In the dynamic world of cryptocurrency, Solana has carved out a significant niche with its innovative approach to blockchain technology. Known for its remarkable transaction speed and a vibrant ecosystem of decentralized applications (DApps), Solana operates on a unique blend of proof-of-stake (PoS) and proof-of-history (PoH) protocols. This synergy allows users to engage in staking their native currency, SOL, opening doors to both passive income and participation in network governance.

The concept of staking on Solana is designed to be straightforward, making it accessible even for those new to the crypto space. By staking, users effectively lock away a portion of their SOL in a cryptocurrency wallet, which not only earns them rewards but also provides a voice in shaping the future of the network. Interestingly, there is no formal minimum requirement for staking, although a practical minimum of about 0.01 SOL is noted as a standard threshold.

“Staking is regarded as one of the safer methods to participate in the cryptocurrency ecosystem.”

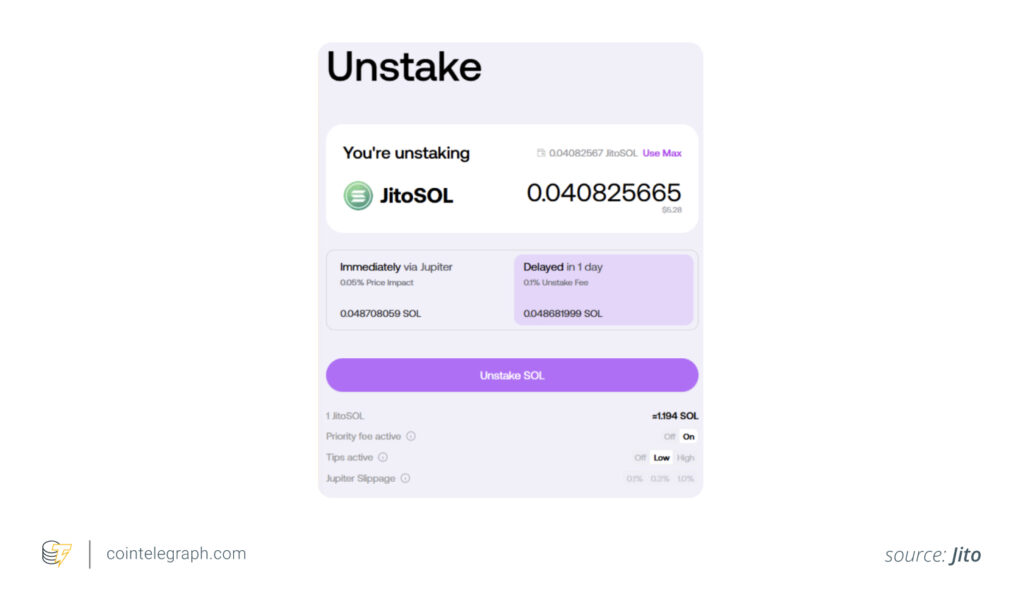

When staking Solana, users can choose between two methods: liquid staking and native staking. Liquid staking allows individuals to maintain control over the liquidity of their SOL while benefiting from rewards. On the other hand, native staking locks up the funds, making them unavailable for immediate use but simpler and more beginner-friendly. Both options come with their own sets of advantages and flexibility considerations.

Moreover, staking rewards are paid out on a bi-daily basis, stimulating consistent engagement within the community. To participate in staking, users need to select a reputable validator—akin to electing a representative who casts votes on network proposals on their behalf. This weight of governance underscores the importance of choosing validators that align with personal values, as larger stakes have more influence.

While staking on Solana may present appealing opportunities, it is vital to acknowledge that it is not without risks. Market volatility, fluctuations in validator performance, potential cyber threats, and even historical network outages could impact the overall staking experience. Before diving into Solana staking, awareness of these factors is crucial for making informed decisions.

Key Takeaways from Staking Solana

Staking Solana can provide numerous benefits, but it is essential to understand the associated risks and requirements. Here are the key points to consider:

- Earning Passive Income: Staking Solana allows you to earn rewards based on the amount of SOL you stake, contributing to potential passive income.

