Cryptocurrency, once a buzzword in the financial landscape, continues to intrigue and entice investors around the globe. With its promise of substantial returns mingled with an air of mystery, many are eager to dive into this digitally driven market. However, alongside the glimmering opportunities lie significant risks that can leave even seasoned investors puzzled.

In this captivating exploration of the cryptocurrency world, we tackle the pressing question, “How did you get suckered?” This phrase echoes the cautionary tales of novices caught in the whirlwind of digital currencies. As the market fluctuates, understanding the intricacies of investing in cryptocurrency has never been more vital.

“Investing in cryptocurrency has its ups and downs, and it’s essential to navigate this terrain with both enthusiasm and caution.”

From potential gains that can seem too good to be true to the technological underpinnings that drive value, this piece provides a well-rounded perspective on what it truly means to engage in crypto investments. As we unpack the latest insights and trends in this fast-paced arena, readers will gain a clearer understanding of how to approach cryptocurrency with knowledge and strategy.

Understanding Cryptocurrency: Opportunities and Risks

Investing in cryptocurrency presents a mix of opportunities and risks that could significantly impact investors’ financial futures. Here are the key points to consider:

- Volatility of Cryptocurrency: The prices of cryptocurrencies often fluctuate dramatically, leading to potential high returns or substantial losses.

- Opportunity for High Returns: Early investors have seen significant profits, which could inspire others to invest with hopes of similar gains.

- Security Risks: Cryptocurrency investments come with risks such as hacking and scams, making security a vital consideration.

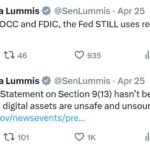

- Lack of Regulation: The cryptocurrency market is less regulated than traditional investments, increasing the likelihood of market manipulation and fraud.

- Diverse Portfolio Potential: Adding cryptocurrencies to an investment portfolio can diversify assets and potentially yield additional financial growth.

- Technological Understanding Required: Investors need to grasp blockchain technology and cryptocurrency fundamentals to make informed decisions.

Investors must weigh the potential for high rewards against the risks of loss, making informed choices vital in navigating the cryptocurrency landscape.

Exploring the Spectrum of Cryptocurrency Investments: Opportunities vs. Risks

The world of cryptocurrency investment is buzzing with excitement and caution in equal measure. Recent discussions across various platforms, including WTOP, delve into the often perilous landscape of digital currencies, where the potential for high returns coexists with equally significant risks. The ongoing narratives highlight how individual investors, drawn in by the allure of quick profits, can frequently find themselves facing unexpected pitfalls.

Competitive Advantages: One of the undeniable advantages of cryptocurrency investment lies in its potential for substantial returns. As highlighted in various news pieces, savvy investors have seen their initial investments multiply rapidly, especially during bullish market trends. Furthermore, the democratization of trading through digital platforms has made it easier for individuals from different financial backgrounds to participate, offering a global reach that traditional markets do not. These characteristics can attract a younger demographic eager to explore new financial avenues.

Challenges and Disadvantages: However, the volatility and speculative nature of cryptocurrencies present significant challenges. Reports often mention the lack of regulation and security that can leave investors vulnerable to fraud or market manipulation. The spotlight on the emotional rollercoaster of market swings frequently deters conservative investors and creates a precarious environment where even seasoned traders can experience substantial losses. This duality means that while opportunities abound, so do risks, making it crucial for investors to conduct thorough research and assess their risk tolerance.

Who Could Benefit or Face Challenges: New and inexperienced investors may find themselves at a disadvantage if they venture into this space without adequate knowledge, particularly in understanding market signals and avoiding scams. On the other hand, educating oneself on these risks can empower informed decisions, transforming apprehension into opportunity for those willing to learn. Established investors observing market trends might leverage the volatility to their advantage, capitalizing on dips to expand their portfolios. Ultimately, whether a potential investor sees the allure or the risk, understanding the dynamics at play will greatly influence their journey in the cryptocurrency market.