This past week in the cryptocurrency arena was marked by the ever-shifting landscape of tariffs, a topic that not only influenced stock markets but also made its presence felt in the crypto world. At the week’s outset, the announcement of import levies sent both stocks and digital currencies tumbling, reflecting the anxiety that often accompanies trade disputes. However, by week’s end, a temporary pause on new tariffs against non-China imports breathed new life into the markets, allowing Bitcoin to recapture a value of $82,000, a notable resurgence compared to its performance the previous week.

As analysts pondered Bitcoin’s dual identity—as a potential safe haven akin to gold versus a risk asset entwined with broader market movements—there was a collective sense that Bitcoin demonstrated resilience amidst the turmoil rather than a clear-cut reassurance in its status.

“Bitcoin performed resiliently rather than completely reassuringly.”

Our dedicated reporting team has been at the forefront of this story, with insights from Asia highlighting the implications of the “basis trade” unwind on Bitcoin’s trajectory. Elsewhere, in a significant legal development, prediction market platform Kalshi prepared to celebrate a win in Nevada, signaling momentum for its endeavors in the U.S. Meanwhile, news broke regarding the first XRP ETF listing in the United States, further diversifying the investment landscape in cryptocurrencies.

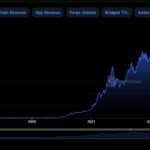

European coverage added depth to the ongoing narrative, including a critical analysis of financial indicators that seem to be moving against former President Trump, alongside a report highlighting how decentralized finance (DeFi) managed to withstand market pressures by attracting substantial capital inflows amid widespread anxiety.

“How DeFi ‘Defied’ Market Carnage as Traders Poured Millions Amid Panic.”

Beyond tariffs, the week was rich with additional developments in the crypto sector. Paul Atkins was confirmed as the new chair of the SEC, while the Department of Justice faced backlash for shuttering its crypto enforcement unit, raising concerns about its commitment to addressing illicit activities in the space. Notably, the SEC also approved ETH ETF options, bringing a wave of anticipation from investors who had long awaited this milestone. Meanwhile, President Trump notably revoked a contentious accounting rule that previously Roused concern among DeFi advocates, underscoring the evolving regulatory environment.

Overall, the week underscored the growing centrality of cryptocurrency in the broader financial landscape. As the implications of these changes ripple through the economic fabric, it’s clear that exciting times lie ahead for the digital currency community.

Impact of Tariffs and Crypto Market Movements

This week has been pivotal in both trade and cryptocurrency markets, marking significant developments that can affect everyday investors and the broader economy. Here are the key takeaways:

- Tariffs Influence on Market Behavior:

- Initial imposition of tariffs caused stocks and cryptocurrency to drop significantly.

- A 90-day pause on new non-China tariffs led to a recovery in markets by week’s end.

- Bitcoin’s Performance:

- Bitcoin price rebounded to $82,000, indicating potential “safe haven” qualities amidst market panic.

- Analysts are debating whether Bitcoin should be classified as a risk asset or a store of value like gold.

- Influential Market Reporting and Analysis:

- Insights on the potential impact of the “basis trade” on Bitcoin by Omkar Godbole.

- Updates on Kalshi’s legal victories and the introduction of XRP ETF listings in the U.S.

- Decentralized Finance (DeFi) Resilience:

- Despite market turmoil, DeFi demonstrated strength as traders invested millions during panic.

- Follow-ups on price manipulation and regulatory changes indicate the evolving nature of this sector.

- Regulatory Changes Affecting Crypto:

- Paul Atkins was confirmed as the new SEC chair, potentially influencing future regulations.

- The closure of the DOJ’s crypto enforcement unit raised concerns about the seriousness of regulatory efforts to combat malfeasance.

- SEC’s approval of ETH ETF options signals a shift in regulatory attitudes towards cryptocurrency investments.

This week’s developments illustrate how intertwined trade policies, market movements, and regulatory frameworks are with the daily financial decisions of investors and businesses. Understanding these dynamics can help readers navigate potential financial opportunities and risks.

Analyzing Recent Developments in Tariffs and Crypto Markets

The latest wave of news surrounding tariffs and their impact on global markets has brought a mixture of challenges and opportunities. The influence of Trump’s fluctuating import levies has been evident, inducing a rollercoaster of volatility particularly in stock and crypto markets. This week’s announcement of a 90-day pause on non-China tariffs reignited investor confidence, leading to a notable recovery in various asset prices, including Bitcoin, which resumed trading at approximately $82,000.

Competitive Advantages: One of the standout elements of this week has been Bitcoin’s resilience amidst market turmoil. Unlike many other risk assets, Bitcoin’s performance has led some analysts to draw comparisons to gold, a traditional safe haven. This narrative could serve to bolster investor interest in Bitcoin as a reliable store of value, especially as economic uncertainty looms large. Furthermore, the timely analysis and reports from our Asia reporting team have illuminated critical dynamics such as the “basis trade,” allowing traders to make more informed decisions. The enthusiasm around new products, like the first U.S. XRP ETF listing, points to a vibrant market ready to adapt to regulatory changes, suggesting a forward momentum that could attract new investors.

Competitive Disadvantages: On the flip side, there are risks inherent in this environment. The ongoing debate regarding Bitcoin’s status—whether as a safe haven or a mere risk asset—can leave potential investors uncertain. Moreover, the recent closure of the Department of Justice’s crypto enforcement unit raises significant questions regarding regulatory rigor, potentially undermining confidence among wary investors. The SEC’s approval of ETH ETF options coupled with the criticism over the approach taken by the Department of Justice may present a double-edged sword; while it suggests a maturing market, it could also provoke fears concerning compliance and oversight.

The various market movements and regulatory shifts are likely to benefit both seasoned crypto traders and institutional investors who can adapt quickly to the changes. However, novice investors or those lacking in risk tolerance may find themselves in a precarious position amid this volatility, leading to potential losses. Overall, the evolving landscape presents a fascinating dynamic where both opportunities and challenges coexist, fostering a lively yet unpredictable market environment.