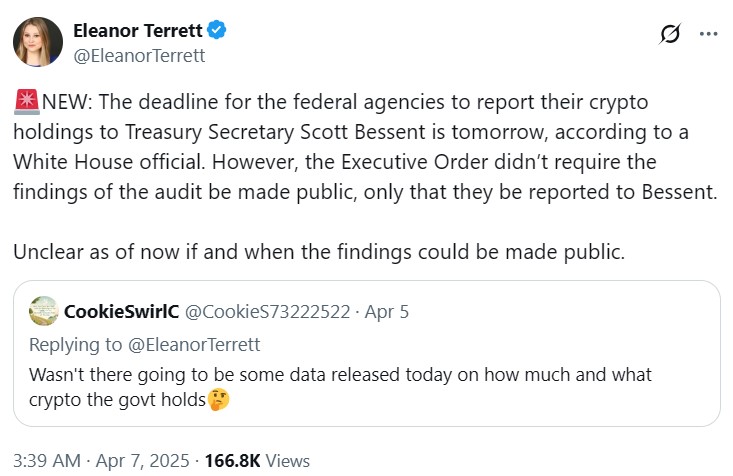

In a significant turn of events for the cryptocurrency landscape, U.S. federal agencies are gearing up to report their digital asset holdings to the Department of the Treasury by April 7. This requirement follows an executive order signed by President Donald Trump earlier this year, which also initiated the establishment of a Strategic Bitcoin Reserve and a broader Digital Asset Stockpile. Journalist Eleanor Terrett has highlighted that these disclosures will remain confidential for the time being, leaving many wondering whether—or when—such information might become public.

The Strategic Bitcoin Reserve is designed to function as a “digital Fort Knox,” ensuring that the federal government holds onto its Bitcoin (BTC) as a store of value, rather than selling it off as it has in the past. Notably, White House official David Sacks has critiqued previous government sales of 195,000 BTC, suggesting that these lost assets could have been worth billions if retained. The reserve will be initially stocked with Bitcoin that federal agencies have obtained through civil or criminal asset seizures, with other agencies currently exploring their authority to contribute to the reserve.

In addition to Bitcoin, Trump has mentioned the inclusion of other cryptocurrencies like XRP, Solana, Cardano, and Ether into this reserve. This initiative aims to promote responsible management of the government’s cryptocurrency assets under the Treasury, signifying a new chapter of formal acknowledgment and governance in the realm of digital currencies.

“It is our duty to steward these assets wisely, ensuring they serve the American people,” Sacks stated, emphasizing the importance of governance in the crypto space.

However, the enthusiasm surrounding this new regulatory approach is tempered by recent market volatility. Following the announcement of a 10% tariff by the Trump administration on numerous countries, including significant rates on China and Japan, the overall cryptocurrency market capitalization took a notable hit, dropping over 8% to approximately $2.5 trillion. This sudden change has sparked discussions about the implications of government policies on the burgeoning digital asset market.

As these developments unfold, the intersection of government regulation and cryptocurrency continues to attract attention, raising questions about the future landscape of digital assets in the United States.

US Federal Agencies to Disclose Cryptocurrency Holdings

Key points regarding the recent developments in the U.S. government’s cryptocurrency strategy and its potential impact on readers:

- Disclosure Deadline:

Federal agencies must report their cryptocurrency holdings to the Department of the Treasury by April 7. These disclosures will initially remain confidential.

- Creation of Strategic Bitcoin Reserve:

An executive order signed in March directed the establishment of a Strategic Bitcoin Reserve, aimed at creating a substantial holding of Bitcoin as a store of value.

- Digital Asset Stockpile:

This stockpile aims to promote responsible management of government-held cryptocurrency assets, which could include potential sales in the future.

- Impact of Recent Tariffs:

The Trump administration’s tariffs on multiple countries resulted in a significant decline in the overall cryptocurrency market, with capitalization dropping over 8% following the announcement.

- Potential Asset Values:

Diversified holdings in the reserve might include major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), which could influence market stability and value.

- Concerns About Asset Sales:

Federal officials highlighted previous mismanagement of Bitcoin resources, emphasizing the importance of holding onto valuable assets instead of selling them at a loss.

These developments could significantly impact the cryptocurrency market and investors by shaping policy and regulation, which may alter investment approaches and the future of digital assets.

Crypto Disclosure: Analyzing the Impact of U.S. Federal Agencies’ Reporting Mandates

The recent directive for U.S. federal agencies to disclose their cryptocurrency holdings to the Department of the Treasury introduces both advantages and challenges for various stakeholders within the cryptocurrency landscape. This requirement arises from a broader strategy aimed at increasing governmental oversight over digital assets, which has already spurred discussions about transparency and regulation in the crypto market.

Competitive Advantages: The mandated reporting could enhance the legitimacy of cryptocurrencies in the eyes of traditional investors and regulatory bodies. By creating a framework for federal agencies to document their cryptocurrency assets, the government is signaling a move towards a more structured and recognized digital asset environment. Additionally, the establishment of a Strategic Bitcoin Reserve could bolster market confidence by ensuring a reserve of digital currency that is safeguarded and not subject to liquidation, as emphasized by David Sacks. Such moves could attract institutional interest, infusing the market with more capital as investors look for stability.

Furthermore, the potential for a broader Digital Asset Stockpile encourages responsible management of crypto assets, which could promote long-term growth and sustainability within the sector. This may pave the way for clearer regulations, fostering innovative developments in blockchain technology and digital currencies as agencies explore their legal authority to manage and utilize these assets.

Competitive Disadvantages: On the flip side, the transparency encouraged by this new directive may deter some individuals and entities from engaging with cryptocurrencies, particularly those who value privacy and autonomy. Increased governmental oversight could heighten regulatory scrutiny, making it more cumbersome for participants in the crypto ecosystem to navigate compliance. Investors may also hesitate, worried about potential government interventions that could disrupt market dynamics or the liquidity of the assets they hold.

Moreover, the turbulence in the crypto market following President Trump’s tariff announcements demonstrates how external policies can significantly influence cryptocurrency valuations. The 10% tariff and its varied impacts on different nations stirred fear among investors, as reflected in the sharp drop in market capitalization. The timing of these economic policies could hinder the positive momentum intended by the cryptocurrency reporting requirements.

Who Benefits and Who Faces Challenges: Institutional investors and large financial entities may find themselves better positioned to gain from this disclosure as they navigate the enhanced clarity and potential legitimacy the government’s framework provides. However, smaller investors or retail traders might find the increasing weight of regulation burdensome, limiting their ability to engage freely with digital assets. Additionally, the uncertainty surrounding potential further policy changes could create volatility, affecting all market participants.