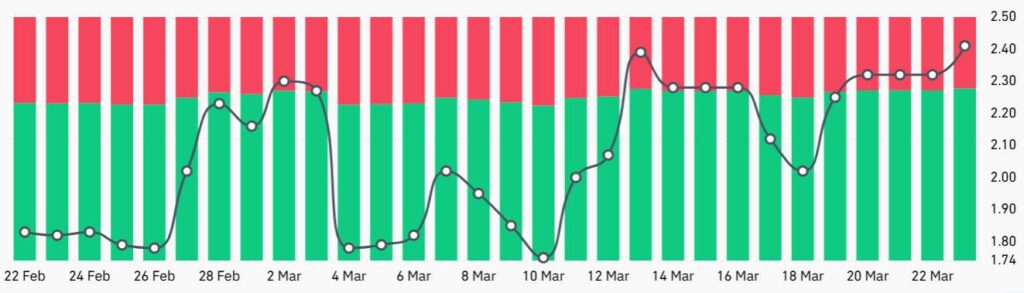

On March 24, Solana’s native token, SOL, surged by an impressive 8.5%, reclaiming the vital 2 threshold for the first time in two weeks. This bullish momentum mirrored the overall resurgence in the cryptocurrency market as optimism grew regarding reduced risks of an economic downturn. Memecoins, known for their playful yet unpredictable nature, also witnessed notable gains, with several up by 12% or more since March 23.

What’s fueling the excitement surrounding SOL is not just the broader market dynamics, but also its own unique developments. Increased network activity, coupled with the intriguing involvement of former President Donald Trump in the memecoin scene, has caught the attention of traders. Moreover, speculation about a potential approval of a Solana exchange-traded fund (ETF) has heightened interest among top investors on major exchanges.

“Despite the recent rally, SOL has underperformed the broader crypto market by 23.7% over the past two months.”

Nonetheless, it’s essential to note that SOL still trades 52% below its all-time high of 5. This downturn is closely tied to a significant 93% drop in Solana’s network fees, a decline prompted by initial disappointment in the memecoin sector that subsequently impacted the entire decentralized application (DApps) market.

Solana remains a robust player in the blockchain space, ranking second in total value locked (TVL) with approximately .8 billion and holding third place in on-chain volumes. In comparison, competitors like BNB Chain have a lower TVL, at .4 billion. Key features of the Solana ecosystem, such as the Jito liquid staking solution and Kamino lending platform, illustrate the network’s growing capabilities and ongoing innovation.

Interestingly, while Ethereum experienced a drop in network fees, Solana’s fees surpassed million per day, marking a significant increase in activity. This uptick hints at a possible resurgence as Solana’s revenue recently reached its highest levels in two weeks, suggesting that the network might be stabilizing after a challenging period.

“Anticipation is building for the possible approval of a Solana ETF, which could add legitimacy to SOL, particularly among institutional investors.”

Adding to the momentum, top traders on Binance have noticeably increased their leveraged long positions on SOL. As excitement surrounds the potential Solana ETF, with a decision expected by the year’s end, traders are leaning into the bullish sentiment. Furthermore, a casual tweet from Donald Trump mentioning a TRUMP memecoin spurred additional interest, helping to uplift various memecoins within the Solana ecosystem.

As the landscape evolves, SOL’s substantial TVL and competitive edge in fees could pave the way for future gains, particularly with renowned traders positioning themselves for potential upward movement. The upcoming developments within the Solana network and the broader market trends will undoubtedly be key factors to monitor in the coming weeks.

Solana’s Recent Performance and Market Implications

Key points from Solana’s recent market activity and its potential impact on investors:

- Price Recovery:

- SOL gained 8.5% on March 24, regaining the 2 mark for the first time in two weeks.

- This rally was part of a broader cryptocurrency market recovery driven by reduced economic downturn fears.

- Network Activity and ETF Potential:

- Increased network activity coupled with anticipation of a spot Solana ETF approval indicates potential for further price growth.

- A successful ETF approval could enhance SOL’s legitimacy among institutional investors.

- Memecoin Market Influence:

- Growing interest in memecoins, spurred by notable figures like Donald Trump, has contributed to market excitement.

- This popularity has boosted several memecoins, with some, like Fartcoin and Dogwifhat, seeing significant price increases.

- Network Fees and Revenue Trends:

- Solana’s network fees have recently reached over million per day, higher than Ethereum’s fees, signaling an uptick in network activity.

- Despite a 93% decline in Solana network fees over two months, recent revenue metrics indicate a possible recovery.

- Competitive Landscape:

- Solana remains a strong contender in the blockchain space, with a TVL of .8 billion, outperforming competitors like BNB Chain.

- However, SOL is still trading 52% below its all-time high, raising questions about market sentiment and future price trajectory.

These points suggest that while there are signs of recovery, investors should remain cautious and aware of the broader market dynamics that influence Solana and its competitors.

Solana’s Recent Rally: A Comparative Analysis with Market Rivals

Solana’s native token, SOL, has showcased a notable 8.5% gain as it breaks through the 2 mark, a comeback after a two-week slump. This spike reflects an upward trend across the broader cryptocurrency landscape, sparked by shifting trader sentiments towards reduced economic risks. Unlike some of its competitors in the memecoin sphere, which have also enjoyed substantial rallies, SOL’s performance is driven by both macroeconomic factors and specific advantages tied to its network.

Competitive Advantages: One key strength for Solana is its growing network activity, evidenced by significant increases in its total value locked (TVL) and day-to-day fees, which exhibit a rebound from previous lows. As competitor platforms like BNB and Tron continue to jockey for position in the on-chain volume race, Solana’s unique offerings such as the Jito liquid staking solution and Kamino lending platform give it a distinct edge. Furthermore, the potential for an ETF approval specifically for Solana could place it ahead of rivals, appealing to institutional investors looking for validated digital asset opportunities.

Additionally, the buzz generated by recent social media mentions, including notable figures like former President Trump, has further bolstered interest in SOL and associated memecoins. With its current staking reward of 7.7%, surpassing Ethereum’s inflation rate, Solana arguably presents a more attractive option for yield-seeking investors amidst the volatile crypto market.

Potential Disadvantages: However, despite the recent price uptick, SOL has lagged 23.7% behind broader market performance over the past two months, largely due to a staggering 93% decrease in network fees. This decline has raised concerns about user engagement and overall trust in the ecosystem. Additionally, trading at 52% lower than its all-time high indicates that while there is optimism, traders are still wary of whether this current rally is sustainable or merely a short-lived reaction to external factors.

As traders grapple with this uncertainty, the recent increased long positions among Binance’s top traders may signal confidence, but it could present risks; a reversal in momentum could amplify potential losses. The competition remains fierce, especially from BNB and XRP, which still hold significant market shares and are weathering their declines more robustly than Solana. By navigating these complexities, SOL’s current situation suggests it could either attract a resurgence of interest or risk alienating current holders looking for more reliable returns.

In summary, while Solana’s recent advances and potential ETF approval present compelling reasons for investment, its recent performance issues and market dynamics denote significant challenges. Investors and traders must weigh these factors carefully as they make decisions in a rapidly evolving cryptocurrency market.