The cryptocurrency landscape is witnessing a remarkable divergence as stablecoins carve out a thriving niche amidst a broader market slowdown. According to asset manager VanEck’s recent report, stablecoins are experiencing what they describe as “a bull market of their own,” with nearly $10 billion added to their total market capitalization in March alone. This growth stands in sharp contrast to the declining activity observed on major smart contract platforms like Ethereum and Solana, which have struggled with reduced revenues and trading volumes.

The report highlights that diminished activity in smart contracts aligns with a cooling market sentiment, attributed to fears over potential economic policies and trade tensions stemming from the U.S. administration’s approach. Matthew Sigel, VanEck’s head of research, suggests that ongoing macroeconomic uncertainty might actually bolster the case for cryptocurrencies, further emphasizing the critical role of stablecoins in the evolving Web3 ecosystem.

Interestingly, the collective yield of stablecoins has seen a slight decline, now sitting between 3% to 5%, which is more in line with traditional Treasury Bills compared to rates that peaked near 10% earlier in the year. Nonetheless, the issuance of tokenized Treasury Bills—a significant driver for institutional stablecoin yield—has risen by 26% month-over-month, surpassing $5 billion in total issuance, reinforcing the stablecoin sector’s resilience.

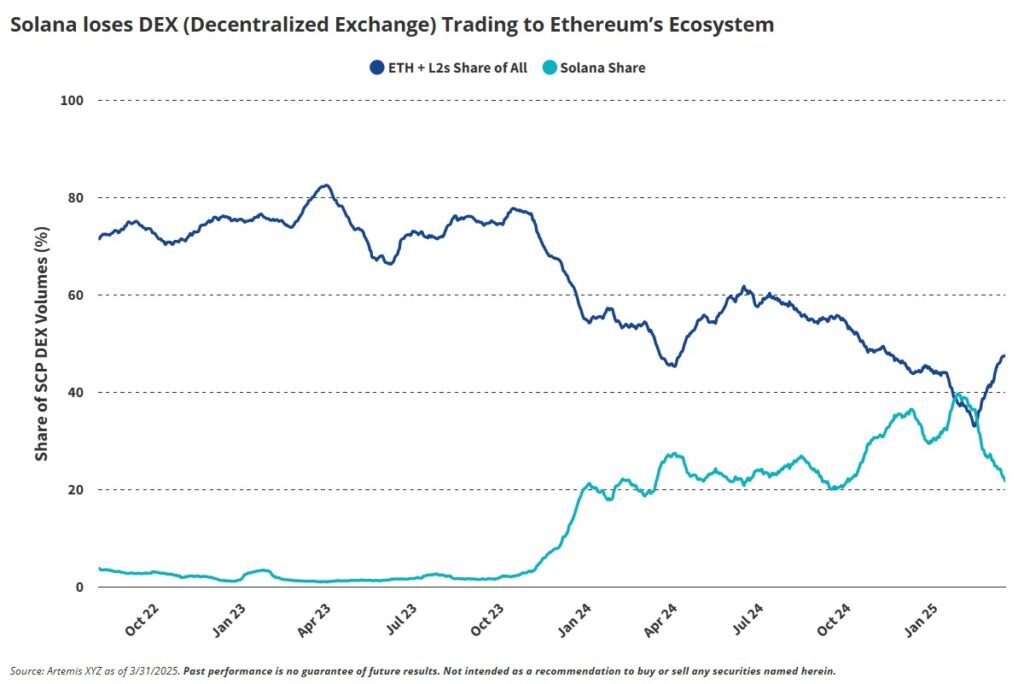

In stark contrast, platforms like Solana have faced significant challenges, with a reported 66% decline in daily fee revenues and a 53% drop in decentralized exchange (DEX) volumes. The volatility in the memecoin sector, which has heavily influenced Solana’s activity, has left many retail traders hesitant following a series of scandals. Meanwhile, Ethereum’s layer-2 solutions also experienced declines, though they fared better than Solana during this tumultuous month.

