The conversation about cryptocurrency and investment strategies is heating up in the UK, as Lisa Gordon, chair of the investment bank Cavendish, advocates for a significant shift in tax policy aimed at encouraging citizens to invest in local stocks. In a recent interview with The Times, Gordon expressed concern over the fact that more than half of Britons under the age of 45 own cryptocurrency, while lacking investments in equities. She proposed that the government impose a tax on crypto purchases, akin to the existing stamp duty on UK-listed shares, to drive funds back into the domestic stock market.

“It should terrify all of us that over half of under-45s own crypto and no equities,” said Gordon, emphasizing the potential economic benefits of this shift.

Currently, the UK charges a modest 0.5% tax on shares listed on the London Stock Exchange, which generates approximately £3 billion, or .9 billion, annually. Gordon believes that by reducing the tax burden on equities and redirecting it towards digital assets, more individuals would consider investing in homegrown companies—stimulating growth, innovation, and ultimately contributing to the broader economy.

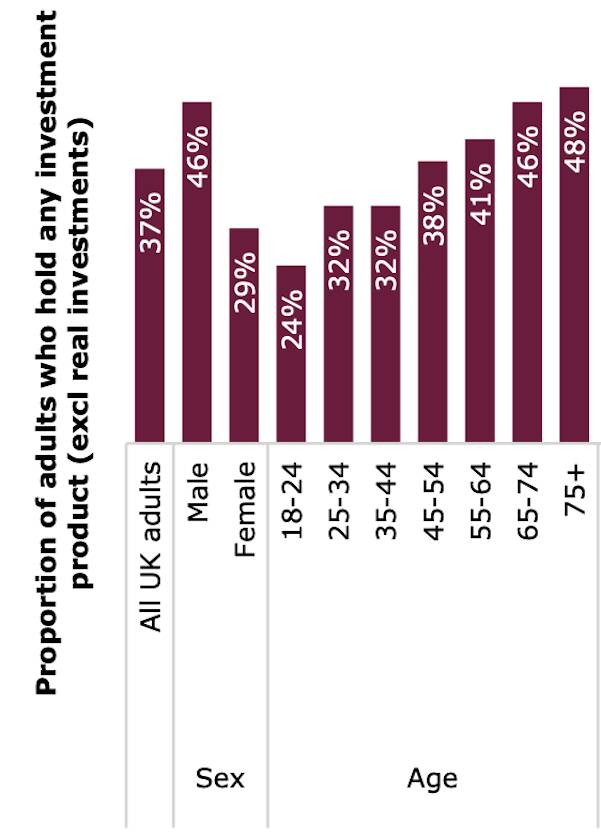

As interest in cryptocurrencies rises, the Financial Conduct Authority (FCA) reported that around 12% of UK adults, equating to nearly 7 million people, now own crypto, with a significant portion being under the age of 55. Gordon noted that many of these individuals are focusing on saving rather than investing, which could jeopardize their financial security in retirement. In fact, a 2022 FCA survey highlighted that while 70% of adults had a savings account, only 38% were actively investing in shares.

“Equities provide growth capital to companies that employ people, innovate and pay corporation tax. That is a social contract,” Gordon stated, stressing the importance of promoting investment in local enterprises.

The economic climate, influenced by a rising cost of living, has prompted many to reconsider their financial choices. A follow-up FCA survey indicated that 44% of adults have either reduced or stopped saving and investing, further complicating their financial futures. Compounding these challenges, the UK stock market experienced a lull recently, with only 18 companies going public last year, down from 23 in 2023, according to consulting giant EY.

While Gordon envisions a brighter future for the UK market, she emphasizes the need for impactful changes to tax regulation to make long-term investments more attractive. As cryptocurrency continues to navigate a fluctuating landscape—with Bitcoin recently experiencing a dip—discussions about reshaping investment behaviors and tax policies remain essential in revitalizing the local economy.

The Case for Taxing Crypto in the UK

Lisa Gordon, chair of investment bank Cavendish, argues that the UK should begin taxing crypto purchases to encourage investments in local stocks, which could significantly benefit the country’s economy. Here are the key points:

- Current Tax Situation:

- The UK currently imposes a 0.5% tax on shares listed on the London Stock Exchange.

- This tax contributes approximately £3 billion (.9 billion) to the UK’s economy each year.

