In a significant development within the cryptocurrency landscape, Strategy (MSTR) has bolstered its bitcoin portfolio by acquiring an additional 3,459 BTC, bringing its total holdings to an impressive 531,644 BTC. This strategic move, announced through a regulatory filing on Monday, involved an investment of $285.8 million, which translates to an average purchase price of $82,618 per bitcoin.

The firm’s total bitcoin acquisition now stands at a staggering $35.92 billion, with an average cost of $67,556 per BTC, highlighting the company’s commitment to digital assets amidst the evolving market dynamics. This recent purchase was facilitated through the sale of common stock, indicating a proactive approach to funding growth initiatives.

“Shares of MSTR have seen a slight uptrend of 1% in premarket trading, reflecting a positive sentiment as bitcoin maintains a steady price above $84,000,”

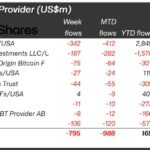

As Strategy continues to expand its bitcoin holdings, the broader implications for the cryptocurrency market remain noteworthy. With institutional interest in bitcoin showing no signs of waning, this move reinforces the trend of traditional companies looking to diversify their portfolios with digital assets. The company’s actions could serve as a bellwether for other investors watching the cryptocurrency space closely.

Key Points on Strategy’s Bitcoin Acquisitions

The following are the most salient aspects of Strategy’s recent bitcoin investments and their potential implications for investors and the market:

- Recent Acquisition: Strategy (MSTR) added 3,459 BTC to its portfolio last week.

- Total Holdings: The company now holds a total of 531,644 BTC.

- Financials: The latest bitcoin purchase cost the company $285.8 million, averaging $82,618 per BTC.

- Cumulative Investment: Strategy has invested $35.92 billion in total for its holdings, with an average cost of $67,556 per bitcoin.

- Funding Source: The recent purchase was financed through the sale of TKTK shares of common stock.

- Market Impact: MSTR shares have increased by 1% in premarket trading, correlated with bitcoin’s price remaining steady above $84,000.

These points suggest that Strategy’s aggressive accumulation of bitcoin could influence market sentiment and investor confidence, impacting individual investment strategies and overall cryptocurrency market dynamics.

Strategy’s Bold Bitcoin Acquisition: Competitive Landscape Analysis

The recent move by Strategy (MSTR) to bolster its bitcoin holdings by acquiring an additional 3,459 BTC for around $285.8 million positions the company as a significant player in the cryptocurrency investment landscape. However, this strategy comes with both competitive advantages and potential disadvantages when compared to similar news in the financial sector. One key advantage is Strategy’s substantial inventory of 531,644 BTC, which not only reflects an aggressive investment strategy but also indicates confidence in the long-term value of bitcoin. This accumulation could attract institutional investors looking for stable digital asset solutions, especially as bitcoin’s value sustains above $84,000.

On the flip side, funding these acquisitions through stock sales introduces an element of risk, potentially diluting shares and unsettling existing shareholders wary of market fluctuations. This could be problematic for investors who prefer companies with minimal reliance on volatile asset sales. Additionally, the average acquisition cost of $67,556 per BTC might make some analysts question whether this is a wise financial move, especially if market prices were to experience a downturn.

The ongoing interest in cryptocurrency is evident, characterized by high-profile purchases and endorsements. Companies like Tesla and MicroStrategy have made headlines with their digital asset strategies, which can overshadow or either elevate Strategy’s moves depending on the market’s response. With competitors like MicroStrategy also increasing their holdings, the pressure mounts for Strategy to not only justify their heavy investments but to outperform peers in both acquisition strategies and market transparency.

This landscape means that investors interested in digital assets and growth tech may find themselves particularly drawn to Strategy’s aggressive posture. However, the potential risks associated with stock dilution and market sensitivity could deter more conservative investors. In essence, while Strategy’s increased stake in bitcoin showcases a bold strategy which could appeal to risk-tolerant investors, the ramifications of funding choices could pose significant hurdles for shareholder confidence.