In the ever-evolving realm of cryptocurrency, the fate of blockchains often hangs in the balance between innovation and user engagement. While leading players like Bitcoin, Ethereum, and Solana have shown exceptional resilience through market fluctuations, many blockchains encounter harsh realities that lead to their abandonment. These quieter chains often suffer from flawed tokenomics, inadequate community participation, security vulnerabilities, or simply a lack of ongoing development. This piece dives deep into why some blockchains, once bursting with potential, fade away into virtual obscurity, becoming digital ghost towns with few active users or developers.

“Not all blockchains are built to last. Some are ghost towns with zero transactions, no developers, and just a handful of holders stuck with worthless tokens.”

As we look forward to 2025, the landscape of blockchain adoption continues to face hurdles. Uncertain regulations, fragmented developer tools, and infrastructure gaps pose significant challenges. While promising networks like Ethereum and Solana strive to establish a foothold, the presence of bots chasing easy returns often overshadows genuine user activity. The need for robust infrastructure, coupled with a dedicated community, is vital for any blockchain’s survival and growth.

In stark contrast to inactive chains such as EOS and Terra, which fell victim to governance issues and market missteps, active networks like BNB Chain, Polkadot, and Near continue to thrive. These platforms engage users daily through their unique features, and their ability to adapt keeps them relevant. The survival of a blockchain ultimately hinges on real activity—how many people interact with it on a daily basis, and whether developers are consistently building new applications.

“The key to reviving an inactive chain lies in finding compelling use cases, fostering a strong community, and introducing robust incentives.”

The future of blockchain technology is uncertain, yet full of potential. Understanding what keeps these digital ecosystems alive and what causes them to fade can illuminate the path for emerging projects and investors alike. Exploring the balance between technical prowess and active engagement will be essential as we move deeper into this transformative era of digital currency.

Why Some Blockchains Die

Understanding the factors that contribute to the survival or demise of blockchains can have a significant impact on your investment decisions, technology adoption, and engagement in the crypto landscape. Here are the key points to consider:

- Flawed Tokenomics:

Poorly designed economic models can lead to insufficient incentives for users and developers, reducing the blockchain’s viability.

- Security Issues:

Vulnerabilities can result in hacks, eroding trust and leading to mass abandonment of the platform.

- Lack of Community Engagement:

A blockchain without an active user base becomes a ghost town, negatively impacting token value and project sustainability.

- Regulatory Uncertainty:

Inconsistent or overly strict regulations can stifle innovation, making it difficult for blockchains to attract users and developers.

- Infrastructure Challenges:

Without robust infrastructure, including strong RPC services, a blockchain may experience downtime and poor performance, deterring users.

“The blockchain world moves fast. The ones that last are those with strong community support, real-world utility, and continuous innovation.”

Signs of a Living Blockchain

- Transaction Volume:

High transaction volume indicates active user engagement, essential for a blockchain’s health.

- Total Value Locked (TVL):

A high TVL suggests user trust and effective use of the blockchain’s services.

- Developer Activity:

Increasing numbers of developers working on projects indicate a growing ecosystem and potential for innovation.

- Validator Count:

A robust validator count enhances decentralization and security, crucial for maintaining user trust.

Potential for Revival

- Finding New Use Cases:

Developing practical applications can reignite interest and drive user adoption.

- Strong Community Support:

A dedicated community can pump life back into an inactive blockchain through grassroots initiatives.

- Incentives:

Offering rewards or grants can attract developers and users, fostering a renewed ecosystem.

- Protocol Evolution:

Upgrading to layer-2 solutions can address scalability issues, enhancing functionality and user experience.

Analyzing the Lifecycle of Blockchains: Successes and Failures

The cryptocurrency landscape is as dynamic as it is exhilarating, but not all blockchains thrive. The discussion of why certain blockchains such as Bitcoin, Ethereum, and Solana continue to flourish while others fade into obscurity is both a cautionary tale and a source of insight for investors and developers alike. The primary takeaway is that the keys to a blockchain’s survival are not merely built on initial hype, but rather on sustained utility, community engagement, and ongoing development.

Competitive Advantages: Blockchains like Ethereum have established themselves with a robust infrastructure that fosters a fertile ecosystem for developers. The data indicates that Ethereum leads with over 5,900 active developers, creating an environment rich in decentralized applications (DApps) and other innovations. Solana is similarly positioned, having rebounded from past setbacks and demonstrating active community support and developer engagement, which is evident from its impressive daily active addresses.

