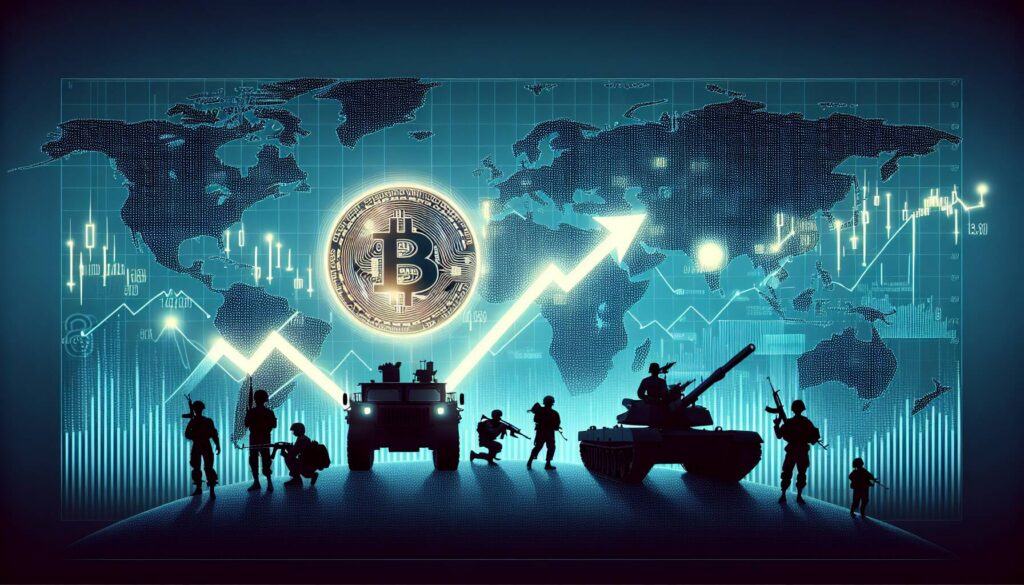

In a significant development on the global financial stage, Russia’s Finance Minister has announced that the country is turning to bitcoin for its foreign trade transactions. This shift highlights a growing trend of cryptocurrency adoption among nations looking to enhance their financial versatility amidst fluctuating economic climates.

“Using bitcoin in our international trade frameworks allows us more flexibility and security,” the Minister stated, underlining the strategic importance of digital currencies.

As the world watches closely, this move by Russia could signal a broader acceptance and integration of cryptocurrencies in mainstream economic activities. The decision to utilize bitcoin not only showcases Russia’s innovative approach to finance but also reflects a shifting landscape where traditional banking systems are being challenged by the rise of decentralized digital options.

This intriguing development serves as a reminder of the evolving nature of finance and highlights the potential of cryptocurrencies to reshape global trade dynamics. With Russia embracing bitcoin, the discourse surrounding digital currencies continues to gain momentum, inviting stakeholders and enthusiasts alike to keep a keen eye on the unfolding story.

Russia’s Adoption of Bitcoin in Foreign Trade

Recent insights from the Russian finance minister reveal significant developments regarding the use of bitcoin in the country’s foreign trade. Here are the key points:

- Integration of Bitcoin: Russia is actively utilizing bitcoin in transactions related to foreign trade, signaling a shift in how the country engages in international commerce.

- Government Support: The move has garnered support from the Russian government, indicating a potential acceptance of cryptocurrencies in official trade practices.

- Impact on Sanctions: The use of bitcoin may provide a workaround for various economic sanctions imposed on Russia, allowing for greater financial flexibility.

- Global Trade Dynamics: This adaptation could alter global trade dynamics, as other countries may follow suit, potentially leading to increased crypto adoption in international markets.

- Risks Involved: The volatility of bitcoin poses risks for businesses, as fluctuating values may impact trade agreements and exchange rates.

Understanding these developments can help readers grasp the evolving landscape of international trade and the implications of cryptocurrency use in their financial decisions.

Russia Embraces Bitcoin for Foreign Trade: A New Era in Cryptocurrency Utilization

In a striking move, Russia’s finance minister has highlighted the nation’s increasing adoption of bitcoin in foreign trade. This development places Russia in a unique position compared to other countries navigating the volatile world of cryptocurrency. While some nations remain hesitant to incorporate digital currencies into their economic frameworks, Russia is actively leveraging the decentralized nature of bitcoin to enhance its foreign trade capabilities.

When considering similar international news, countries like El Salvador and Central African Republic have already taken significant steps towards integrating Bitcoin as legal tender. However, Russia’s approach is distinct; it focuses on utilizing bitcoin primarily for international transactions, which may provide a competitive advantage in easing trade with nations where traditional banking systems are restricted or under sanctions. This ability to bypass conventional financial systems can provide Russia with greater flexibility in its trade dealings, helping foster stronger economic ties with non-Western nations.

On the flip side, this strategy carries inherent risks. The highly speculative nature of cryptocurrency could expose Russia to substantial financial volatility, unlike more stable international currencies. Furthermore, the global regulatory landscape remains uncertain and could impose constraints that limit Russia’s ability to fully capitalize on bitcoin’s advantages. Countries that are skeptical of cryptocurrency may perceive this as a threat, leading to strained diplomatic relations or further sanctions.

This news could benefit various sectors within Russia, such as the tech industry and cryptocurrency exchanges, which stand to gain from increased interest in digital currencies. Businesses engaged in foreign trade may also find new opportunities through reduced transaction costs and faster payment processes. However, for traditional banking institutions and companies reliant on conventional financial markets, this shift could present significant challenges, as they may struggle to compete in an environment increasingly influenced by digital currency transactions.

In summary, as Russia forges ahead with bitcoin integration in foreign trade, both opportunities and challenges loom on the horizon. While the innovation evokes excitement and potential benefits, it also raises questions about sustainability and regulatory compliance in a rapidly evolving financial environment.