Tokenization is making waves in the financial landscape, presenting exciting opportunities for retail investors who have historically been sidelined from certain asset classes. Johann Kerbrat, senior vice president and general manager of Robinhood Crypto, emphasized its significance during his address at the Consensus 2025 event in Toronto. With a focus on financial inclusion, he highlighted that a staggering 90% of the U.S. population currently lacks access to investments such as private equity and real estate, which are exclusive to accredited investors.

Kerbrat pointed out the challenges of traditional investments, particularly in real estate, noting the difficulty for everyday people to afford properties in high-demand areas like New York City. He explained that tokenization could revolutionize this sector by enabling fractional ownership, thus allowing more individuals to invest in such assets without needing substantial capital. “You can get a piece of it with fractionalization, through tokenization,” he asserted, advocating for a more accessible investment landscape.

“You need to be an accredited investor to invest in private equity right now,” he stated. “How many people can afford a house or an apartment in New York?”

Robinhood is not alone in exploring this promising frontier; other major investment firms like BlackRock and Franklin Templeton are also venturing into Real World Asset (RWA) tokenization. As of May 16, the market for on-chain RWAs stood at an impressive $22.5 billion, albeit concentrated among just over 101,000 asset holders, suggesting significant potential for growth and broader inclusion.

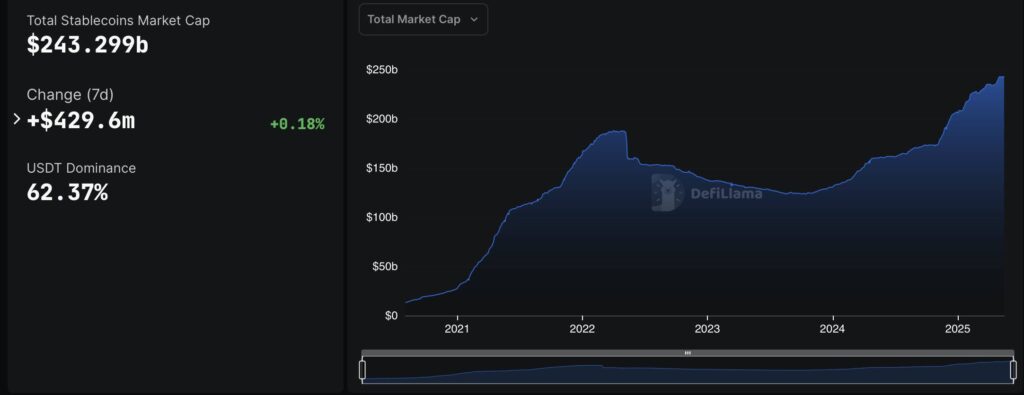

In his discussion, Kerbrat also forecasted trends in the stablecoin market, predicting a diversification toward specialized stablecoins tailored to specific markets. Currently, dollar-pegged stablecoins dominate the sector, with Tether’s USDT and Circle’s USDC making up a colossal 87.1% of the total market cap of $243.3 billion. This shift toward specialized tokens could further facilitate transactions across global markets, enhancing the utility of stablecoins.

“If you’re trying to move funds from the US to Singapore, maybe you will use a specific stablecoin,” predicted Kerbrat, noting a broadening of functionality in the crypto space.

With the continued evolution of tokenization and stablecoins, the cryptocurrency industry is poised to redefine financial access and innovation, potentially changing the way everyday investors participate in the market.

Tokenization and Financial Inclusion: Key Insights

Tokenization presents significant opportunities for retail investors, potentially transforming access to traditionally restricted asset classes. Here are the key points related to this topic:

- Access to Restricted Asset Classes

- Tokenization could allow retail investors to access assets like real estate and private equity.

- Currently, these assets are often limited to accredited investors, restricting participation to about 10% of the US population.

- Fractional Ownership

- With tokenization, investors can buy fractional shares in costly assets, making it feasible to invest in expensive markets like New York real estate.

- This could democratize investment opportunities, enabling more individuals to invest in high-value assets.

- Market Capitalization Insights

- As of May 2023, the on-chain real-world asset (RWA) market capitalization was $22.5 billion.

- There were 101,457 asset holders, with an average holding of $221,867 in on-chain assets.

- Stability and Specialization in Stablecoins

- Johann Kerbrat predicts an increase in specialized stablecoins catering to specific markets, resulting in greater flexibility in transactions.

- Current market dynamics show significant dominance by dollar-pegged stablecoins, accounting for a large portion of the market cap.

- Implications for Global Transactions

- Specialized stablecoins may facilitate easier and more efficient fund transfers across borders, such as from the US to Singapore.

- This paves the way for advancements in how individuals manage and move their funds internationally.

“How many people can afford a house or an apartment in New York? But you can get a piece of it with fractionalization, through tokenization.” – Johann Kerbrat

Financial Inclusion and Tokenization: A Game Changer for Retail Investors

The emerging trend of tokenization in the financial sector presents exciting opportunities for retail investors seeking access to previously restricted asset classes. Johann Kerbrat, the senior vice president and general manager of Robinhood Crypto, emphasized this point during his presentation at the Consensus 2025 event in Toronto. By highlighting how real-world assets (RWAs)—like real estate and private equity—have been largely out of reach for the majority of the population, Kerbrat underlined the potential of fractionalization through tokenization as a means to enhance financial inclusion.

At this point, it’s crucial to consider how Robinhood’s foray into RWA tokenization compares to similar efforts by industry giants like BlackRock, Franklin Templeton, and Apollo. These firms are not just dabbling; they’re establishing strong footprints in the tokenized asset market, which could create a competitive landscape. Robinhood’s approach might be viewed as more provocative due to its accessibility angle, which positions it uniquely against larger, more traditional financial players. However, these incumbents have the advantage of established reputations and greater resources to navigate regulatory hurdles that come with tokenization.

Moreover, as the market capitalization of on-chain RWAs hovers just under $23 billion, it’s worth noting that while interest exists, the scale is limited. The current average hold of $221,867 in on-chain assets per holder indicates that retail interest has yet to reach a critical mass. This could pose challenges for Robinhood if it plans to rely on retail engagement alone, especially when larger firms might have the infrastructure to attract institutional investors first.

However, Robinhood’s focus on expanding access has the potential to benefit a myriad of retail investors, particularly those who have felt marginalized by traditional financial systems. Accessible tokenization could fundamentally shift the investment landscape, allowing ordinary individuals to own fractional pieces of valuable assets. On the flip side, it might create problems for traditional financial institutions that could see a decline in their customer base as retail investors seek more democratized investment opportunities.

Kerbrat also touched upon the evolution of stablecoins, noting that diverse, specialized tokens are expected to rise alongside increasing demand. This development creates both opportunities and challenges. Larger entities like Tether and USDC, which dominate the current market, may find their positions threatened by new entrants that cater to niche needs—especially as geographic transaction needs become more varied. This shift could benefit users seeking specific solutions for cross-border transactions, yet it poses the risk of fragmentation within the stablecoin market, potentially complicating regulatory compliance and consumer trust.

In summary, while Robinhood’s approach to RWA tokenization and the anticipated diversification of stablecoins positions it favorably for retail investors, it also faces formidable competition from established financial entities that may leverage their resources to maintain heavy influence in the evolving landscape.