The cryptocurrency landscape is rapidly evolving, especially with the introduction of automated trading solutions. Recently, trading bots have become a hot topic, as they offer the ability to analyze vast amounts of market data and execute trades with remarkable precision. A detailed analysis from Cointelegraph dives into the world of trading bots, examining how they operate and which strategies might fit different trader profiles.

Three main types of trading bots have emerged: Telegram bots that facilitate trades on decentralized exchanges (DEX), non-Telegram bots that cater to both DEX and centralized exchanges (CEX), and the newest entrants—AI agent bots. Each option presents unique features tailored to a user’s trading style, risk appetite, and level of experience.

“Telegram bots shine in fast-paced trading, making them ideal for users hunting for new token releases and memecoins, while AI agent bots offer an automated approach for those preferring a hands-off strategy.”

Telegram bots, operating directly via the Telegram app, focus on speed and are equipped with advanced functionalities like trading on mobile devices, which enhances usability for traders on the move. Bots like Trojan and Sol Trading Bot have shown impressive revenue generation, particularly peaking during the January 2025 memecoin frenzy.

On the other end of the spectrum, AI agent bots, powered by sophisticated machine learning algorithms, are designed to independently analyze market sentiment and execute trades accordingly. Notably, platforms like Virtuals Protocol and ai16z have introduced a new level of interactivity and governance, appealing to users who appreciate a more experimental, tech-driven approach to trading.

“The historical performance data reveals a fascinating pattern: Telegram bots thrived during bullish trends, while AI agents experienced explosive growth, underscoring the dynamic nature of the market.”

Additionally, bots operating directly on DEX or CEXs provide experienced traders with a suite of strategies tailored for both high-speed execution and deep market access. Performance analysis indicates that grid bots perform exceptionally well in volatile, downward markets, while DCA bots have shown mixed performance across different asset classes. This blend of automated trading tools continues to intrigue traders, emphasizing the need for a strategic approach based on market conditions.

In summary, the rise of trading bots in the cryptocurrency sector highlights an exciting shift towards automation and data-driven trading strategies. As more users explore these options, understanding each bot’s capabilities and performance will be key for navigating this complex and ever-shifting market.

The Rise of Automated Trading Bots in Cryptocurrency

The emergence of automated trading solutions, especially in the form of trading bots, has significantly impacted how individuals engage in the cryptocurrency market. Here are the key points and their implications:

- Growing Popularity of Trading Bots:

- Automated trading bots analyze vast datasets and execute trades with precision.

- This accessibility allows users of various skill levels to engage more effectively in the market.

- Types of Trading Bots:

- Telegram Bots:

- Ideal for fast trading opportunities, especially with memecoins and token launches.

- Enhance mobile trading usability without the need for a web browser.

- AI Agent Bots:

- Utilize artificial intelligence for complex trading strategies and market analysis.

- Best suited for users comfortable with automation and experimental strategies.

- CEX/DEX Bots:

- Offer structured strategies like dollar-cost averaging and grid trading.

- Provide more control and cater to traders looking for reliability and liquidity.

- Telegram Bots:

- Impact of Trading Strategies:

- Different bots exhibit varying performance based on market conditions and strategies employed.

- Backtesting indicates that grid bots excel during downturns, while DCA bots are effective in volatile markets.

- Signal bots tended to match the buy-and-hold strategy in bullish markets.

- Performance Metrics:

- Top Telegram bots like Trojan and Sol Trading Bot have dominated fee generation.

