The aftermath of the Terra ecosystem’s dramatic collapse continues to unfold as Terraform Labs announces a new initiative designed to assist affected investors. On March 31, the company will launch an online portal where individuals can file claims for losses tied to the downfall of the Luna token and the TerraUSD stablecoin. This move comes as part of Terraform Labs’ court-supervised bankruptcy process, aiming to provide a structured way for investors to seek recovery.

Investors will have a month to submit their claims through the dedicated website, claims.terra.money, with a strict deadline set for April 30 at 11:59 p.m. ET. It is crucial for claimants to be aware that late submissions will not be accepted, meaning any missed deadlines will result in a forfeiture of recovery rights. As detailed in a recent Medium post from the company, claims must specifically relate to certain cryptocurrencies that were held during the tumultuous period leading up to the Terra ecosystem’s collapse.

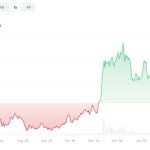

“It was one of the most significant events in the history of cryptocurrency, with LUNA’s market capitalization plummeting from over billion to approximately million within just three days,” the post stated, emphasizing the scale of the disaster.

To facilitate the claims process, Terraform Labs has outlined eligibility criteria and documentation requirements. Notably, claims concerning assets with less than 0 in on-chain liquidity, as well as certain cryptocurrencies like Terra 2.0’s Luna, will not be considered. Claimants will need to provide proof of ownership, with read-only API keys from exchanges being the preferred form of evidence. This is viewed as a more reliable method compared to screenshots or other manual submissions, which may risk extended review periods or denial of claims.

Once submitted, the claims will undergo a thorough review process, with initial decisions expected to be communicated within 90 days after the deadline. Approved claims will have the opportunity to receive pro rata distributions once the processing is completed. As Terraform Labs navigates this challenging phase, investors ravaged by the collapse now have a path to potentially reclaim some of their lost assets.

Claim Your Losses: Terra’s Bankruptcy Process

Terraform Labs is facilitating a claims process for investors affected by the collapse of the Luna token and TerraUSD stablecoin, which significantly impacted the cryptocurrency market. Here are the key points to be aware of:

- Claims Portal Launch: A portal will be available starting March 31 for investors to file claims related to their losses.

- Submission Deadline: Investors must submit their claims by April 30 at 11:59 p.m. ET. Late submissions will not be accepted, risking the forfeiture of recovery rights.

- Eligible Claims: Only claims tied to specific cryptocurrencies during the collapse of the Terra ecosystem will qualify, excluding assets with less than 0 in on-chain liquidity and certain others like Terra 2.0’s Luna.

- Proof of Ownership: Claimants must provide proof of ownership. Read-only API keys from exchanges are preferred over screenshots or manual documents.

- Review Process: Submitted claims will be reviewed. Initial decisions will be communicated within 90 days after the deadline.

- Pro Rata Distributions: Approved claims will be eligible for pro rata distributions once processing is complete.

“The Terra ecosystem collapse in 2022 resulted in unprecedented wealth destruction within just three days, highlighting significant risks in the cryptocurrency market.”

Understanding these points is crucial for stakeholders affected by the collapse, as timely submissions may offer a chance for recovery in a volatile market. Investors should act promptly and ensure they have the necessary documentation to support their claims, thus possibly recouping some of their losses from this historic financial event.

Terraform Labs Opens Claims Portal Amidst Crypto Turmoil

In a significant move for affected investors, Terraform Labs is set to launch an online portal allowing claims for losses linked to the company’s well-documented downfall. This initiative, operational from March 31 and facilitated by claims administrator Kroll, is part of a larger court-supervised process designed to address the aftermath of the catastrophic collapse of the Luna token and TerraUSD stablecoin. The urgent deadline of April 30 leaves little room for procrastination, compelling those impacted to quickly navigate the claims process or risk missing out entirely.

Competitive Advantages: The claims portal represents a structured approach to recovery in a space often riddled with uncertainty. By establishing a clear timeline and using reliable verification methods, Terraform Labs is providing investors with a semblance of order amid chaos. This kind of transparency can instill trust in a market that has often been shaken by scandals and dubious practices. Additionally, leveraging established administrators like Kroll signals a move towards professionalism that could set a precedent for future bankruptcies in the crypto realm.

Disadvantages: However, the limitations set forth—such as the exclusion of assets with less than 0 in liquidity and the stipulation for proof of ownership via API keys—could serve as a barrier for many small investors. The fear of denied claims due to technical difficulties in documentation adds additional stress to those already facing financial losses, potentially alienating a segment of the investor community. Furthermore, the tight deadline might lead to a rush that could result in hasty submissions, further complicating claims verification.

This initiative likely stands to benefit larger investors who have held significant stakes in the failing ecosystem, as they would be more familiar with regulatory processes and capable of providing the necessary documentation. Conversely, smaller, more casual investors may find themselves at a considerable disadvantage, particularly those who lack technical know-how or are unable to meet the strict criteria. As the crypto landscape continues to evolve, this situation underscores the importance of due diligence and preparedness in facing potential setbacks in the volatile market.