In an exciting development for the cryptocurrency landscape, spot exchange-traded funds (ETFs) centered around Solana (SOL) are poised to make their debut in Canada on April 16. This news comes from Bloomberg analyst Eric Balchunas, who shared insights from a private client note from TD Bank, confirming that the Ontario Securities Commission (OSC) has granted approval to notable asset managers including Purpose, Evolve, CI, and 3iQ to launch these funds.

The launch of these ETFs is a significant milestone, especially as it marks Canada’s advancement in the altcoin arena. Unlike the United States, where the Securities and Exchange Commission (SEC) has only sanctioned ETFs linked to Bitcoin and Ether, Canada offers a more flexible regulatory approach. One key feature of these new ETFs is the ability to stake a portion of their Solana holdings, potentially enhancing yield for investors.

“This is our first look at the altcoin race,” Balchunas mentioned in his update.

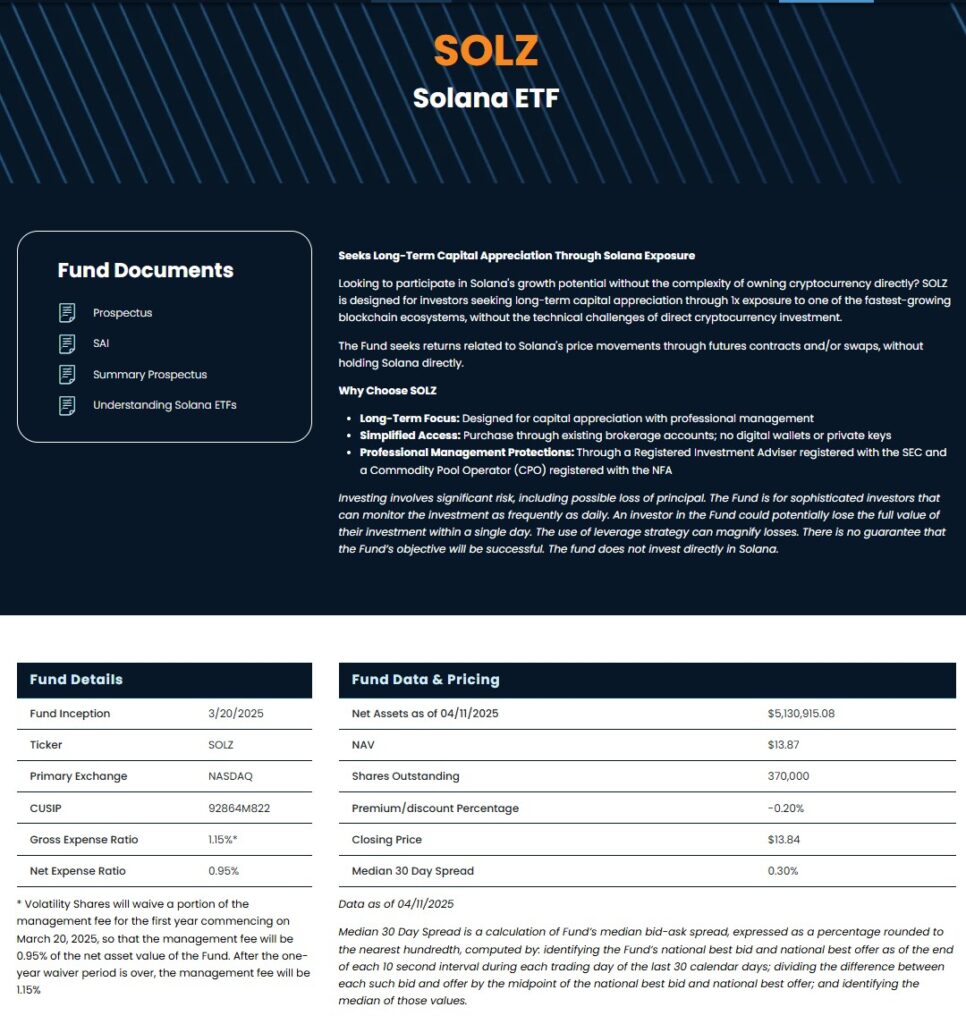

Despite the optimistic outlook, interest in altcoin ETFs may not match that of more established cryptocurrencies. Research head Katalin Tischhauser from crypto bank Sygnum conveyed that while there is considerable excitement surrounding upcoming ETFs, the tangible demand remains uncertain. Recent data reveals that the Solana futures ETF, launched by Volatility Shares, has garnered only about $5 million in net assets since its inception.