- Low Minimum Requirement: There is no minimum requirement for staking, but practically, you may start with as little as 0.01 SOL.

- Wallet Requirement: A SOL-compatible wallet, such as Phantom, is necessary to store and stake your SOL.

- Safe Investment: Staking is seen as one of the safer methods to participate in the crypto ecosystem.

- Unique Consensus Mechanisms: Solana combines proof-of-stake (PoS) and proof-of-history (PoH), enhancing its efficiency and security.

“Staking gives you a say in governance, allowing you to vote on proposals that shape the Solana network.”

- Types of Staking:

- Liquid Staking: Maintains liquidity, allowing you to use your SOL in decentralized finance (DeFi) applications.

- Native Staking: Locks your funds for rewards and governance participation but restricts liquidity.

- Tax Implications: Rewards are subject to income and capital gains tax, affecting your net earnings.

- Validator Selection: Carefully choose a validator, as their performance impacts your rewards and governance influence.

- Staking Risks:

- Market Volatility: The value of your staked SOL can fluctuate drastically based on market conditions.

- Validator Behavior: Poor actions by validators can lead to slashing, which affects reward rates.

- Cyber Threats: Blockchain networks are vulnerable to hacks, posing risks to your staked assets.

Understanding these aspects can help you effectively manage your staking strategy, ultimately impacting your investment outcomes and financial stability in the cryptocurrency space.

Staking Solana: An In-Depth Comparison With the Crypto Ecosystem

Staking Solana (SOL) stands out as a notable player in the growing cryptocurrency market, providing unique advantages that can either propel users towards passive income or introduce challenges depending on their investment strategies. With its innovative combination of the proof-of-stake (PoS) and proof-of-history (PoH) mechanisms, Solana offers lightning-fast transaction speeds and a robust decentralized applications (DApps) ecosystem compared to other staking opportunities, such as Ethereum or Cardano.

Competitive Advantages: The low barriers to entry are a hallmark of Solana staking, allowing users to begin with as little as 0.01 SOL. This accessibility could attract new crypto enthusiasts who might previously have been deterred by the high initial investment requirements of other platforms. Additionally, the dual staking options—liquid and native—empower users with choices that cater to both liquidity preferences and long-term staking commitments, further enhancing its appeal. Investors seeking to harness regular rewards every two days (known as epochs) will find Solana’s system efficient and straightforward, thus simplifying the staking process for beginners.

Moreover, Solana’s emphasis on governance through staking adds a layer of community involvement that not only builds trust but provides a sense of direction for those deeply invested in the network’s future. Users have a voice through their votes, allowing them direct participation in key decisions affecting the blockchain.

Potential Disadvantages: On the flip side, Solana’s staking mechanisms have their drawbacks that can impact users negatively. The reliance on validators means that the centralization of stake can lead to governance risks, where a few large wallets may exert disproportionate influence on the network’s future. This centralization could alienate smaller stakers, creating a divide between power players and casual users. Furthermore, the volatility typical to cryptocurrencies means that even staked SOL can experience dramatic value fluctuations, potentially offsetting the benefits of earning rewards.

Another notable concern is the history of network outages that Solana has faced, which raises questions about the network’s reliability. Instances of downtime can be frustrating for stakers, especially if they coincide with high market activity or critical governance proposals. These risks could deter potential investors, causing them to seek out alternatives that demonstrate stronger uptime and stability.

Who Could Benefit or Face Challenges: Investors looking for a low-cost entry into staking, combined with the allure of governance participation, may find the Solana staking experience rewarding. Beginners navigating the crypto landscape will appreciate the basic mechanics that allow for both staking rewards and an engaged community. However, more seasoned investors who prioritize decentralization and network security might view the centralization risks as a significant drawback. Additionally, developers focused on stability may choose competing networks that prioritize uptime and reliability over staking rewards.

Overall, while staking Solana showcases compelling benefits, it is essential for both new and experienced crypto participants to weigh these advantages against the potential challenges that may arise. The evolving landscape of cryptocurrency means that adaptability and research are crucial in making informed staking decisions.