- Rise of Crypto Ownership:

- Over 50% of individuals under 45 own cryptocurrency, while many have no investments in local equities.

- Crypto ownership among UK adults rose to 12%, translating to about 7 million people.

- Shift in Saving Habits:

- Many younger individuals are prioritizing savings over investments at a time when investing is crucial for long-term financial health.

- A sizable portion of young adults (18-25 years) do not hold any investments.

- Impacts on Retirement:

- Gordon warns that the shift towards saving instead of investing may jeopardize future retirement plans for many individuals.

- Investment in equities is essential for providing growth capital to companies that create jobs and pay taxes, fostering economic growth.

- Market Conditions:

- The UK stock market experienced a significant decline in new listings, suggesting a struggling local investment environment.

- There have been more delistings compared to new listings, indicating that companies are leaving the UK market for better opportunities elsewhere.

- Potential for Economic Revitalization:

- Introducing taxes on crypto could lead to a reallocation of investment towards local companies, stimulating the economy.

- A cut in stamp duty on equities along with a tax on crypto could persuade individuals to invest more in the UK market.

- Global Market Context:

- Comparatively, the UK is seen as a safer investment environment than the US, which has faced volatility and losses in its stock market.

- Crypto markets have also been declining, with Bitcoin facing a 11% drop yet could retain some growth potential.

“Equities provide growth capital to companies that employ people, innovate and pay corporation tax. That is a social contract.” – Lisa Gordon

The implications of these discussions around taxing cryptocurrency could directly affect readers’ financial decisions, especially those under 45 who currently favor crypto investments. Understanding these dynamics may encourage a reevaluation of investment strategies going forward.

Assessing the UK’s Crypto Tax Proposal: Implications for Investors and the Economy

In a recent argument, Lisa Gordon, chair of the investment bank Cavendish, has proposed introducing a tax on cryptocurrency purchases in the UK to encourage citizens to invest in local equities instead. This perspective is particularly noteworthy as it highlights the stark divide between investments in crypto and traditional stocks, with more than half of those under 45 reportedly holding cryptographic assets rather than equity. The potential shift in fiscal policy, which includes possibly lowering stamp duty on equities, emphasizes Gordon’s view of equities as “productive assets” that contribute to the economy compared to cryptocurrencies, which she labeled as “non-productive.”

When looking at global trends, several countries have explored or implemented tax measures on crypto transactions. For instance, the US has proposed regulations that would require crypto transactions to be taxed similarly to traditional investment vehicles. While the common thread is a push to generate revenue and redirect investment towards more stable markets, the efficacy and appeal of such taxes vary widely. In countries like Australia, the introduction of a crypto tax coincided with a significant increase in local stock market participation, suggesting that might be a model for the UK. However, the US market showed that these measures can provoke pushback from crypto enthusiasts, who argue that taxation on digital currencies stifles innovation.

In terms of competitive advantages, Gordon’s proposal could stimulate local market growth by fostering a more favorable environment for company listings. If more Britons invest in domestic stocks, it could potentially bolster the economy through job creation and increased tax revenues from successful companies. This resonates particularly well with proponents of the UK as a ‘safe haven’ for investors, highlighting the nation’s ability to provide stability amid volatile global markets.

However, the challenges are pronounced. Introducing a crypto tax might disenfranchise a younger demographic that views cryptocurrencies as modern investment vehicles. The FSA survey indicates that while 12% of adults own crypto, a significant portion prefers saving over investing. Therefore, if the UK’s financial policies alienate young investors, it could exacerbate the issues they face regarding retirement and financial growth—issues already highlighted by Gordon.

This current discourse has significant implications for various stakeholders. Traditional investors and conservative financial institutions may find the proposal appealing, as it could lead to a broader base of capital invested in local companies. Conversely, younger generations who are gravitating toward cryptocurrencies as alternative assets might see this move as an unnecessary barrier to entry and a deterrent to future investments, thereby complicating their financial options and resilience amidst an ever-evolving economic landscape.

Furthermore, while Cavendish appears to position itself to benefit from greater engagement in public offerings, the risk lies in creating disillusionment among the crypto community. If these investors perceive regulations as punitive rather than supportive, it could hinder the UK’s ambition to be viewed as a technological and financial leader. Balancing these competing interests will be essential as the country navigates its fiscal future in the context of rapid technological change.