The cryptocurrency landscape is buzzing with significant news as the U.S. regulatory environment shifts to accommodate greater participation by banks in blockchain networks. On March 7, the Office of the Comptroller of the Currency (OCC) loosened its regulations, allowing banks to act as validators within independent node verification networks. This move is seen as a pivotal moment for institutional adoption of cryptocurrencies but comes with its own set of challenges. Bohdan Opryshko, the chief operating officer of the staking service provider Everstake, highlighted concerns regarding potential centralization risks associated with this newfound involvement.

“If banks become dominant validators, power could become concentrated, reducing the decentralized nature of PoS networks,”

Opryshko emphasized the dual nature of banks entering proof-of-stake (PoS) networks like Ethereum and Solana, suggesting that while the influx of institutional capital might boost the networks, it could also negatively impact smaller players. He expressed concerns that large stakes from banks could lead to a reduction in staking rewards for existing participants, fundamentally altering the incentives that drive decentralization.

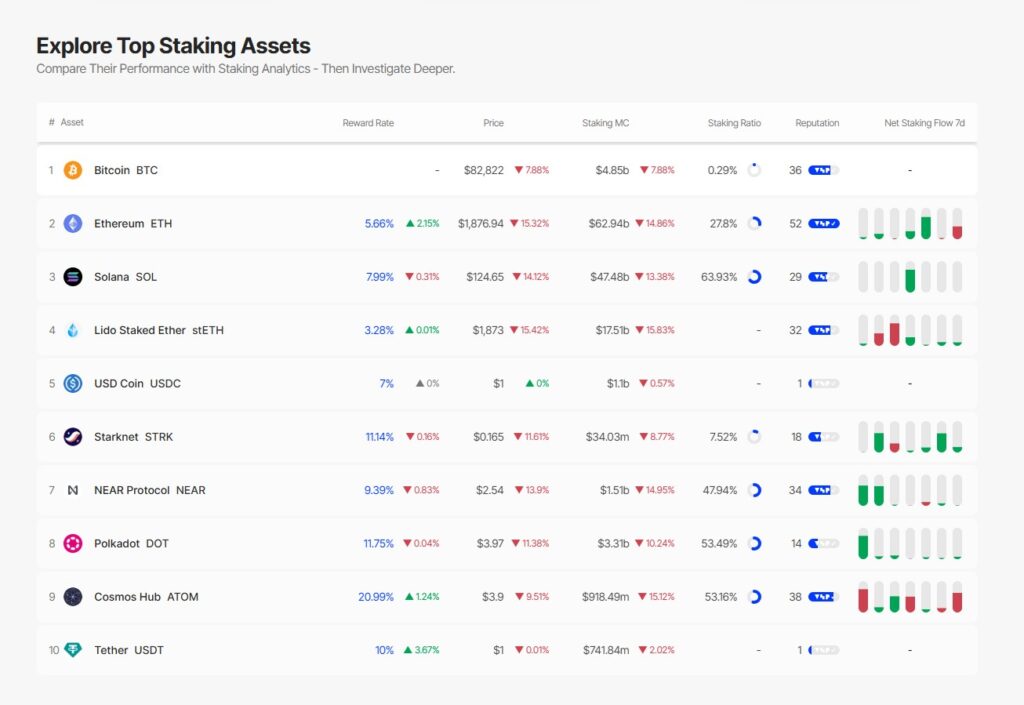

As of mid-March, staking yields for Ethereum and Solana stand at approximately 5.5% and 8% respectively, data from Staking Rewards indicates. Staking consists of locking up cryptocurrencies with validators in return for rewards, and the mechanics of this process may undergo significant changes as institutional interest grows.

“If major institutional players, such as banks, enter the staking market and suddenly stake large amounts, it could cause a sharp reduction in staking rewards for all other participants,”

This regulatory shift coincides with renewed discussions about a more favorable banking environment for crypto firms. Following remarks from former President Donald Trump, who championed the idea of making the U.S. the “world’s crypto capital,” a firestorm of criticism arose regarding the treatment of crypto businesses in the banking sector. In recent months, a lawsuit from Coinbase revealed alarming communication between regulators and banking institutions suggesting they pause crypto activities, igniting calls for reform.

