptocurrency market.

Key Takeaways from Solana’s Recent Surge

Understanding the current momentum in Solana’s market can significantly impact potential investment decisions. Here are the key aspects to consider:

- 15% Surge in Price: Solana’s recent price increase indicates strong bullish momentum.

- Pivotal Technical Level: A close above the 50-week exponential moving average (EMA) could trigger further rallies, as historically observed.

- Historical Performance:

- In October 2023, Solana experienced a similar breach leading to a 515% rally by March 2024.

- Current conditions mirror past scenarios where significant price growth followed the recovery above the 50-week EMA.

- Liquidity Inflows: Over $165 million has been bridged to Solana from other networks, reflecting growing confidence in its infrastructure.

- Market Share in DeFi: Solana currently holds 28.99% of the market share among decentralized exchanges (DEX), showcasing its scalability and user adoption.

- Potential Price Targets:

- If the 50-week EMA holds, predicted price range for Solana could be between $250 and $350 by September 2025.

- A breakout above immediate resistance levels could lead to a parabolic rally by Q3 2025.

Investors should remain cautious: While trends indicate bullish potential, it’s crucial to conduct thorough research and consider risks.

Solana’s Recent Surge: Analyzing Competitive Advantages and Market Impact

Solana’s notable 15% surge and its leap towards a stable position above the critical 50-week EMA are major indicators of its bullish momentum, reminiscent of the impressive 515% rally experienced in early 2024. As more liquidity flows into Solana, with over $165 million bridged from other networks, it reflects a significant uptick in confidence that could position Solana as a leader in the DeFi space.

In comparison to competitors like Ethereum and Arbitrum, Solana’s recent performance showcases its advantages in both speed and scalability. The robust influx of liquidity and the network’s significant share of decentralized exchange volumes demonstrate its increasing adoption and user engagement. While Ethereum maintains its dominance, particularly with a well-established user base and robust dApp ecosystem, Solana’s agility could create a compelling alternative for users seeking lower transaction costs and enhanced speeds.

However, this burgeoning position isn’t without its drawbacks. The cautionary optimism around Solana stems from its historical volatility and potential reliance on sustained momentum to maintain its current price trajectory. Investors focused on long-term stability may find a headwind as Solana struggles to consistently outperform Ethereum, which continues to innovate and expand its offerings. If Solana fails to secure strong support levels or if a market correction occurs, it could lead to investor hesitation, stalling its growth momentum.

The surge in liquidity and active trading could significantly benefit retail investors and traders looking to capitalize on short-term momentum. This demographic, often driven by rapid changes and market sentiment, may find Solana’s current bullish trend to be an attractive opportunity. Conversely, institutional investors might approach with caution, assessing the overall sustainability of Solana’s growth amid rising competition and existing market volatility.

In summary, while Solana’s excellent performance and growing adoption paint a promising picture for its future, the rivalry with established platforms like Ethereum presents both a challenge and an opportunity. Whether Solana can maintain its momentum and extend its gains will ultimately depend on market dynamics and its ability to differentiate itself in an increasingly competitive landscape.