The U.S. debt ceiling is once again making headlines as the nation prepares to hit its borrowing limit of approximately trillion on Tuesday. This cap on government borrowing does not permit new spending but poses a significant concern: the risk that the federal government might struggle to meet its existing financial commitments. Outgoing Treasury Secretary Janet Yellen underscored this risk in a recent announcement, bringing attention to the potential financial crunch facing the world’s largest economy.

However, amidst the looming concerns, there’s a notable silver lining for investors eyeing risk assets like bitcoin (BTC). While the idea of a government unable to issue new debt can invoke panic, historical data suggests that such situations often lead to positive outcomes for cryptocurrencies and other investments. Yellen reassured the public by stating that the Treasury will employ “extraordinary measures” starting this Tuesday, a strategy intended to stave off immediate defaults and buy time until at least mid-March.

“The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations.” – Janet Yellen

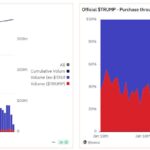

One of the strategies that the Treasury might resort to involves utilizing the Treasury General Account (TGA), which functions as the government’s central operating account. By drawing down the TGA balance—currently at 7 billion—funds are funneled to various networks including contractors and employees, essentially enhancing the reserves held by commercial banks. This increased reserve capacity can lead to greater lending, thereby stimulating investment in the economy and financial markets.

An analysis of past events reveals an interesting trend: declines in the TGA have often coincided with surges in bitcoin’s value. As the government allocates its TGA balance, it tends to drive liquidity into the market, which in turn may encourage investment in riskier assets. This historic pattern could suggest a potential bullish sentiment for bitcoin as the situation unfolds, echoing previous episodes of debt ceiling negotiations that favored cryptocurrency performance.

Impact of the U.S. Debt Ceiling on Bitcoin and Risk Assets

The ongoing discussions about the U.S. debt ceiling are vital for investors and the general public, as they highlight potential economic shifts and their repercussions. Here are some key points to consider:

- Debt Ceiling Context:

- The U.S. debt ceiling is currently set at approximately trillion.

- This limit constrains the government’s ability to borrow and fund its ongoing operations.

- Past statements from Treasury Secretary Janet Yellen emphasize the risks of not fulfilling legal obligations.

- Risk of Default:

- A potential default could send shockwaves through financial markets and investor confidence.

- However, immediate shutdowns or defaults are not expected, thanks to “extraordinary measures” by the Treasury.

- Extraordinary Measures Explained:

- These measures may include utilizing the Treasury General Account (TGA) to manage obligations.

- The TGA balance can influence market liquidity and the banking sector’s lending capacity.

- Historical Impact on Bitcoin and Risk Assets:

- Previous episodes of debt ceiling negotiations have been linked to bullish trends in bitcoin and other risk assets.

- Drawdowns in TGA have often preceded rises in bitcoin’s price, indicating a possible inverse relationship.

- TGA Balance and Economic Implications:

- The current TGA balance is 7 billion, which could nourish liquidity in the banking sector when spent.

- Increased reserves from government spending could eventually lead to enhanced lending and economic growth.

The observed correlation between the TGA balance and bitcoin’s price movements suggests that shifts in government borrowing and spending could play a crucial role for investors and economic enthusiasts alike.

The U.S. Debt Ceiling: Implications for Bitcoin and Risk Assets

The recurrent topic of the U.S. debt ceiling has resurfaced, with significant implications for financial markets, particularly for bitcoin (BTC) and other risk assets. This recent development offers both opportunities and challenges that differ markedly from previous scenarios. Historically, the approach taken by the government under similar circumstances has led to fluctuations in market behavior, providing a lens through which to analyze the current situation.

Competitive Advantages: One of the standout features of this current episode is the use of “extraordinary measures” heralded by Treasury Secretary Janet Yellen. These measures are designed to mitigate immediate risks associated with hitting the debt ceiling, allowing the Treasury to borrow from itself temporarily without formal congressional approval. This creative maneuvering could serve as a lifeline for market liquidity, facilitating additional capital in the economy through increased lending from banks that experience a surge in reserves. In turn, this liquidity can be a boon for bitcoin and other speculative investments, which often thrive in environments of increased monetary flow.

Comparative Disadvantages: On the flip side, the looming threat of potential government default creates a sense of uncertainty among investors. While the immediate likelihood of a shutdown is minimized by temporary measures, the overhanging debt ceiling still raises questions about long-term fiscal health. The instability could deter risk-averse investors who traditionally favor stability, leading to volatility in markets and potentially dampening the enthusiasm surrounding bitcoin. Innovation and speculation thrive in certainty, and any hesitation or fear of a financial misstep could pull investors back toward safer assets.

Potential Beneficiaries and Challenges: This scenario primarily benefits those already invested in risk assets, including cryptocurrencies and stocks, as heightened bank reserves often translate to greater investment capacity. Especially for those who closely follow market trends and potential correlations, this situation presents an intriguing opportunity to capitalize on historical patterns suggesting bullish trends in bitcoin when TGA balances decrease. Conversely, traditional investors in bonds and stable currencies may struggle, as their assets may not perform well under heightened uncertainty, ultimately creating two distinct factions among the investor community.

As the U.S. navigates this complex fiscal landscape, the implications of the debt ceiling extend beyond mere numbers, affecting global market sentiment and investment strategies alike. Understanding how these factors interplay could prove pivotal for investors looking to maximize their positions in a fluctuating economic climate.