The cryptocurrency landscape is buzzing with news as U.S. President Donald Trump’s media company, Trump Media (often referred to by its ticker DJT), has announced its intention to partner with the popular crypto exchange Crypto.com. This collaboration aims to introduce a range of exchange-traded products (ETPs) and funds (ETFs) that will blend crypto assets with other sectors, including the energy industry. According to a press release issued on Monday, these investment vehicles are slated for launch in 2025.

As part of this partnership, Crypto.com will take charge of crucial backend technology and custody solutions, ensuring that the cryptocurrency supply is securely managed. This venture signifies a deeper dive into the realm of digital currencies, especially for Trump’s media firm, which is already behind the social media platform Truth Social, heavily utilized by the former President.

“The integration of crypto assets into traditional investment vehicles demonstrates a growing acceptance and interest in digital currencies,”

the announcement stated. This development is part of a broader trend involving Trump and his associates, who have also ventured into the world of non-fungible tokens (NFTs) and memecoins. Additionally, they have launched a decentralized finance (DeFi) protocol named World Liberty Financial (WLFI), showcasing their ambitious aspirations in the evolving crypto market.

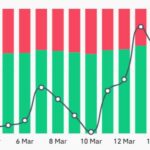

Following the announcement of this partnership, the stock of Trump Media (DJT) saw a notable increase, rising over 9% in after-hours trading. This upward movement reflects increasing investor interest and confidence in the potential of these planned crypto products.

Trump Media’s Partnership with Crypto.com

Key aspects of the recent announcement regarding Trump Media’s collaboration with Crypto.com and its potential implications:

- Partnership Announcement:

Trump Media is partnering with Crypto.com to launch exchange-traded products (ETPs) and exchange-traded funds (ETFs).

- Inclusion of Crypto Assets:

The ETPs will feature a mix of crypto assets alongside securities from other sectors, like energy.

- Technology and Custody Solutions:

Crypto.com will supply the necessary backend technology and custody solutions for the ETPs.

- Launch Timeline:

The anticipated launch date for these investment vehicles is 2025.

- Relation to Truth Social:

Trump Media is the owner of Truth Social, a platform that has gained popularity among Trump’s supporters.

- Past Crypto Initiatives:

This partnership is part of a broader trend of crypto initiatives involving Trump, including NFT collections and a DeFi protocol.

- Stock Market Impact:

Following the announcement, DJT stock rose more than 9% in after-hours trading.

This partnership and the related crypto initiatives could significantly shift how traditional investors view cryptocurrency and potentially impact personal investment strategies, especially among Trump’s supporter base.

Trump Media’s Venture into Crypto: Analyzing Competitive Landscape

Trump Media’s move to collaborate with Crypto.com presents a significant shift in the financial landscape, particularly within the ever-evolving realm of cryptocurrency and investment products. By introducing exchange-traded products (ETPs) and exchange-traded funds (ETFs) that intertwine crypto assets and traditional sectors like energy, Trump Media is positioning itself as a forward-thinking entity in a competitive market. This venture is not merely a reaction to the crypto boom; it aligns with broader trends of traditional finance increasingly adopting digital assets.

Competitive Advantages: This partnership with Crypto.com comes with robust technological support, especially in backend systems and custody solutions, which are crucial for investor confidence in the volatile crypto market. Additionally, Trump Media can leverage its existing social media platform, Truth Social, to promote these new investment vehicles, potentially attracting a user base fueled by Trump’s loyal following. The integration of crypto and traditional sectors within the ETPs can also appeal to a diverse range of investors, from crypto enthusiasts to those interested in energy investments, expanding their target market.

Potential Disadvantages: However, the association with Trump could significantly affect perceptions of these financial products. Many investors may harbor skepticism or outright disapproval toward Trump-related ventures, which could deter some from investing. Moreover, the cryptocurrency space is notoriously volatile, and aligning ETPs and ETFs with such assets may raise concerns about stability and performance, especially as regulatory scrutiny intensifies. Furthermore, the launch slated for 2025 may seem like a long-term vision, potentially impacting immediate investor interest and commitment.

This initiative stands to benefit a variety of stakeholders. Retail investors intrigued by the cryptocurrency market can engage with ETPs that add an extra layer of security through their association with established sectors such as energy. Conversely, established financial institutions may view this venture as a disruptive threat, facing competition for market share in the growing crypto investment space. Additionally, active cryptocurrency investors may find these new products an accessible way to diversify their portfolios.

On a broader scale, Trump’s branding could polarize public sentiment, making it difficult for some to navigate their investment decisions associated with such a controversial figure. As the financial world watches closely, it will be intriguing to see how these products perform against their competitors, all while being under the shadow of political and public sentiment.