Solana’s native cryptocurrency, SOL, recently experienced a significant setback, dropping 8% after briefly reaching 7 on March 25. Over the past three weeks, the token has struggled to reclaim the coveted 0 mark, prompting traders to speculate whether the earlier bullish trends, fueled by memecoin excitement and interest in artificial intelligence, are beginning to wane.

Some analysts maintain that SOL price could see a considerable boost if a Solana spot exchange-traded fund (ETF) gains approval in the United States. Additionally, the growth of tokenized real-world assets (RWA) on the Solana network, including stablecoins and money market funds, holds potential for future profitability. Nikita Bier, co-founder of TBH and Gas startups, argues that the Solana platform is equipped with “the fundamental building blocks for something to break out on mobile,” thanks to its user-friendly experience for mobile users.

“The constructive regulatory environment from US President Donald Trump will have long-term benefits, particularly as the memecoin frenzy brought millions of new users to Web3 wallets and decentralized applications,” asserts Bier.

Nevertheless, the recent announcement regarding Bitcoin reserves has cast a shadow over the entire cryptocurrency market, contributing to losses for many traders. The U.S. government has officially decided not to add altcoins to its strategic reserve, which was disappointing for investors hoping that Solana and other altcoins would be included. President Trump’s signing of a bill on March 6 allows the U.S. Treasury to acquire Bitcoin in a budget-neutral manner while strategically selling off other altcoins, leaving Solana unnoticed in the broader digital asset discussion.

While Solana boasts an ecosystem that transcends mere memecoin trading, including areas like liquid staking, collateralized lending, and yield platforms, recent data reveals a troubling downturn. Over the week leading to March 24, DApp revenues plummeted to million from .7 million just two weeks prior, while base layer fees also fell sharply. This diminished on-chain activity signals a decline in investor interest, complicating prospects for SOL’s resurgence.

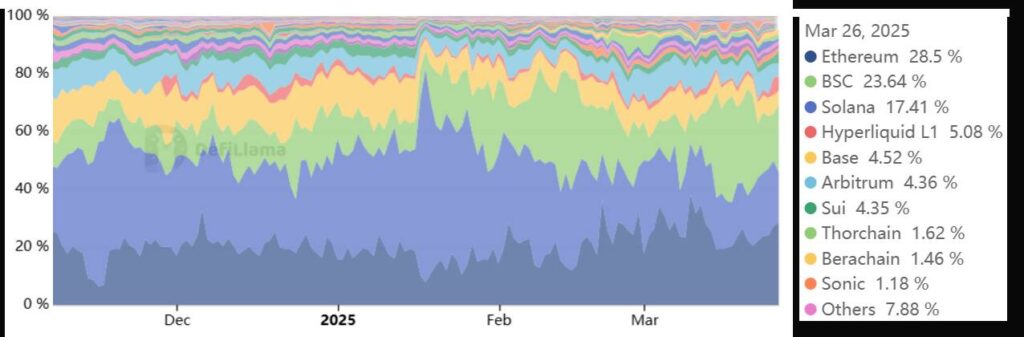

Recently, Solana’s position in the decentralized exchanges (DEX) landscape has shifted dramatically. Once a leader, the network has seen its volume diminish, especially as BNB Chain recently claimed the top spot despite holding considerably less total value locked (TVL) than Solana. This shift in market dynamics has raised concerns regarding SOL’s ongoing viability and competitiveness in a space increasingly dominated by rivals like Ethereum and BNB Chain.

Despite these challenges, it’s worth noting that Solana continues to provide a user experience and level of decentralization that many users find appealing. Unlike its competitors, Solana’s Phantom Wallet even broke into the top 10 on the Apple App Store last November, highlighting its unique position in the cryptocurrency domain.

Upcoming Challenges and Prospects for Solana’s SOL Token

Solana’s native token, SOL, is experiencing significant fluctuations in its value, impacting traders and investors in various ways.

- Recent Price Movements:

- SOL faced an 8% drop after briefly touching 7 on March 25.

- The token has struggled to reclaim the 0 level for three weeks.

- Market Sentiment:

- Declining bullish momentum raises concerns among traders.

- Memecoin speculation and AI sector excitement are losing their influence.

- Future Prospects:

- Potential SOL price boost from the approval of a Solana spot ETF in the U.S.

- Expansion of tokenized real-world assets (RWA) could enhance SOL’s value.

- Mobile User Onboarding:

- Nikita Bier states Solana is well-positioned for mobile applications.

- Constructive regulatory environment supports the growth of decentralized applications (DApps).

- Investor Concerns:

- Disappointment with U.S. government’s altcoin acquisition strategy.

- Absence of explicit references to Solana in government digital asset strategies.

- Activity Declines:

- Solana’s DApp revenues and chain fees have significantly decreased recently.

- Total value locked (TVL) is stable, but reduced onchain activity limits SOL’s appeal.

- Competition:

- Solana is losing ground in DEX volumes to competitors like Ethereum and BNB Chain.

- Trading volumes on rival platforms have seen significant increases.

- Unique User Experience:

- Solana’s integrated user experience is seen as a competitive advantage.

- Phantom Wallet has achieved top app rankings, unlike competitors.

This information highlights the ongoing challenges and potential opportunities within the Solana ecosystem, urging investors to be aware of the evolving market landscape and the impact of mobile onboarding and regulatory developments.

Solana’s SOL Token Faces Challenges Amidst Market Fluctuations

The recent performance of Solana’s native token, SOL, reveals a stark reality in the ever-evolving cryptocurrency landscape. After experiencing a brief rise to 7 on March 25, SOL encountered an abrupt 8% rejection, igniting concerns regarding its ability to sustain bullish momentum. Unlike other tokens that might thrive in speculative fervor, Solana’s journey appears more arduous, especially as it struggles to regain the 0 level.

Competitive Advantages: Observers point to the pending approval of a Solana spot exchange-traded fund (ETF) as a significant boon for its future, potentially catalyzing renewed investor interest. The expansion into tokenized real-world assets (RWAs)—such as stablecoins and money market funds—also positions Solana favorably in a competitive market. Additionally, as highlighted by Nikita Bier, the platform’s streamlined onboarding for mobile users could attract a new wave of participants, particularly in an era leaning heavily towards mobile blockchain interactions.

Competitive Disadvantages: However, challenges loom large. The recent downturn in altcoin enthusiasm, coupled with an unexpected announcement from the US government regarding cryptocurrency reserves, has dampened the spirits of many investors. With no mention of Solana specifically and a broader focus on Bitcoin, the result has been a loss of investor confidence. Furthermore, the diminishing revenues from decentralized applications (DApps) and reduced onchain activities reflect a worrisome trend, questioning whether Solana can maintain its appeal against rising competitors like BNB Chain and Ethereum, both of which have recently eclipsed Solana’s DEX volumes.

The current stagnation may present a mixed bag for different stakeholders in the Solana ecosystem. For avid traders and investors, the lack of bullish indicators could create an atmosphere of fear and uncertainty. Conversely, developers and users drawn to the promise of mobile-friendly solutions might find inherent value in deepening engagement with the platform, irrespective of short-term price fluctuations.

As the competitive narrative unfolds, it is essential to keep an eye on how Solana adapts to the evolving dynamics and whether it can leverage its unique strengths to overcome the prevalent challenges it faces.