Furthermore, the concept of transaction volume is another competitive edge. For example, the recent surge of daily active addresses on Solana, reaching over 3.68 million, showcases a thriving user base engaging with the blockchain’s offerings. This real user interaction creates a sense of legitimacy and trust, which contrasts sharply with those blockchains that exhibit low transaction counts and minimal user participation.

Disadvantages: However, it isn’t all smooth sailing. Regulatory uncertainties pose a significant challenge across the board, which can inhibit development and deter potential users or investors. The differing approaches to legislation can lead to a fragmented market, where only a few networks effectively navigate these complexities. This has been particularly evident for newer entrants like Sui and Near, which face a steep uphill battle in attracting talent and users away from their more established counterparts.

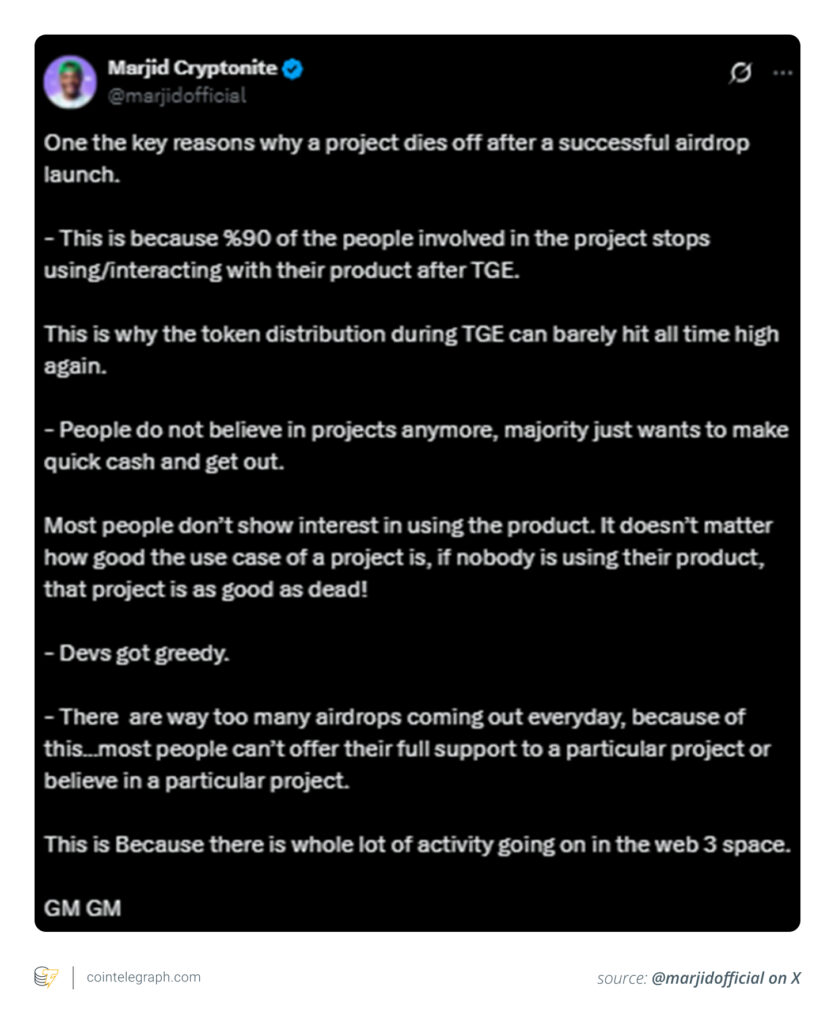

Moreover, blockchains that don’t manage to create a strong community risk becoming ghost towns. As observed with EOS and Terra, the initial excitement does not guarantee longevity. When governance issues arise or when the community stagnates, as seen with Terra’s spectacular implosion, even a promising platform can rapidly fall out of favor. The lack of real activity can lead to a dwindling user base and investment, creating a downward spiral from which recovery is often unlikely.

Beneficiaries and Challenges: These dynamics can significantly benefit existing assets as they consolidate their market positions. For developers and users, the bustling activity around blockchain ecosystems like Ethereum and Solana presents myriad opportunities in DeFi, NFTs, and gaming. On the flip side, the struggles faced by blockchains lacking momentum create significant problems for investors looking for stability—or those who find themselves locked in stagnant projects.