In a remarkable surge, cryptocurrency investment products in the United States have drawn over $7.5 billion in investments so far this year, as reported by digital asset manager CoinShares. This uptick includes a significant $785 million influx just last week, marking the fifth consecutive week of net positive growth in the sector. Notably, this resurgence follows a challenging period that saw nearly $7 billion in outflows during the months of February and March.

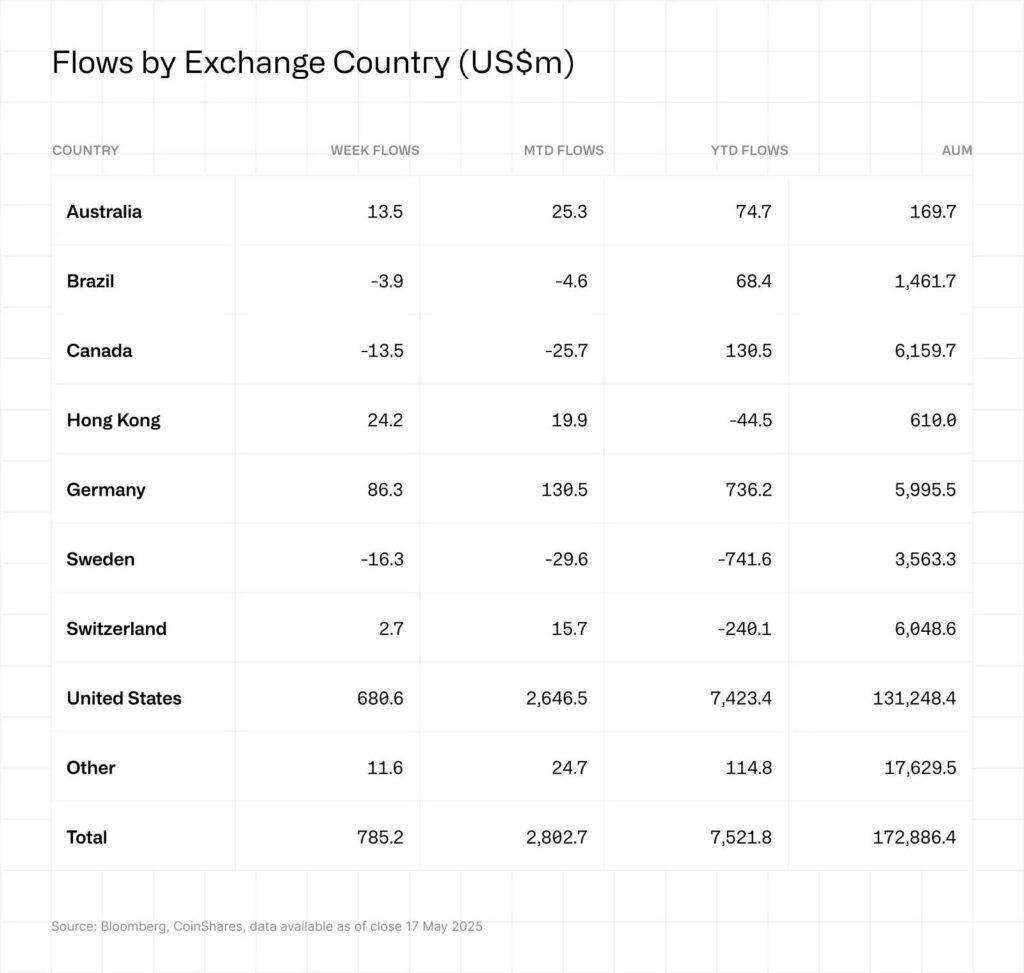

The dominant share of this recent investment came from the U.S., which accounted for $681 million of the total, while Germany and Hong Kong contributed $86.3 million and $24.4 million, respectively. Interestingly, investor enthusiasm appears to have been revitalized after the White House announced a 90-day pause on new tariffs between the U.S. and China on May 12, coinciding with a notable spike in Bitcoin withdrawals from the Coinbase exchange, indicating a growing appetite among institutional investors.

