The looming U.S. debt ceiling is back in the conversation, raising eyebrows and stirring discussions in financial circles, especially concerning its potential effects on risk assets, including bitcoin (BTC). As the U.S. is set to hit its approximately trillion borrowing cap, Treasury Secretary Janet Yellen highlighted that although new spending isn’t sanctioned, this situation could jeopardize the government’s ability to fulfill existing obligations.

With the deadline approaching, investors are advised to stay vigilant, but it’s worth noting that immediate chaos, such as a default or government shutdown, is unlikely. Yellen emphasized that the Treasury will initiate “extraordinary measures” from the onset of the debt ceiling crisis, giving the government a temporary reprieve, at least until March 14.

“The debt limit does not authorize new spending, but it creates a risk that the federal government might not be able to finance its existing legal obligations,” – Janet Yellen

One of the primary strategies being considered is the utilization of the Treasury General Account (TGA), which acts as the government’s financial hub at the Federal Reserve. During prior debt ceiling events, including the early 2023 episode, actions involving the TGA have been correlated with increased liquidity in the banking system. This outcome often leads to greater lending capacity, potentially uplifting broader economic activities and various asset classes.

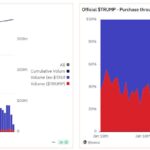

As of now, the TGA holds a significant balance of 7 billion, and historical data suggests that withdrawals from this account often herald bullish trends in bitcoin’s price. As the chart shows, there appears to be a pattern wherein declines in the TGA coincide with upward movements in bitcoin, painting a picture of an intriguing relationship between governmental financial maneuvers and cryptocurrency market dynamics.

The Impact of the U.S. Debt Ceiling on Financial Markets and Bitcoin

Understanding the intricacies of the U.S. debt ceiling and its implications for the economy and financial assets like Bitcoin is crucial for investors and individuals alike. Here are the key points:

- Debt Ceiling Defined:

- The U.S. debt ceiling limits the maximum amount the government can borrow, currently around trillion.

- Immediate Concerns:

- The debt limit could impact the government’s ability to meet existing obligations, as stated by outgoing Treasury Secretary Janet Yellen.

- While a default is a significant concern, it is unlikely to happen immediately due to scheduled “extraordinary measures.”

- Extraordinary Measures:

- The Treasury will run down the Treasury General Account (TGA), allowing for continued funding of government operations until at least March 14.

- Historical Impact on Risk Assets:

- Previous instances of TGA drawdowns have positively influenced risk assets, including Bitcoin, due to increased liquidity in the banking system.

- Cash payments from the TGA to contractors and employees increase reserves and capacity for banks to lend, subsequently boosting the economy.

- Correlation with Bitcoin:

- There appears to be an inverse correlation between TGA drawdowns and Bitcoin bull runs, suggesting that as government liquidity increases, so does Bitcoin’s value.

- The current balance of the TGA, at 7 billion, positions the market for potential growth in Bitcoin and other risk assets.

“The thought of the world’s largest economy unable to borrow more might scare investors, but this situation can also create opportunities in risk assets like Bitcoin.”

The U.S. Debt Ceiling: A Boon or Bane for Bitcoin and Risk Assets?

The ongoing saga of the U.S. debt ceiling, with its potential implications for both traditional and emerging assets like bitcoin, has resurfaced, capturing the attention of investors and analysts alike. With the government hitting its trillion borrowing cap, conversations around the financial ramifications are heating up. Despite the looming threat of default, historical precedents indicate that such crises could catalyze positive market movements, particularly for risk assets and cryptocurrencies.

Comparative Advantages: One of the primary advantages of the current debt ceiling situation is the anticipated activation of “extraordinary measures” by the Treasury, which could empower risk assets, including bitcoin, as seen during similar previous occurrences. The drawdown of the Treasury General Account (TGA) tends to infuse liquidity into the banking system. This liquidity surge can often lead to increased lending capabilities for banks, sparking a broad boost in investments across various sectors. As a result, past instances demonstrate that bitcoin prices tend to climb in tandem with declines in TGA balances, suggesting a potentially bullish outlook for the cryptocurrency amidst fiscal tension.

Disadvantages and Risks: However, the uncertainty surrounding government operations and the prospect of an impending default raises significant concerns. This volatility can deter risk-averse investors from participating in markets perceived as unstable. Additionally, if the government were to fail in meeting its financial obligations, the negative sentiment could spill over, affecting market psychology broadly and thereby exerting downward pressure on bitcoin prices. Thus, while some may look at this scenario as a glass half full, others see it as a precarious balancing act fraught with potential pitfalls.

Target Audience: Who Will Benefit or Face Challenges? On one hand, risk-tolerant investors and cryptocurrency enthusiasts may find opportunities in this tumultuous financial landscape, using it as a chance to acquire bitcoin and other assets at potentially lower prices, anticipating a post-crisis rally. Conversely, conservative investors or individuals whose financial futures are tied to the stability of traditional markets may experience anxiety, potentially leading them to withdraw from riskier investments until a clearer picture emerges. Overall, the current debt ceiling narrative presents both opportunities and challenges, making it critical for stakeholders to stay informed and adaptable in the evolving economic climate.