The cryptocurrency landscape is witnessing a significant evolution with the recent launch of Solv Protocol’s yield-bearing Bitcoin token, SolvBTC.AVAX, on the Avalanche blockchain. This innovative token is designed to enhance institutional investors’ exposure to yield opportunities backed by real-world assets (RWAs). Unveiled on May 16, SolvBTC.AVAX connects Bitcoin (BTC) with stable investment options like U.S. Treasurys and private credit facilitated by leading financial firms such as BlackRock and Hamilton Lane.

At the heart of this development is a collaborative effort among a group of seven partners, including Solv, Avalanche, Balancer, Elixir, Euler, Re7 Labs, and LFJ. Ryan Chow, founder of Solv Protocol, emphasized that this new token aims to bridge the gap between Bitcoin and real-world economic cycles, steering clear of the traditional volatility often associated with Bitcoin’s four-year boom-and-bust cycle.

Utilizing a multi-protocol strategy, SolvBTC.AVAX generates yield through Elixir’s synthetic dollar, deUSD, alongside Treasurys provided by major investment firms, ultimately enhancing exposure to RWAs through the Euler lending platform. Notably, the yields from this initiative will be distributed in Bitcoin format, creating a unique opportunity for yield-seeking investors.

“The yield is received in BTC format,” a Solv Protocol spokesperson noted, highlighting the innovative approach they are taking to attract institutional interest.

As the demand for Bitcoin yield solutions grows, the market is abuzz with competition. Recently, Coinbase announced the launch of its own Bitcoin Yield Fund, promising investors annual returns between 4% and 8% through a cash-and-carry strategy. Analysts, including CoinShares’ Satish Patel, have noted a shift in perspective among investors who now view Bitcoin not just as a store of value, but also as a viable source for generating yields.

With the rise of various yield strategies, such as leveraging derivatives and yield farming, this evolving ecosystem is indicative of a broader trend in the cryptocurrency market. As Solv Protocol and its partners push the envelope, their efforts not only aim to offer innovative yield solutions but also signify the growing influence of real-world assets in the crypto realm.

Solv Protocol Launches Yield-Bearing Bitcoin Token on Avalanche

The introduction of SolvBTC.AVAX marks a significant development in the realm of Bitcoin yields, linking it with real-world assets.

- Launch of SolvBTC.AVAX: A yield-bearing Bitcoin token on the Avalanche blockchain, developed through a partnership involving several key players.

- Connection to Real-World Assets: The token links Bitcoin to assets such as US Treasurys and private credit, diversifying the yield opportunities for institutional investors.

- Multi-Protocol Strategy for Yield Generation: The protocol uses a combination of platforms and instruments, including Elixir’s deUSD, Treasurys from reputable firms, and Euler lending to enhance returns.

- Bitcoin’s Economic Cycle Reflection: SolvBTC.AVAX aims to provide exposure to less volatile assets, countering BTC’s traditional boom-and-bust cycles.

- Institutional Demand for Yield Solutions: Growing interest from institutions signifies a shift in perceiving Bitcoin not only as a store of value but also as a means for yield generation.

- Competitive Landscape: The launch is part of a broader trend in the crypto market where exchanges like Coinbase are creating their own yield offerings for Bitcoin.

- Impact on Investors: With Bitcoin yield solutions becoming more accessible, individual and institutional investors can utilize these products to potentially enhance return on investments.

“While there are many ways to generate Bitcoin yield, institutional interest is driving innovation and competition in this sector.”

Comparative Analysis of Solv Protocol’s Yield-Bearing Bitcoin Token

In the burgeoning world of Bitcoin investment, Solv Protocol’s introduction of the yield-bearing Bitcoin token, SolvBTC.AVAX, marks a significant evolution in how institutional investors engage with digital assets. By intertwining Bitcoin with real-world assets such as US Treasurys and private credit, this initiative sets itself apart from other offerings in the market, notably Coinbase’s recently launched Bitcoin Yield Fund.

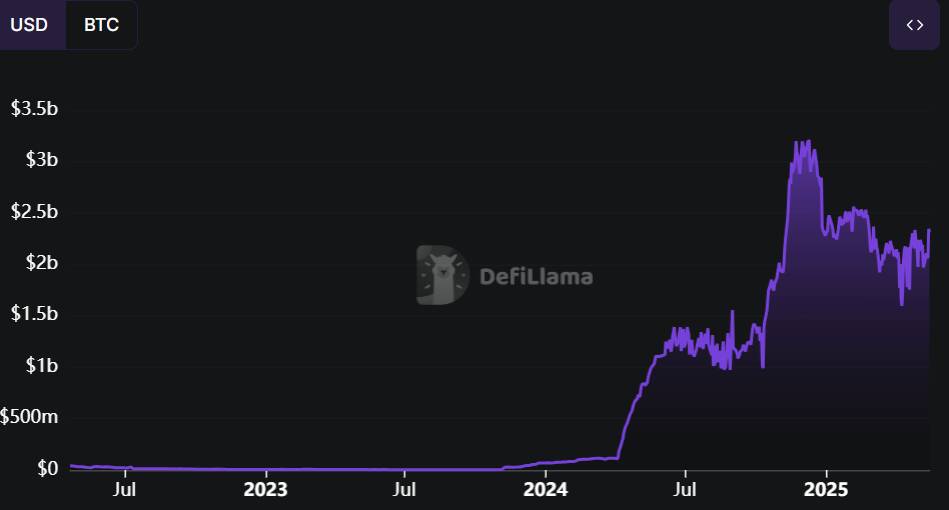

Competitive Advantages: One of the primary advantages of SolvBTC.AVAX is its innovative approach to integrating Bitcoin with stable, low-volatility assets. This linkage not only diversifies risk but also provides exposure to uncorrelated economic cycles, an attractive feature for risk-averse institutional investors. The use of established firms like BlackRock and Hamilton Lane lends additional credibility and gravitas to this token, promising a sophisticated yield-generation strategy through a multi-protocol approach. Moreover, with Solv Protocol’s significant total value locked (TVL) of over $2.3 billion, it brings scalability and reliability, appealing features within the DeFi landscape.

Competitive Disadvantages: However, the pathway is not without its challenges. Solv’s unique offering may be too complex for some investors who prefer straightforward yield strategies, leading to potential hesitation in adoption. In contrast, Coinbase’s Bitcoin Yield Fund presents a simpler cash-and-carry strategy that could attract those who are less technologically inclined or unfamiliar with DeFi protocols. Additionally, while Solv embraces multi-protocol strategies, such complexity increases the avenues for risk, including smart contract vulnerabilities and dependence on multiple entities working cohesively.

This competitive landscape creates opportunities and challenges: institutional investors looking to diversify their portfolios can benefit significantly from Solv’s innovative structure, while those favoring simplicity and lower risk may find traditional options like Coinbase’s Bitcoin Yield Fund more appealing. Furthermore, as crypto adoption grows, Solv Protocol’s approach could either establish it as a leader in yield-bearing options or expose it to scrutiny if investor expectations aren’t met immediately.

As the market dynamics evolve, Solv Protocol’s ambition to tie Bitcoin with real-world economic cycles signals a potential shift in institutional investment strategies. However, it remains to be seen how these distinct approaches will affect market positions moving forward.