As the cryptocurrency market evolves, investors are keenly waiting for the SEC’s next steps regarding altcoin ETFs, which could take several months. The forthcoming Canadian ETFs represent a new frontier, stimulating hope and speculation within the crypto community about future developments across North America.

Spot Solana ETFs Launch in Canada

The upcoming launch of spot Solana exchange-traded funds (ETFs) represents a significant development in the cryptocurrency investment landscape, especially for Canadian investors. Below are the key points regarding this announcement:

- Launch Date: Spot Solana ETFs are set to launch in Canada on April 16.

- Regulatory Approval: The Ontario Securities Commission (OSC) has approved asset managers Purpose, Evolve, CI, and 3iQ to issue these ETFs.

- Staking Opportunities: The ETFs will be permitted to stake a portion of their Solana (SOL) holdings for additional yield.

- First Altcoin ETFs: This development marks Canada’s first foray into altcoin ETFs, as noted by Bloomberg analyst Eric Balchunas.

These points may significantly impact investor decisions as follows:

- Pioneer Investment Option: The launch provides Canadian investors a new investment vehicle to access Solana, potentially increasing interest in the cryptocurrency market.

- Yield Generation: Investors may benefit from staking opportunities, which could enhance returns on SOL investments.

- Market Sentiment: The launch might signal growing acceptance and regulation of cryptocurrencies in traditional financial markets.

- Awaiting U.S. Regulations: Canada’s move contrasts with the U.S., where the SEC has not yet approved altcoin ETFs, affecting American investors and sparking comparisons between the two markets.

Investor sentiment will likely be influenced by the performance of these ETFs and general market trends in the crypto sector, leading to reconsiderations about cryptocurrency investments.

Spot Solana ETFs Launching in Canada: A New Contender in the Crypto Space

The debut of spot Solana exchange-traded funds (ETFs) in Canada marks a significant moment in the cryptocurrency investment landscape. As revealed by Bloomberg analyst Eric Balchunas, this development could provide a compelling advantage for Canadian investors keen to delve into altcoins, particularly Solana (SOL). The Ontario Securities Commission (OSC) has given the green light to several asset managers, potentially making it easier for retail and institutional investors to gain exposure to this cryptocurrency without directly holding it.

One of the notable competitive advantages lies in the ability of these ETFs to stake a portion of their SOL holdings, which could drive additional yield for investors—a feature currently absent in U.S. markets, where staking remains off-limits for crypto ETFs. This strategy could attract yield-seeking investors and make the Canadian offerings more appealing compared to U.S.-based alternatives. Furthermore, with Canada having a more agile regulatory environment compared to the U.S., ETF providers can tap into market demand more rapidly, capitalizing on Solana’s growing adoption and interest.

However, challenges remain. The initial reception of similar offerings, such as the Volatility Shares Solana futures ETF, raises questions about investor appetite for altcoin ETFs. With just $5 million in net assets, it seems that enthusiasm for trading altcoins may not match that for more established cryptocurrencies like Bitcoin and Ethereum, as highlighted by research head Katalin Tischhauser. This lukewarm interest could pose a problem for new Solana ETFs, as they might struggle to attract significant investments amidst skepticism regarding long-term demand for these types of products.

The launch could be beneficial for tech-savvy investors and those looking to diversify beyond traditional cryptocurrencies. However, a disparity in enthusiasm between U.S. and Canadian markets may hinder broader acceptance, raising caution for asset managers. If the anticipated demand fails to materialize, it could lead to a scenario where investors might find themselves holding ETFs that underperform relative to their expectations. Thus, while the introduction of spot Solana ETFs opens up exciting avenues for investment, the overall market dynamics call for careful evaluation by prospective investors.