A newly minted memecoin themed around Eric Trump has taken the cryptocurrency world by storm, surging an astonishing 6,200% within just 24 hours of its launch on the Solana platform. Dubbed ERICTRUMP and utilizing the token address “jv7d,” this digital asset shot past a remarkable $140 million market capitalization shortly after its debut on May 16, according to CoinMarketCap data.

However, this meteoric rise has not gone unnoticed, as blockchain analysts issue warnings about potential dangers lurking beneath the surface. A report from the blockchain data platform Bubblemaps highlighted alarming patterns in the coin’s distribution, suggesting that a rug pull could be imminent. In the cryptocurrency realm, a rug pull often refers to the sudden withdrawal of liquidity by insiders, which leaves everyday investors holding tokens that plummet in value.

“The majority of the tokens are concentrated within 10 main addresses, raising serious concerns about the sustainable nature of this token’s value,” warned the Bubblemaps report.

This ownership concentration feels eerily familiar, echoing the troubling trajectory of other recent memecoins, such as the WOLF token, which suffered a catastrophic 99% price collapse after it was discovered that over 82% of its supply was controlled by a single entity. Such precedents have made industry observers extremely cautious.

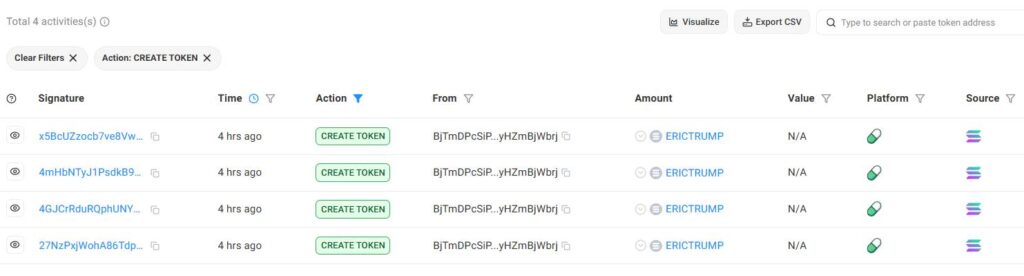

In an intriguing twist, investigations reveal that the creator behind the ERICTRUMP token has a troubling history, having launched three other failed Eric Trump-themed tokens on the same Pump.fun platform. This pattern of behavior raises the specter of previous scams, leading many to speculate on the long-term viability of this latest venture.

As the cryptocurrency community remains alert, the recent turmoil in this space serves as a stark reminder of the potential risks tied to speculative assets and the importance of rigorous due diligence.

Rise and Risks of Eric Trump-Themed Memecoin

Key points to consider regarding the recent surge of the ERICTRUMP memecoin:

- Historic Surge: The fake Eric Trump-themed memecoin launched on Solana’s Pump.fun platform rose over 6,200% within 24 hours, suggesting extreme volatility.

- Market Capitalization: Within a day, the memecoin’s market cap surpassed $140 million, highlighting the speculative nature of recent crypto trends.

- Rug Pull Concerns: Analysts warn of a potential rug pull, where insiders may suddenly sell off their tokens, leading to significant losses for retail investors.

- Token Distribution Risks: The majority of the tokens are concentrated among 10 main addresses, which is reminiscent of previous memecoin collapses, raising alarms for potential investors.

- Historical Precedents: Similar ownership patterns seen in tokens like WOLF have led to dramatic price crashes, underscoring the importance of caution.

- Scam Tokens Link: The deployer of ERICTRUMP has also created at least three other scam tokens on Pump.fun, indicating a pattern of fraudulent activity.

- Industry Vigilance: Following high-profile rug pulls, the crypto community is increasingly aware of the dangers posed by these types of tokens, necessitating careful investment strategies.

Understanding the risks associated with memecoins is essential, as the speculative boom can lead to massive financial losses, especially for uninformed investors.

Examining the Rise and Risks of the ERICTRUMP Memecoin Phenomenon

The sudden surge of the ERICTRUMP memecoin, launching on Solana’s Pump.fun, has sparked a mix of excitement and skepticism within the cryptocurrency community. With a staggering increase of over 6,200% in a mere 24 hours, this token has quickly captivated attention, leading to a rapid market capitalization exceeding $140 million. However, as blockchain analysts raise alarm about potential rug pulls, the risks associated with this endeavor must not be overlooked.

Similar instances in the crypto landscape reveal a pattern of behavior that could serve as both a warning sign and a competitive disadvantage for memecoins like ERICTRUMP. The notorious collapse of the WOLF token, which suffered a catastrophic 99% price drop after displaying alarmingly concentrated ownership, echoes the current ownership patterns observed in ERICTRUMP. This precedent may serve to undermine investor confidence and raise questions regarding the sustainability of such rapid price increases.

Moreover, the repeated involvement of the same deployer in creating multiple failed tokens adds another layer of concern. Industry insiders and potential investors must consider whether engaging with not just ERICTRUMP but also similar memecoins could expose them to substantial risks. Those less familiar with cryptocurrency could find themselves unwitting victims of significant financial losses should the mechanism behind these tokens unravel.

Conversely, seasoned traders might find opportunities within this volatile market. Understanding the red flags associated with rugged tokens can be beneficial, allowing astute investors to capitalize on price fluctuations while managing risk through timely exits. Nevertheless, the environment for casual participants starkly contrasts this notion; for them, this news is likely to breed confusion and trepidation in an already tumultuous market.

Overall, as more parallels emerge between ERICTRUMP and prior memecoins, it’s essential for investors to approach with caution. While the allure of rapid gains can be tempting, the backdrop of potential scams and liquidity risks weighs heavily on the decision-making process, especially for those new to the engaging world of memecoins.