The cryptocurrency landscape is buzzing with activity as traders navigate the highs and lows of the memecoin market. Despite indicators suggesting that the once-thriving memecoin “supercycle” may be slowing down, many successful cryptocurrency traders, often dubbed “smart money,” are still actively pursuing quick profits through speculative investments. Insights from Nicolai Sondergaard, a research analyst at Nansen, highlight this ongoing trend, as smart traders are embracing the excitement of rapid returns while also displaying caution through increased stablecoin holdings.

“The recent meme frenzy was just a fun play they worked on, while the broader market is sorting out the direction because memecoins aren’t necessarily affected by the same macroeconomy as Bitcoin and Ethereum,” Sondergaard noted during Cointelegraph’s Chainreaction live show.

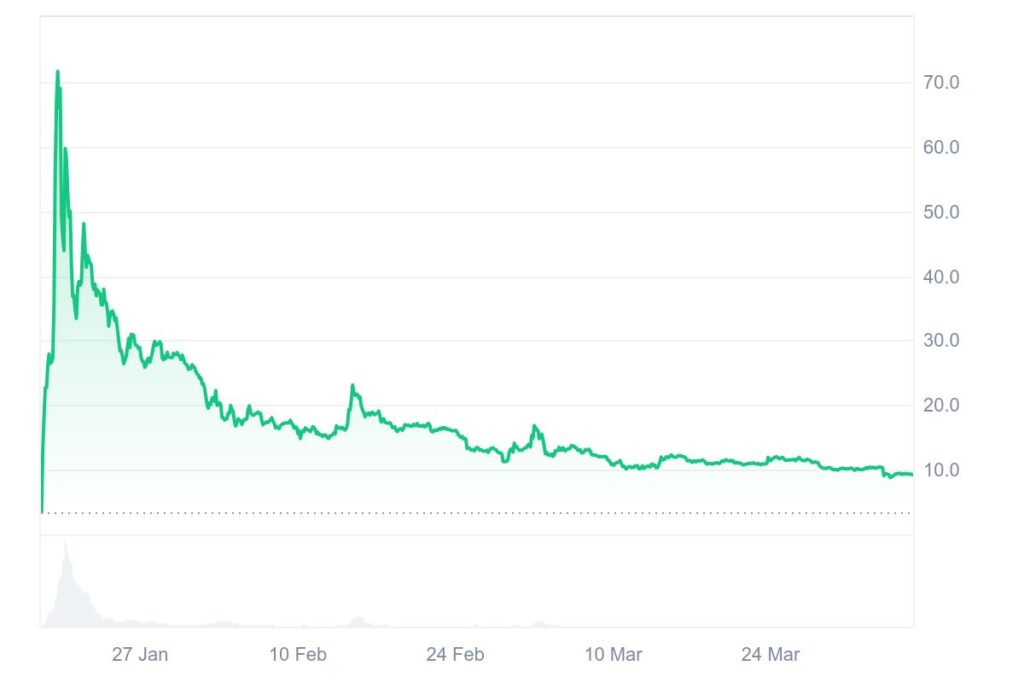

This latest trading enthusiasm follows the high-profile launch of the Official Trump (TRUMP) memecoin earlier this year, which some analysts believe may have marked a turning point for the memecoin sector. A recent report from Binance revealed concerning trends: while the popular memecoin launchpad Pump.fun saw massive activity during the Trump token’s inauguration week, user engagement has since plummeted, dropping significantly from 2.85 million active wallets to just 1.44 million as of late March.

“Market sentiment also appears to have shifted amid unverified reports of insider trading linked to subsequent high-profile tokens such as $MELANIA and $LIBRA,” added a Binance spokesperson, noting that broader economic uncertainties could be fueling this decline.

Crypto Trading Trends and Memecoin Insights

The landscape of cryptocurrency trading, particularly involving memecoins, is undergoing significant shifts. Here are some key points to consider:

-

Chasing Quick Profits:

- Successful traders are still pursuing rapid gains through memecoins.

- Despite a downturn in the broader market, there remains interest in speculative assets.

-

Shift in Market Sentiment:

- Recent launches of memecoins associated with Donald Trump garnered mixed reactions.

- The USD trend indicates a cautious approach among smart money investors.

-

High-Risk Trading Examples:

- A trader transformed a $2,000 investment into $43 million with the Pepe cryptocurrency.

- Despite holding, they still made significant profits despite market plummeting.

-

End of the Memecoin Supercycle:

- The launch of the Official Trump memecoin may have contributed to the end of a speculative trading phase.

- Usage metrics and active wallets on platforms like Pump.fun show decline.

-

Impact of Broader Economic Factors:

- Macro factors like global tariff policies may affect investor appetite for speculative assets.

- Reports of insider trading might also dampen interest and trust in new tokens.

“The recent meme frenzy was just a fun play they worked on, while the broader market is sorting out the direction because memecoins aren’t necessarily affected by the same macroeconomy as Bitcoin and Ethereum.”

These points highlight significant trends in cryptocurrency trading that could impact investors, particularly those interested in memecoins versus more established cryptocurrencies like Bitcoin and Ethereum. It illustrates the volatility and speculative nature of the crypto market, prompting potential traders to approach with caution and awareness.

Shifting Trends in Memecoin Trading: Insights and Implications

The current landscape of memecoin trading reveals a juxtaposition between fervent speculation and emerging caution, particularly among top-tier cryptocurrency traders, often referred to as “smart money.” These traders continue to pursue rapid returns from memecoins, defining a competitive advantage in their ability to capitalize quickly on market trends. However, the recent launch of the Official Trump token appears to have ushered in potential disillusionment, marking a notable turning point in the memecoin “supercycle.”

While innovative traders have seen remarkable success—such as turning a mere $2,000 investment into an astonishing $43 million with the Pepe token—this success comes amidst broader indicators of market volatility and declining investor sentiment. The staggering profit margin accentuates the allure of memecoins, yet the reality that even high-stakes investments can suffer significant losses highlights the precarious nature of these assets. The decline of tokens like TRUMP—which has plummeted over 87% from its peak—stands as a grim reminder of the risks involved.

The competitive edge for savvy traders lies in their agility; they deftly navigate the market’s iterations, able to pivot and pull back when the environment turns hostile. However, their continued engagement with high-risk assets like memecoins can inadvertently foster instability. This behavior may alienate more risk-averse investors, reducing overall market participation and potentially stifling liquidity.

Furthermore, as the memecoin market faces increased scrutiny, particularly in light of regulatory concerns raised by the Trump token’s launch, the stage is set for potential friction with regulatory bodies like the SEC. This scrutiny could deter new participants—especially institutional investors—thereby creating challenges for the memecoin platform’s growth potential.

This volatility could offer mixed blessings; while it continues to attract thrill-seekers eager for quick profit opportunities, the overall skepticism towards memecoins creates an atmosphere where essential growth may be hindered. Individuals who have previously thrived on speculative plays may find themselves navigating a more complex terrain, wherein opportunistic trading strategies become riskier as the market matures.

As these dynamics unfold, it will be intriguing to see how the traditional cryptocurrency ethos of rapid profit generation clashes with burgeoning regulatory frameworks and a more cautious investment landscape. This evolution will likely determine who ultimately comes out ahead and who might face hardships in this fast-evolving sector.