The world of cryptocurrency continues to intertwine with politics in unexpected ways, as recent reports reveal a surprising connection between former President Donald Trump and the blockchain firm Ripple Labs. According to a report by Politico on May 8, Trump was allegedly persuaded by a lobbyist associated with Ripple to announce a new initiative that would include the XRP token in a proposed U.S. national cryptocurrency reserve. This assertion has emerged from claims that an employee of Brian Ballard, a pro-Trump lobbyist, provided Trump with the exact wording for a social media post about this strategic crypto reserve.

“He is not welcome in anything anymore,” Trump reportedly said about Ballard after discovering Ripple was among his clients.

This incident adds a layer of complexity to Trump’s relationship with cryptocurrency, particularly as Ripple’s legal officer, Stuart Alderoty, had previously contributed over $300,000 to Trump’s fundraising efforts, and Ripple itself donated $5 million in XRP to support his presidential inauguration. Furthermore, Darting back to January, both Alderoty and Ripple’s CEO, Brad Garlinghouse, had engaged with Trump during his transition period into office, hinting at a long-standing rapport between the two entities.

Interestingly, the recent news has not significantly affected the market value of XRP, which maintained a price of $2.23 around the time of the report, even reflecting an approximately 5% increase in the preceding 24 hours. The entangled nature of cryptocurrency and political advocacy continues to provoke discussions regarding the potential implications for policy and market dynamics going forward.

Trump and the XRP National Cryptocurrency Reserve Incident

Key points regarding the involvement of US President Donald Trump with the XRP token and the implications for readers:

- Lobbyist Manipulation:

A lobbyist associated with Ripple Labs, Brian Ballard, reportedly influenced Trump to announce that XRP would be included in a national cryptocurrency reserve.

- Strategic Crypto Reserve Announcement:

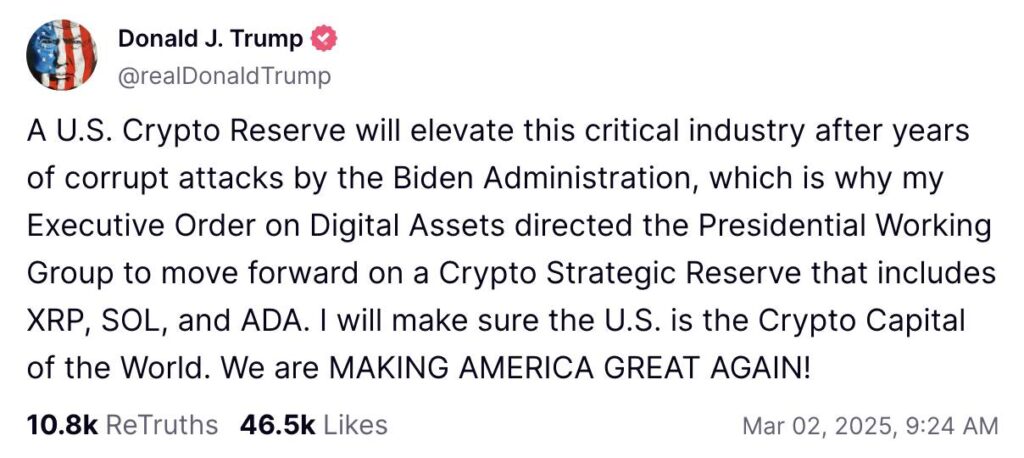

On March 2, Trump shared a social media post regarding a US strategic crypto reserve, which included XRP, Solana (SOL), and Cardano (ADA), based on recommendations from a lobbyist’s employee.

- Trump’s Reaction:

Upon discovering Ripple’s connection to the lobbyist, Trump expressed anger, feeling he had been manipulated into the announcement.

- Prior Connections to Ripple:

Before the announcement, key figures in Ripple had made significant financial contributions to Trump’s political efforts, indicating a long-standing relationship.

- Ripple’s Political Donations:

- Ripple contributed $5 million worth of XRP to Trump’s inaugural fund.

- Ripple has supported a PAC focused on pro-crypto candidates, which could influence future political landscapes and regulations affecting cryptocurrencies.

- Immediate Aftermath:

Trump signed an executive order for a “Digital Asset Stockpile” on March 6, a few days after the announcement, highlighting the urgency and potential impact of cryptocurrency policies.

- Price Stability of XRP:

Despite the political developments, XRP’s price remained relatively stable around $2.23, suggesting that speculation driven by political news may not significantly impact cryptocurrency markets.

The situation raises questions about the integrity of political influence on financial markets and the implications for everyday investors and users of cryptocurrency.

Trump’s Troubling Ties to Ripple: A Crisis of Trust in Cryptocurrency

The recent revelation about Donald Trump’s connections with Ripple Labs and the controversial role of lobbyist Brian Ballard has injected a tempest into the already volatile world of cryptocurrency. While some may see this as a boon for XRP’s notoriety, others recognize it as a significant disadvantage in terms of public perception and regulatory scrutiny. As Trump attempts to embrace a national cryptocurrency reserve, the introduction of XRP alongside established coins like Solana (SOL) and Cardano (ADA) complicates an already intricate landscape.

One competitive advantage for Ripple is their already substantial financial backing, illustrated by hefty donations to Trump’s campaigns. This aligns them closely with key political players, potentially granting Ripple a level of influence that smaller crypto firms could only dream of. Moreover, Trump’s announcement regarding the digital asset stockpile opened doors for further discussion on crypto regulations, something that could benefit Ripple in the long run.

However, this also casts a shadow over Ripple’s credibility and long-term growth prospects. As the market increasingly becomes wary of insider dealings and political manipulations, other players within the sector may suffer collateral damage. For instance, the optics of Trump’s endorsement could alienate potential investors wary of political entanglements, leading to hesitance in accepting XRP as a legitimate asset. In turn, this underscores the potential for problems for less politically connected cryptocurrencies, which might struggle to gain traction in a climate increasingly dictated by regulation and political favor.

Furthermore, the accusations of Trump feeling “used” by Ballard could indicate looming tensions that may surface within Ripple’s relations with political figures moving forward. If Trump decides to distance himself from Ripple, it could badly affect their collaborative efforts in the future and pose challenges for securing further political support. As the political landscape evolves, this situation might discourage investor confidence and hinder XRP’s growth potential.

Ultimately, the intersection of cryptocurrency and politics, as highlighted by this incident, opens doors for a broad audience, including small investors and crypto advocates who may feel caught in the middle of a high-stakes game. The potential fallout from this incident could also act as a cautionary tale for others in the industry about the risks of entwining political relationships with digital asset growth.