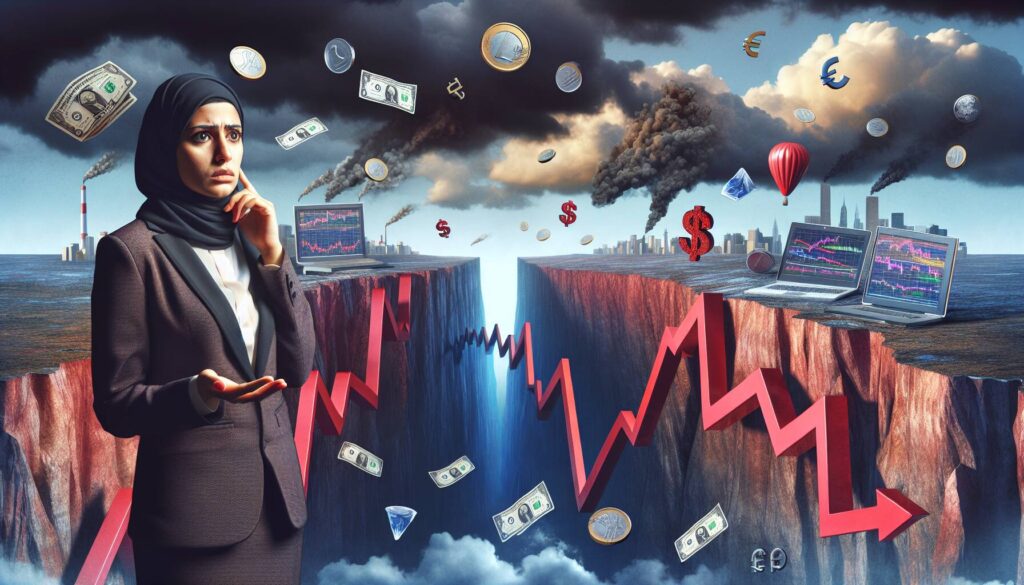

The recent article from Slate Magazine titled ‘The Moment I Realized We Were Headed for Another Financial Crisis’ dives into the unsettling signs that point towards a potential economic downturn. Drawing from personal experiences and expert insights, the piece paints a vivid picture of the growing anxiety surrounding our financial landscape.

As the author reflects on their journey through various financial ups and downs, they highlight critical moments that triggered their alarm bells. The narrative explores how certain market behaviors and economic patterns echo those seen before previous crises, stirring memories of uncertainty that many are not eager to relive.

“It’s in the air we breathe,” the author asserts, hinting at the pervasive fear and skepticism lurking among consumers and investors alike.

This thought-provoking exploration encourages readers to pay closer attention to the subtle warnings around us, raising important questions about the stability of our financial system. With insightful observations and a relatable approach, Slate Magazine invites its audience to engage in a necessary conversation about the possibility of another financial crisis on the horizon.

The Moment I Realized We Were Headed for Another Financial Crisis

This article discusses the warning signs and factors that suggest another financial crisis may be on the horizon. Here are the key points extracted from the content:

- Warning Signs of Economic Instability:

- Rising debt levels among consumers and businesses

- Increased inflation rates affecting purchasing power

- Stock market volatility and erratic trading behaviors

- Historical Patterns:

- Comparisons to past financial crises that occurred under similar conditions

- Lessons learned and often ignored from previous economic downturns

- Impact on Individuals:

- Potential job insecurity and unemployment rates rising

- Decreased consumer confidence leading to reduced spending

- Increased importance of personal financial planning and savings

- Advice for Preparation:

- Ways to strengthen personal finances before a crisis hits

- Importance of diversifying investments and not relying solely on one source of income

The potential for another financial crisis serves as a reminder for individuals to stay vigilant, informed, and proactive about their economic wellbeing.

The Unfolding Financial Crisis: Insights from Slate Magazine

In a thought-provoking article by Slate Magazine, the author delves into the ominous signs of an impending financial crisis, echoing sentiments widespread across economic circles. This piece stands out in a crowded field of financial news for its in-depth analysis and engaging narrative style, which captures the reader’s attention while thoroughly investigating the complexities at play. The unique angle offered by Slate focuses on personal anecdotes and relatable experiences, setting it apart from traditional, more technical financial reporting.

Compared to other similar news outlets, such as The Wall Street Journal or Bloomberg, which often lean heavily on data-driven insights and financial jargon, Slate’s human-centric approach can make complex economic scenarios more accessible for a broader audience. This competitive edge allows readers to emotionally connect with the narrative, fostering a better understanding of the potential impacts of another financial crisis on everyday lives.

However, there are some drawbacks to Slate’s style. While engaging and easy to digest, it may lack the rigorous analytical depth that finance professionals and investors often seek. Readers already well-versed in economic theory might find the article less informative compared to in-depth analyses offered by specialized financial publications. This discrepancy could lead to missed opportunities for professionals seeking concrete predictions or data-backed strategies.

This article is particularly beneficial for general readers, everyday consumers, and those concerned about the broader economic landscape, as it encourages them to reflect on their financial well-being in the face of potential downturns. However, for seasoned investors and industry analysts, the more narrative-driven approach could present challenges. They may need additional resources to complement Slate’s insights for more comprehensive financial planning or risk assessment.

Ultimately, the article serves as a crucial reminder of the realities of financial instability and invites readers to engage with economic discussions. Its style and perspective may widen the audience but could also generate skepticism among financial experts seeking more profound analyses.