“Stablecoin adoption is a key measure of Web3’s overall health, and despite fears in the market, it continues apace,” VanEck notes.

As the world of cryptocurrencies navigates these challenging waters, the strong performance of stablecoins reflects a potential shift in investor focus—a shift towards security and stability in uncertain times.

Stablecoins and the Current Crypto Market Landscape

As the cryptocurrency market experiences volatility, stablecoins have emerged as a stable force. The following key points outline the current trends and implications for readers interested in the evolving landscape of digital currencies.

- Stablecoin Growth

- Stablecoins added nearly $10 billion in market capitalization in March.

- Adoption is seen as a key metric for the health of Web3.

- Macroeconomic Factors

- Uncertainty in macroeconomic conditions could increase the strategic appeal of cryptocurrencies.

- US President Trump’s tariff policies may impact market sentiment and trading behaviors.

- Stablecoin Yields

- Current yields for stablecoins range from 3% to 5%, resembling Treasury Bills.

- There has been a significant decline from yields of up to 10% earlier in the year.

- Tokenized Treasury Bills

- Issuance of tokenized Treasury Bills increased by 26%, surpassing $5 billion.

- This supports the yield structure of stablecoins, making them attractive to institutional investors.

- Smart Contract Platforms Decline

- Ethereum and Solana have seen a significant drop in activity, with revenues and trading volumes falling 36% and 40%, respectively.

- Solana, in particular, faced drastic declines, with DEX volumes down by 53%.

- Impact of Memecoins

- Memecoin trading has slowed, affecting Solana’s DEX performance.

- Recent scandals have led to decreased confidence among retail traders in memecoins.

“Ongoing macroeconomic uncertainty could accelerate the strategic case for crypto.” – Matthew Sigel, VanEck

Stablecoins Thrive Amid Market Turbulence

The recent observations by asset manager VanEck highlight a fascinating juxtaposition within the cryptocurrency landscape. While traditional smart contract platforms like Ethereum and Solana grapple with a notable downturn in activity and user engagement, stablecoins appear to be flourishing in what can only be described as their own bull market. This divergence raises critical questions about both the future of digital currencies and the accompanying market sentiment.

Competitive Advantages for Stablecoins

Stablecoins are gaining significant traction thanks to factors that play to their strengths. The steady rise in their total market capitalization by nearly $10 billion in March indicates robust demand—even amidst declining yields, now hovering between 3% and 5%, which positions them nearly on par with traditional Treasury Bills. Furthermore, the issuance of tokenized treasury bills has surged, enhancing the attractiveness of stablecoin investments for institutional players seeking lower-risk avenues. Macroeconomic uncertainties, such as the potential repercussions of U.S. tariff policies, further amplify the strategic appeal of stablecoins, positioning them as a safer haven during turbulent times.

Challenges for Smart Contract Platforms

Contrastingly, smart contract platforms are struggling to maintain their foothold in the market. With a staggering drop in revenues and trading volumes—36% and 40% respectively—these platforms, particularly Solana, have seen sharp declines. The downturn is compounded by the fallout from recent memecoin scandals, which have significantly dampened retail investor sentiment. For Solana, which had briefly overtaken Ethereum in decentralized exchange (DEX) volumes, the sharp retraction is particularly alarming, revealing vulnerabilities that could deter future investment.

Implications for Stakeholders

The dichotomy between stablecoin growth and the struggles of smart contract platforms presents unique implications for various stakeholders. For seasoned investors and institutions, stablecoins offer a reliable alternative for preserving capital amid uncertainty and could serve as a safe harbor during down markets. Conversely, retail traders who flocked to platforms like Solana for high-risk, high-reward opportunities may find themselves disillusioned, particularly if the volatility continues and opportunities diminish. This segment could experience increased anxiety as they watch their preferred assets falter in performance.

As this landscape evolves, the rise of stablecoins and the challenges faced by smart contract platforms underscore the importance of adaptability in the crypto world. Investors and developers alike must navigate these divergent paths to find their foothold in the ever-changing domain of digital finance.