In a surprising twist in the world of cryptocurrency, the latest news revolves around former President Donald Trump and his rising influence within the digital currency market. Recently, a notable surge in “Trump crypto” has caught the attention of investors and enthusiasts alike. This unexpected spike came after the former president announced an enticing opportunity: a private dinner for top holders of this cryptocurrency.

As excitement grows, many are eager to see what this high-profile event will mean for the future of Trump’s digital currency.

The announcement not only highlights the growing intersection of politics and the cryptocurrency sphere but also opens up intriguing discussions about the role of influential figures in shaping market trends.

With the potential for further developments in both the political and financial landscapes, all eyes are on how this unprecedented offer might affect investor sentiment and the broader crypto market.

Trump Crypto Soars as US President Offers Dinner to Top Holders

This article discusses the significant rise in value of Trump-themed cryptocurrency following an announcement from the former US President regarding a dinner invitation for top holders. Below are key points derived from the content:

- Trump-Themed Cryptocurrency Surge

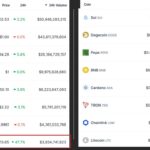

- The value of Trump-related cryptocurrencies has reportedly increased in response to a political announcement.

- This surge reflects how political events can affect market sentiment and cryptocurrency values.

- Exclusive Dinner Invitation

- The former president offered a dinner invitation to significant holders of the cryptocurrency, which has generated interest among investors.

- This gesture may create a sense of community and exclusivity around the cryptocurrency, driving more investments.

- Impact on Investors

- Investors may perceive this event as a bullish sign, influencing them to purchase more tokens in hopes of further gains.

- Conversely, it may prompt caution among some investors concerned about the stability and legitimacy of the cryptocurrency market.

- Political Influence on Cryptocurrencies

- This instance exemplifies the connection between political figures and cryptocurrency markets, showcasing how political discourse can impact financial decisions.

- Such relationships might affect how individuals view cryptocurrency investments in the future, possibly integrating political factors into their strategies.

This scenario illustrates the evolving landscape of cryptocurrency and how intertwined it is with current events, highlighting the role of social and political dynamics in financial markets.

Trump’s Crypto Surge: A Masterstroke in Market Sentiment

In a bold move that has sent shockwaves through the cryptocurrency landscape, former President Donald Trump recently announced an exclusive dinner for top cryptocurrency holders. This initiative not only elevates his personal brand within the crypto community but also significantly impacts investor sentiment, creating a surge in the value of his associated crypto ventures. The decision to engage directly with key players in the cryptocurrency market presents a comparative advantage that could reshape how political figures interact with emerging financial technologies.

When we consider similar news in the political and financial spheres, like Elon Musk’s periodic Twitter influence on Bitcoin and Dogecoin, Trump’s strategy appears well-timed. While Musk’s tweets can shift market dynamics in an instant, Trump’s face-to-face engagement and exclusive offers may lend a sense of legitimacy and community-building absent in purely digital communications. This human touch could prove invaluable, fostering loyalty and potentially stabilizing market volatility tied to public figures.

However, potential pitfalls accompany this tactic. By aligning himself so closely with a specific group of crypto investors, Trump risks alienating small holders or those skeptical of his motivations. This exclusivity may foster distrust among a broader audience, leading to backlash from factions within the crypto community who value decentralized governance and democratized access. Moreover, should the planned dinner not yield favorable outcomes—like tangible policy changes or shifts in market dynamics—criticism could arise, dampening the initial excitement.

From an investment perspective, this news could create opportunities for larger financial players, hedge funds, and accredited investors looking to capitalize on any upswing following Trump’s engagement. Conversely, smaller investors or less organized crypto enthusiasts might find themselves at a disadvantage, missing out on the benefits that come with being in the “inner circle.” As such, while Trump’s move has the potential to inject life into the crypto market, it also underscores the often-divisive nature of investment strategies propped up by political figures.