In a significant turn of events for the cryptocurrency industry, President Trump’s recent executive order has paved the way for the creation of a Strategic Bitcoin Reserve. This strategic reserve aims to hold Bitcoin seized by the government while also establishing a stockpile of various digital assets. Investment bank KBW described this initiative as a “pivotal moment” for the sector, highlighting that the world’s largest superpower is taking substantial steps toward integrating blockchain technology.

According to the report, Bitcoin emerges as the clear frontrunner, designated as a reserve asset, with no plans to sell the holdings. KBW estimates that the U.S. government currently possesses approximately 198,000 Bitcoins, although around 55% of that amount is earmarked for return to the crypto exchange Bitfinex, leaving an estimated 86,000 BTC in government custody. As this strategic move unfolds, speculation rises over how the government intends to accumulate further Bitcoin; one possibility includes liquidating a portion of its extensive gold reserves, valued at over 0 billion.

Moreover, KBW has suggested innovative financing strategies, such as the issuance of U.S. Treasury Bitbonds, which would essentially tie Bitcoin bonuses to traditional treasury bonds. This could potentially lessen the government’s borrowing costs while also increasing its cryptocurrency holdings. Another avenue could involve partnerships with domestic Bitcoin miners, offering tax incentives in exchange for royalties paid in Bitcoin.

“The world’s largest superpower has embraced several leading blockchain protocols,” remarked the KBW report, emphasizing the shifting landscape of digital finance.

With these developments, the cryptocurrency market is poised for notable changes as the government explores multiple pathways to strengthen its footing in the digital asset realm. Observers are keenly watching how these strategies could reshape the future of Bitcoin and the overall crypto landscape.

Impact of Trump’s Executive Order on Bitcoin and Cryptocurrency

The recent executive order by President Trump regarding the formation of a strategic bitcoin reserve marks a significant change in the government’s approach to cryptocurrency. Here are the key points identified in the report by investment bank KBW:

- Establishment of a Bitcoin Strategic Reserve:

The U.S. government is set to create a reserve specifically for Bitcoin, which includes assets seized by the government.

- Formation of a crypto stockpile:

In addition to Bitcoin, the order calls for a stockpile of various digital assets, indicating a broader acceptance of cryptocurrencies.

- Bitcoin as a Reserve Asset:

Bitcoin is positioned as a reserve asset, suggesting that the government is treating it with a level of legitimacy comparable to traditional reserve assets.

- Current Holdings:

KBW estimates that the government currently holds about 198,000 Bitcoin, with plans to reclaim a significant amount back to Bitfinex.

- Options for Accumulating More Bitcoin:

- Liquidation of Gold Reserves: The government may consider selling part of its over 0 billion gold reserves to purchase more Bitcoin.

- Issuance of U.S. Treasury Bitbonds: Proposed treasury bonds could be issued that include a Bitcoin component, potentially reducing borrowing costs.

- Partnerships with Miners: The government may explore partnerships with U.S. Bitcoin miners to receive royalties in exchange for tax incentives.

- Market Implications:

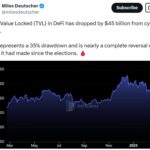

This executive order could remove billion in potential selling from Bitcoin, affecting its market stability and possibly driving prices up.

This development is crucial, as the actions of the world’s largest superpower toward Bitcoin may influence investor confidence and shape the future landscape of digital assets.

Trump’s Strategic Bitcoin Reserve: A Game Changer for Digital Assets

In a groundbreaking move, President Trump’s directive to establish a strategic Bitcoin reserve could reshape the landscape of the cryptocurrency market. Investment bank KBW describes this initiative as a “pivotal moment” that underscores the U.S.’s commitment to embracing blockchain technology. By treating Bitcoin as a reserve asset, this decision positions the cryptocurrency as a mainstay in governmental financial strategy, which is a significant competitive advantage over countries that remain hesitant to integrate digital currencies into their financial frameworks.

One of the most intriguing aspects of this development is the possibility of the U.S. government not only holding existing Bitcoin assets but actively seeking to acquire more. With an estimated 198,000 Bitcoin currently in possession, and 55% slated to return to Bitfinex, there’s a considerable amount of Bitcoin at play. KBW suggests that the government might utilize its substantial gold reserves or even explore innovative financial instruments like U.S. Treasury Bitbonds, which include Bitcoin incentives, to further bolster its digital asset acquisitions. This diversification of resources for accumulating Bitcoin could instill a level of security for investors, fostering a robust market confidence that could benefit the entire crypto ecosystem.

However, it is crucial to recognize the potential downsides. The federal government stepping into the crypto space raises questions regarding market manipulation, liquidity, and the overall decentralized ethos of digital currencies. Critics may argue that a significant government presence in Bitcoin trading could deter individual investors and lead to increased volatility. Furthermore, the broader implications for companies looking to innovate within the blockchain space could stifle competition if government partnerships create barriers to entry for smaller entities.

This news could be a win for large-scale investors and institutional players eager to dive deeper into Bitcoin as a legitimate asset class. However, smaller investors and startups may find this development problematic, especially if excessive government influence skews market dynamics in favor of established players. Ultimately, this initiative not only showcases the potential of cryptocurrencies but also emphasizes the importance of monitoring how government actions play out in shaping the future of finance.