In a recent report from TD Cowen, the impact of Strategy’s significant bitcoin (BTC) purchases on market prices comes under scrutiny. Despite being recognized as a major corporate player in the cryptocurrency space, the research suggests that these large-scale acquisitions have little effect on bitcoin’s price fluctuations. The findings, published on Monday, challenge the notion that Strategy’s buying spree is instrumental in sustaining bitcoin’s value, raising questions about the actual power of corporate purchasing in this volatile market.

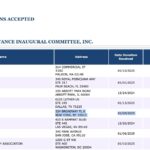

Strategy has made headlines by raising approximately $842 million through the issuance of 1.8 million new shares, using these proceeds to acquire 6,556 bitcoins. This strategic acquisition increased their bitcoin yield by 1% for the quarter, bringing it to 12.1%. Yet, relative to the overall bitcoin market, these purchases are minimal, averaging only 3.3% of weekly trading volume. Over a 27-week period, the company’s total purchases represented 8.4% of that volume, highlighting a stark contrast between their activity and the broader market dynamics.

“Our conclusion is that in most periods, it doesn’t appear plausible that Strategy’s purchases could have had a sustained, material impact on the price of bitcoin,” noted the TD Cowen analysts.

The report further explores the relationship between Strategy’s buying patterns and bitcoin prices, revealing a weak correlation coefficient of just 25%. Even as discussions arise about the company outpacing bitcoin miners through its substantial purchases, the data indicates a misinterpretation of market mechanics; secondary trading has significantly outstripped mining volume. Over the last six months, trading in the secondary market exceeded new supply by nearly 20 times, suggesting that both miners and purchasers like Strategy are effectively responding to already existing market conditions.

While the findings imply that Strategy’s influence on bitcoin prices may be exaggerated, the success of its investment strategy cannot be overlooked. The recent purchases have yielded substantial gains, contributing to an impressive 306% increase in its bitcoin holdings since the start of the year, without overly diluting its share count. This growth is supported by a remaining ATM capacity of $1.53 billion, positioning Strategy favorably for future acquisitions and shareholder value enhancement.

The TD Cowen analysis concludes that while Strategy may not be a price setter in the bitcoin market, it continues to generate value through strategic treasury operations, which could yield significant advantages for its shareholders moving forward.

Impact of Strategy’s Bitcoin Purchases on Market Dynamics

Here are the key points regarding Strategy’s actions in the Bitcoin market and their implications for investors:

- Limited Influence on Bitcoin Prices:

According to a TD Cowen report, Strategy’s large-scale purchases have minimal impact on Bitcoin’s price, challenge the theory that their buying supports market values.

- Small Portion of Market Volume:

Strategy’s purchases account for only 3.3% of weekly trading volume on average, making their impact negligible against the broader market.

- Weak Correlation with Price:

The correlation between Strategy’s buying activity and Bitcoin’s price movements is statistically weak, showing little link to short-term price shifts.

- Outpacing Miners Argument:

Although Strategy购买的比特币超过采矿量,这并不意味着价格会受到影响,因市场的次级交易量远超新供应。

- Value Creation for Shareholders:

Despite the minimal market impact, Strategy’s purchases have generated significant financial gains, with an estimated increase of $600 million in value this quarter.

- Future Growth Potential:

With substantial ATM capacity and board approval for further share issuance, Strategy is positioned to enhance Bitcoin yield, benefiting shareholders.

“Our conclusion is that in most periods, it doesn’t appear plausible that Strategy’s purchases could have had a sustained, material impact on the price of bitcoin.” – TD Cowen Analysts

Strategy’s Bitcoin Moves: A Deeper Dive into Market Dynamics

The recent findings from TD Cowen offer a refreshing perspective on the ongoing discussions surrounding Strategy’s Bitcoin (BTC) acquisition efforts. While the firm has emerged as a substantial institutional player in the BTC market, analysts point out a significant disconnect between its buying activities and the broader market price movements. This brings forth a fascinating comparative landscape when we look at other corporate players investing in cryptocurrencies.

Competitive Advantages

One of Strategy’s notable strengths lies in its substantial capital and strategic approach to cryptocurrency as a treasury asset. With an impressive 306% increase in Bitcoin holdings since the beginning of the year, the company is reaping the benefits of long-term investments without the immediate pressure of market volatility. Its recent $842 million fundraise demonstrates a robust capacity for ongoing investment, which could signal stability for its shareholders, even when individual purchases are not significantly swaying the market.

In contrast, companies like MicroStrategy have also been major players in corporate Bitcoin acquisitions, but they have frequently been scrutinized for their market impact. The clarity provided by TD Cowen’s analysis may favor Strategy in that it can continue its purchasing strategies without excessive market disruption, allowing it to position itself as a reliable long-term holder rather than just a transient buyer.

Competitive Disadvantages

Beneficiaries and Challengers

Investors focused on long-term value generation may find Strategy’s approach highly advantageous. Those who believe in the potential of Bitcoin as a digital gold or inflation hedge are likely to appreciate the calculated and sustained acquisitions made by the company. Conversely, day traders and short-term investors might struggle to find traction in a company that does not significantly sway market prices, leading to potentially conflicting sentiments about Strategy’s growth trajectory.

Moreover, other major players like Tesla can benefit from these findings as they too have adopted a cautious yet strategic stance toward Bitcoin investments. By understanding that their market activities may not exert as significant an influence as assumed, companies may recalibrate their investment strategies, allowing them to participate without fueling speculative bubbles.

In this landscape, Strategy stands at a unique crossroads: poised for growth with a steadfast investment approach while also facing skepticism regarding immediate market impact. Whether this will strengthen or weaken its position in the competitive crypto market remains to be seen.