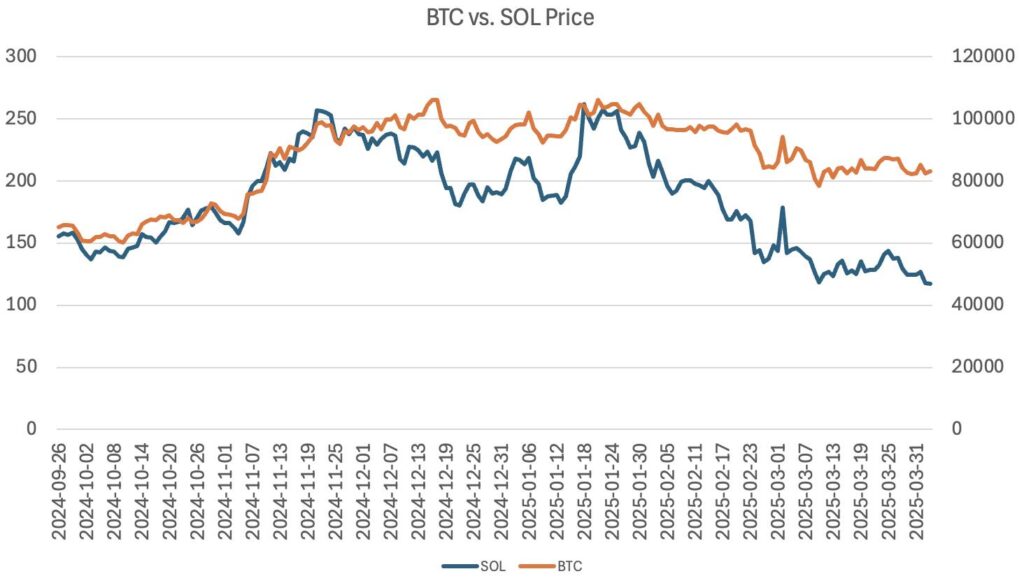

- AI agent bots showed explosive growth but faced downturn challenges, with performance closely tracking market trends.

- Future Considerations for Traders:

- Choosing the right bot aligns with user goals, risk tolerance, and trading experience.

- Users need to stay informed about market conditions as they heavily influence trading outcomes.

The evolution of trading bots reflects broader trends in the cryptocurrency market, making automation a crucial element for both novice and experienced traders.

Competitive Landscape of Cryptocurrency Trading Bots: A Deep Dive

The burgeoning world of cryptocurrency trading bots showcases three primary contenders: Telegram DEX bots, AI agent bots, and traditional CEX/DEX bots. Each of these automated trading solutions comes with its own set of competitive advantages and challenges, shaping the dynamics of traders in the fast-paced crypto market.

Advantages of Telegram DEX Bots: Telegram bots stand out for their effortless integration into the widely popular messaging app, making them particularly accessible for mobile-centric users. Their focus on rapid transactions, especially for memecoins and token launches, appeals to traders seeking quick, nimble strategies. The rise of popular bots like Trojan and BonkBot has shown impressive revenue generation, particularly during surges in market enthusiasm, such as the infamous memecoin boom of early 2025. These tools target a specific niche of impulsive traders who thrive on immediate market opportunities.

Disadvantages of Telegram DEX Bots: However, this convenience does carry its drawbacks. Many Telegram bots lack transparency on individual trade outcomes, making it difficult for users to assess performance accurately. Additionally, those operating on a revenue-sharing model have exhibited vulnerability during market downturns, leading to significant price drops and user discontent during bearish conditions. This variability could deter risk-averse traders who prefer more stable and predictable investments.

Benefits of AI Agent Bots: The use of sophisticated algorithms by AI agent bots like Virtuals and ai16z presents a groundbreaking shift for those interested in an autonomous trading approach. These bots leverage not only market data but also social sentiment analysis, an advanced feature that can detect trends before they become visible to the average trader. This diverse analytical capability can benefit users seeking an innovative edge in a traditionally volatile market.

Drawbacks of AI Agent Bots: As promising as they are, AI agent bots tend to attract a tech-savvy demographic, potentially alienating less experienced users. Their experimental nature often leads to high rewards but also significant risks, especially amid fluctuating market conditions. Furthermore, the complexity of operating within decentralized autonomous organizations (DAOs) might deter individuals who prefer straightforward trading methods.

CEX/DEX Bots and Their Market Position: On the other hand, CEX/DEX bots cater to the more experienced trader, offering deep liquidity and an array of customizable trading strategies. Their versatility allows traders to switch seamlessly between centralized and decentralized platforms, capitalizing on price discrepancies effortlessly. The recent backtesting results illustrate that grid bots excel during turbulent markets, converting chaos into profit, appealing to those who thrive on high volatility.

Challenges for CEX/DEX Bots: The major downside here is the steep learning curve associated with configuring multi-faceted trading strategies. Users might feel overwhelmed, particularly if they lack the necessary background in trading algorithms. Additionally, the reliance on centralized exchanges poses regulatory risks, creating uncertainty in an already volatile environment.

In summary, as the cryptocurrency market continues to evolve, the diverse array of trading bots offers unique opportunities tailored to varying trader preferences. Telegram DEX bots may resonate with fast-paced, opportunistic traders, while AI agent bots capture the interest of those adventurous enough to embrace complex trading algorithms. Conversely, seasoned traders gravitate toward CEX/DEX bots, valuing control and strategy diversity. Understanding these dynamics can empower traders to navigate complexities, ultimately enhancing their trading experiences.