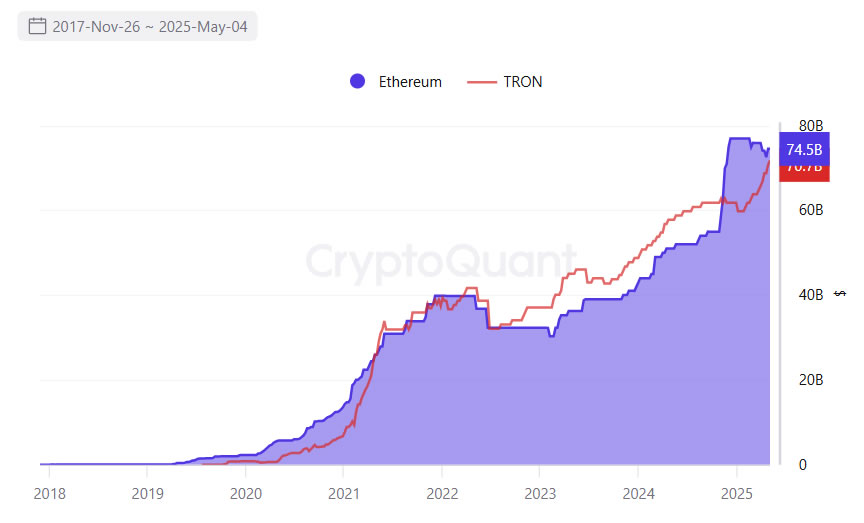

The Tron network is making headlines as it inches closer to reclaiming its spot ahead of Ethereum in the circulating supply of Tether (USDT). On May 5, Tether issued a substantial $1 billion in USDT on the Tron network, pushing its total circulation to an impressive $71.4 billion, as reported by Arkham Intelligence. In comparison, Ethereum currently boasts $72.8 billion in circulation, meaning Tron is just $1.4 billion away from regaining the lead in USDT supply.

This competitive landscape isn’t new; Tron held the lead over Ethereum in USDT circulation from July 2022 until an impressive $18 billion mint on Ethereum tipped the scale back in favor of Ethereum. Following Tron and Ethereum, Solana stands as the third-largest network for USDT with $1.9 billion in circulation, while smaller amounts are found on platforms like Ton and Avalanche.

Tether’s overall issuance is also noteworthy, reaching a record high of $149.4 billion USDT, marking an 8.6% increase since the start of the year. This substantial growth gives Tether a dominant market share of 61% in the stablecoin sector, according to CoinGecko.

The stablecoin market is witnessing swift growth, with stablecoins now comprising about 8% of the total cryptocurrency market capitalization. Notably, the U.S. Treasury Department has projected that the stablecoin market could swell to $2 trillion by 2028, contingent on regulatory clarity.

Developments in U.S. legislation could play a crucial role in this growth. Two significant bills—the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, and the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act—are making their way through Congress. These pieces of legislation aim to establish clearer guidelines and oversight for stablecoins. A vote on the GENIUS Act is expected before May 26.

Looking ahead, Tether is also gearing up to launch a US-based stablecoin later this year, with the rollout dependent on the outcome of these legislative changes. As the stablecoin landscape continues to evolve, eyes remain trained on how these developments will shape the future of digital currencies.

Tron Network Approaches Lead Over Ethereum in Tether Circulation

The recent developments in the cryptocurrency market highlight significant changes in the stablecoin sector, particularly regarding Tether (USDT) circulation across different networks. Here are the key points that may impact readers:

- Major Minting on Tron Network:

Tether minted an additional $1 billion USDT on the Tron network, increasing its total circulation to $71.4 billion.

- Close Competition with Ethereum:

Currently, there is only a $1.4 billion difference between USDT circulating on Tron and Ethereum, suggesting Tron could reclaim the top spot soon.

- Historical Context:

Tron previously led in USDT circulation until an $18 billion mint on Ethereum shifted the balance back in Ethereum’s favor between July 2022 and November 2024.

- Solid Market Share:

Tether’s total circulation reached a record high of $149.4 billion, capturing a 61% share of the stablecoin market.

- Regulatory Environment:

The anticipated passage of the GENIUS Act and STABLE Act in the US Congress could significantly influence the stablecoin market’s growth and stability.

- Tiered Competition:

Solana is the third-largest network with only $1.9 billion USDT, highlighting the dominance of both Tron and Ethereum in the market.

- Future Prospects:

The US Treasury forecasts that the stablecoin market could surge to $2 trillion by 2028, contingent on regulatory advancements.

“Stablecoin issuance has surged over the past six months, currently representing 8% of the total crypto market capitalization.”

Understanding these dynamics may help readers navigate their investments in the cryptocurrency landscape, particularly as stablecoins become increasingly integral to digital finance and payments.

Tether Minting Surge: A Competitive Edge for Tron Over Ethereum

The recent developments surrounding Tether’s minting activities have emphasized the ongoing rivalry between the Tron and Ethereum networks concerning USDT circulation. On May 5, Tether minted a substantial $1 billion on the Tron network, edging closer to overcoming Ethereum’s USDT lead, which currently stands at only $1.4 billion more than Tron’s impressive $71.4 billion supply. This competitive dance highlights the evolving landscape of stablecoins, with Tether’s strategic moves positioning Tron as a formidable contender against Ethereum.

Competitive Advantages: Tron’s ability to mint USDT in vast volumes not only ensures liquidity but also attracts users seeking lower transaction fees and faster processing times compared to Ethereum. The marked increase in USDT on the Tron network could draw in new investors and traders who are predominantly price-sensitive and prefer functionality. Furthermore, with Tether’s total circulation of nearly $149.4 billion, holding a hefty 61% of the stablecoin market share, Tron’s alignment with such a dominant player amplifies its market appeal.

Potential Disadvantages: On the flip side, Ethereum’s established reputation as a pioneering smart contract platform could present challenges for Tron. Despite recent minting boosts, Ethereum remains synonymous with decentralized finance (DeFi) and non-fungible tokens (NFTs), making it tougher for Tron to fully eclipse Ethereum’s market presence. Additionally, Ethereum’s robust ecosystem enables it to innovate rapidly, while Tron’s reputation for centralization and governance remains a concern among more decentralization-focused investors.

This tug-of-war in stablecoin dominance could benefit a range of users, including traders and institutions looking for cost-effective options. Conversely, regulatory uncertainties loom large, especially with pending legislation in the United States that could reshape the landscape for stablecoins. The potential approval of the GENIUS and STABLE Acts may also force companies to navigate stricter compliance parameters, affecting operations on both networks.

Ultimately, as Tron’s surge continues, it raises intriguing questions about market positioning and user preferences in an evolving regulatory framework. This landscape is crucial for anyone invested in or considering stablecoin adoption, as shifts between networks can lead to varying experiences in the blockchain ecosystem.