In a noteworthy turn of events within the cryptocurrency landscape, decentralized finance platform Synthetix has announced the cancellation of its $27 million acquisition plan for crypto options platform Derive. This decision, made public on May 22, comes in the wake of considerable pushback from the Synthetix and Derive communities. A spokesperson for Synthetix confirmed these developments, stating that the acquisition proposal “did not resonate” with community sentiments and that both parties mutually opted to withdraw from the deal.

The acquisition, initially revealed on May 14, was intended to involve an exchange of tokens, valuing Derive at approximately $27 million, or a rate of one SNX token for 27 DRV tokens. However, the proposal faced skepticism, primarily concerning issues like the token lock-up period and the overall pricing structure, which many community members found unfavorable. Ben Celermajer, Synthetix’s strategy lead, acknowledged that responses from the community were not as positive as hoped and emphasized the platform’s commitment to exploring opportunities for a decentralized derivatives platform on the Ethereum mainnet instead.

“While we understand the commercials did not resonate with all community members, a number of holders from both communities believed the deal was fair and acceptable,” Celermajer noted. “However, we acknowledge that the response fell short of expectations.”

Community feedback from Derive users highlighted significant concerns regarding the token exchange rate and the perceived value of the deal. One user remarked that the proposed rate did not accurately represent Derive’s worth, likening it to “selling the bottom” of market value. Another voiced worries about the deal’s potential impact on their holdings, citing Synthetix’s plans for an increased token supply as a source of dilution, which could undermine the overall benefit of the acquisition.

Originally launched as Lyra in 2021, Derive had been part of the Synthetix ecosystem before pursuing its independent operational strategies, including a significant rebranding effort. This latest development underscores the complexities and dynamics within the rapidly evolving decentralized finance sector, where community sentiment plays a critical role in the direction of projects and partnerships.

Impact of Synthetix’s Acquisition Decision on Decentralized Finance

The recent decision by Synthetix to abandon its $27 million acquisition of Derive has significant implications for the decentralized finance (DeFi) community. Here are the key points surrounding this development:

- Community Feedback Influences Decisions:

- The acquisition proposal faced negative feedback from both the Synthetix and Derive communities, leading to its cancellation.

- Synthetix acknowledged that the initial proposal did not resonate with the larger community, emphasizing a collaborative approach in future endeavors.

- Economic Concerns:

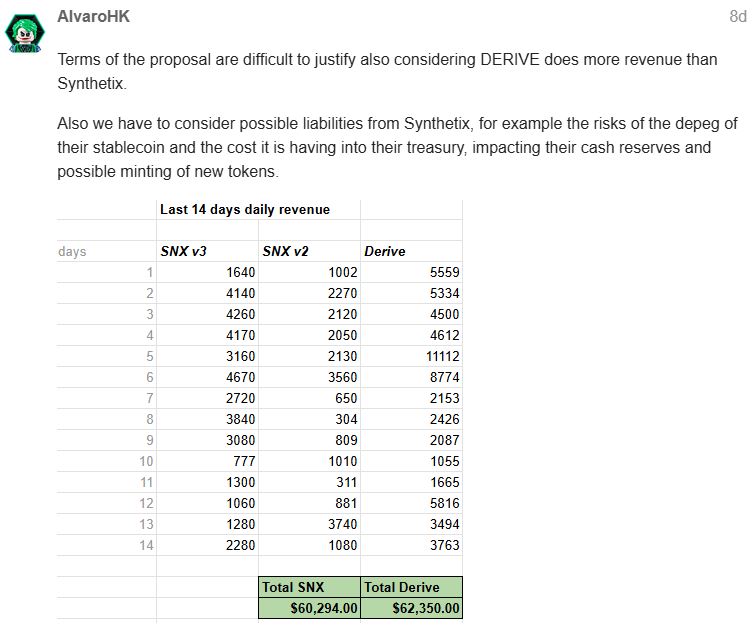

- Concerns were raised regarding the token exchange rate (1 SNX to 27 DRV), which some community members viewed as undervaluing Derive.

- Discussions about potential token dilution arose, with some users fearing that Synthetix might increase its SNX supply, impacting the value of their holdings.

- Future Developments in DeFi:

- Synthetix plans to continue exploring other opportunities for building a decentralized derivatives platform, indicating ongoing innovation in the DeFi space.

- The focus on community-driven decision-making suggests that stakeholders’ opinions will play a crucial role in future projects.

- Impacts on Individual Investors:

- Investors in both Synthetix and Derive need to stay informed about these developments to gauge their potential impact on investment strategies.

- Community sentiments can significantly influence the valuation of tokens, making it essential for investors to engage with project discussions.

Understanding the community dynamics and the economic implications of proposals in DeFi can help investors navigate the complexities of the crypto market.

Community Backlash: Synthetix Cancels Derive Acquisition

The recent decision by Synthetix to abandon plans for acquiring Derive has raised intriguing questions about community engagement and investment strategy within the decentralized finance space. This move reveals both competitive advantages and disadvantages that could significantly impact stakeholders from both sides.

Competitive Advantages: Synthetix’s choice to withdraw stems from a clear commitment to listening to its community’s concerns. By prioritizing community feedback, Synthetix showcases a transparency that can enhance trust among current and potential users. Maintaining a positive community sentiment is crucial for platforms dealing with volatile assets, making this decision potentially beneficial for user loyalty in the long run. Furthermore, Synthetix can pivot towards exploring other opportunities within the Ethereum ecosystem without the burden of an unpopular deal.

On the other hand, Derive’s ability to stand firm against the acquisition signals its independence and self-assuredness in the market, which could attract other potential investors interested in a strong, self-reliant decentralized platform. By exposing the deal’s perceived flaws, the Derive community might rally for more favorable negotiations or partnerships in the future.

Disadvantages: However, for Synthetix, this withdrawal may be perceived as a loss in their ambition to expand their offerings within the derivatives market. It risks sending a signal to the market that it is unable to secure strategic opportunities, potentially making it less attractive to investors who appreciate decisive action. Furthermore, the public fallout could overshadow any positive initiatives Synthetix may introduce going forward.

For Derive, while it retains autonomy, the scrutiny surrounding the perceived valuation could lead to hesitancy among potential collaborators or investors. The backlash may also spark fear of stagnation since their resistance to the acquisition might limit access to larger pools of liquidity that could have propelled them into broader market visibility and credibility.

Target Audience Insights: This dynamic situation is particularly relevant for crypto enthusiasts and investors who are seeking platforms that prioritize community engagement and long-term viability over swift expansions. Those geared towards risk assessment may find Synthetix’s current stance reassuring, while ardent supporters of Derive could view this as a critical moment for redefining their future trajectory independently. Nonetheless, this development provides a ripe opportunity for rival platforms to step in, offering alternatives that could appeal to users disenchanted with the current affiliations and negotiations within both Synthetix and Derive.