The influx of capital into digital assets is clearly gaining momentum, as evidenced by Ethereum leading the weekly inflow charts with an impressive $205 million. Factors contributing to this optimism include the successful launch of Ethereum’s Pectra upgrade, which introduced beneficial enhancements such as higher staking limits.

Despite this positive trend, not all cryptocurrencies are enjoying the spotlight; Solana, for instance, experienced a minor setback with $890,000 in withdrawals. Additionally, Ethereum co-founder Vitalik Buterin is making waves with new proposals aimed at enhancing user accessibility and reducing data burdens for network participants, which underscores ongoing developments in improving the overall ecosystem.

Investment Trends in U.S. Crypto Products for 2025

The recent surge in investments in U.S. cryptocurrency products highlights the growing interest in digital assets among investors. Here are the key takeaways:

- Significant Investment Growth:

- Crypto investment products in the U.S. attracted over $7.5 billion in 2025.

- Last week alone, U.S.-based products saw an influx of $785 million, marking a fifth consecutive week of positive net inflows.

- Major Contributions by Key Markets:

- The U.S. accounted for $681 million of last week’s inflows, leading the market.

- Other notable contributors included Germany ($86.3 million) and Hong Kong ($24.4 million).

- Impact of Policy Changes:

- A 90-day pause on additional tariffs announced by the White House revitalized investor confidence and interest in risk assets like cryptocurrencies.

- Coinbase experienced its highest net outflow in 2025, with over $1 billion withdrawn, indicating growing institutional adoption.

- Ethereum’s Dominance:

- Ethereum led the crypto investment products race with $205 million in inflows, boosting its year-to-date total to over $575 million.

- Recent upgrades, such as the Pectra upgrade, have fostered renewed optimism among investors.

- Challenges for Other Cryptos:

- While Ethereum saw inflows, Solana faced net outflows of approximately $890,000 over the last week.

- Future Innovations:

- Vitalik Buterin’s proposal aims to enhance Ethereum’s accessibility by reducing the data burden on local nodes, which may diversify the user base.

Understanding these trends can impact readers by encouraging them to consider how global economic policies, technological upgrades, and the performance of various cryptocurrencies could influence their investment strategies.

Crypto Investment Boom: A Dive into Recent Trends and Insights

The surge in crypto investment products in the United States, which saw an impressive inflow of over $7.5 billion in 2025, marks a turning point for the digital asset landscape. This is particularly noteworthy as it follows a challenging few months where nearly $7 billion in outflows were recorded. This newfound investor enthusiasm, hinted at by consecutive weeks of positive inflows, is primarily fueled by political developments, specifically the White House’s 90-day pause on tariff increases, which has alleviated some economic uncertainty.

The competitive advantages of this upward trend are clear. With $785 million attracted in just one week, the U.S. is firmly leading the charge in crypto investments, surpassing countries like Germany and Hong Kong significantly. Ethereum’s performance stands out, drawing $205 million in inflows. The successful Pectra upgrade not only bolstered investor confidence but also showcased Ethereum’s commitment to technological innovation, positioning it favorably against other assets.

However, not all news is bright in the crypto world. Solana, despite being a major player, faced outflows of $890,000, indicating potential investor skepticism about its current offerings. This situation underscores the competitive disadvantages within the crypto sector, as some assets may be struggling to retain investor trust amidst the prevailing optimism surrounding others, particularly Ethereum.

This dynamic environment creates opportunities as well as challenges for various stakeholders. Retail investors might benefit from a broader selection of viable investment options, particularly those advocating for technologies that enhance security and accessibility in the space. Conversely, institutions heavily invested in underperforming assets might experience difficulties, which could lead to reevaluation of strategies in their crypto portfolios. The landscape remains ripe for new entrants, but with potential volatility, cautious optimism is advisable for all stakeholders involved in the crypto revolution.