Currently, Anchorage Digital remains the only federally chartered bank in the U.S. providing cryptocurrency staking services as the industry grapples with its evolving landscape. With these changes, the potential for both growth and challenges in the cryptocurrency sector becomes increasingly evident.

Impact of New US Regulatory Guidance on Blockchain Validators

This new development from the US regulatory body could significantly reshape the landscape of cryptocurrency, particularly in terms of institutional participation and decentralized finance.

- Regulatory Easing for Banks:

- US banks are now allowed to serve as validators for blockchain networks.

- This provides a pathway for greater institutional involvement in cryptocurrency and blockchain technology.

- Concerns Over Centralization:

- Increased dominance of banks as validators may lead to centralization risks within Proof-of-Stake (PoS) networks.

- This centralization could undermine the fundamental decentralized nature of blockchain technology.

- Impact on Staking Yields:

- Large stakes from banks could suppress staking rewards for existing smaller validators.

- Reduced staking yields could discourage individual investors from participating in staking networks.

- Current Staking Yields:

- As of March 12, Ether stakers earn approximately 5.5% APR.

- Solana stakers earn close to 8% APR, indicating potential profitability for current participants.

- Broader Crypto Banking Landscape:

- The OCC’s announcement aligns with a larger movement to provide fair access to banking services for digital asset firms.

- Following regulatory hurdles, there’s hope for economic growth and innovation through blockchain technology.

“If banks become dominant validators, power could become concentrated, reducing the decentralized nature of PoS networks.” – Bohdan Opryshko

This regulatory shift could directly affect readers involved in cryptocurrency, whether by influencing their investment strategies, impacting potential rewards for their staking efforts, or altering the foundational principles of the networks they engage with.

Unlocking the Door to Institutional Adoption: A Mixed Bag for Blockchain

The recent regulatory guidance from the US Office of the Comptroller of the Currency (OCC) is stirring the pot in the blockchain arena. With banks now allowed to become validators for blockchain networks, this shift signals a new era of institutional adoption that could lay the groundwork for significant growth. However, it also raises important issues related to centralization. As Bohdan Opryshko of Everstake pointed out, the move presents both advantages and disadvantages that could shape the landscape of proof-of-stake (PoS) networks.

On the one hand, the entry of banks into PoS ecosystems like Ethereum and Solana could provide a boost in financial stability and credibility. This institutional backing might attract more investors who have been hesitant about engaging with crypto due to its perceived volatility and risks. Furthermore, with banks backing their investments, newer platforms could see increased flow and trust from the general public. This surge in institutional involvement could ultimately lead to a more robust infrastructure for digital assets, fostering a sense of security that has been notably lacking in the crypto space.

Conversely, the potential for centralization poses a significant concern. Opryshko highlighted the risk of banks becoming dominant validators, which could diminish the decentralized nature that is often heralded as blockchain’s crown jewel. If a few major players monopolize the staking space, it could stifle competition and innovation, creating a landscape where smaller validators struggle to survive. This lack of diversity could ultimately compromise the original vision of blockchain technology—its very foundation built on decentralization and empowerment for all participants.

The implications of this regulatory shift extend beyond simply institutional players; it could adversely affect smaller validators and retail investors as well. If banks start staking large amounts of crypto, it might drive down staking yields, making it less financially attractive for smaller participants. As Opryshko indicated, the influence of major institutions could lead to a significant drop in rewards for those who contribute to the network’s integrity through smaller stakes. Consequently, this could hinder the very community-driven spirit that has characterized the crypto world.

This new regulatory landscape might benefit investors who prefer a more structured and reliable investment environment, but it creates challenges for smaller players and those who cherish decentralization. Thus, while the OCC’s guidance opens the door for great opportunities, it simultaneously sows the seeds for potential problems that could reshape the dynamics of blockchain technology for years to come.